Popular Posts

How Machine Learning Algorithms Classify Chart Patterns in Cryptocurrency Markets

Understanding how machine learning algorithms classify chart patterns is essential for traders, investors, and financial analysts aiming to leverage AI-driven tools for better decision-making. As cryptocurrencies continue to grow in popularity and complexity, traditional analysis methods are increasingly supplemented or replaced by advanced computational techniques. This article explores the process behind machine learning classification of chart patterns, its recent advancements, and the implications for the crypto trading landscape.

What Are Chart Patterns in Cryptocurrency Trading?

Chart patterns are visual representations of historical price movements that help traders identify potential future trends. These patterns form based on recurring behaviors in market data and can signal reversals or continuations of current trends. Common examples include head and shoulders, triangles (symmetrical, ascending, descending), wedges (rising or falling), flags, pennants, and double tops/bottoms.

Recognizing these patterns manually requires experience and skill; however, with the advent of machine learning algorithms—especially deep learning models—automatic pattern recognition has become more accurate and efficient. This technological shift allows traders to analyze vast amounts of data quickly while reducing human error.

How Do Machine Learning Algorithms Classify Chart Patterns?

Machine learning models classify chart patterns through a multi-step process that involves data collection, preprocessing, feature extraction, training, and evaluation:

Data Collection: The foundation lies in gathering extensive historical price data from various cryptocurrency exchanges. This includes open-high-low-close (OHLC) prices over different timeframes.

Data Preprocessing: Raw market data often contains noise or inconsistencies that can hinder model performance. Preprocessing involves cleaning this data—removing anomalies—and normalizing it so that features are scaled uniformly across datasets.

Feature Extraction: To enable effective classification by algorithms like neural networks or support vector machines (SVMs), relevant features must be identified from raw data:

- Technical indicators such as moving averages (MA), Relative Strength Index (RSI), Bollinger Bands

- Price derivatives like rate of change

- Pattern-specific metrics such as breakout points or trendlines

Model Training: Using labeled datasets where chart patterns have been annotated by experts or derived from algorithmic detection methods enables supervised training:

- Deep learning architectures like convolutional neural networks (CNNs) excel at recognizing spatial hierarchies within pattern images.

- Recurrent neural networks (RNNs) capture temporal dependencies inherent in sequential price movements.

Model Evaluation: After training on a subset of data ("training set"), models are tested against unseen datasets ("validation" or "test sets") to assess their accuracy using metrics such as precision, recall—and overall classification accuracy.

Recent Developments Enhancing Classification Accuracy

The field has seen significant progress due to innovations primarily driven by deep learning techniques:

Deep Learning Integration: CNNs have been particularly effective because they can analyze image-like representations of charts—such as candlestick charts—to detect complex pattern structures with high precision[1]. Similarly, RNNs handle sequential time-series data well[9].

Multi-Tool Integration: Modern platforms combine pattern recognition with sentiment analysis derived from social media feeds or news sources[2]. This holistic approach provides traders with richer insights beyond just technical signals.

Real-Time Analysis Capabilities: Advances in cloud computing infrastructure allow these models to operate continuously on live market feeds[3], enabling timely alerts when specific chart formations emerge—a critical advantage amid volatile crypto markets.

Implications for Crypto Traders

The automation brought about by machine learning not only improves detection speed but also enhances consistency compared to manual analysis—which is subjective and prone to bias[10]. Traders benefit from more reliable signals when making buy/sell decisions based on recognized chart formations validated through AI systems.

However—as with any technology—the reliance on automated classifiers introduces risks:

- Overfitting may cause models to perform poorly under novel market conditions.

- False positives could trigger unnecessary trades.

- Market volatility might amplify errors if multiple systems react simultaneously without proper safeguards [5].

Addressing Ethical Concerns & Regulatory Challenges

As AI becomes integral within financial markets—including cryptocurrencies—ethical considerations come into focus:

- Transparency about how models make decisions is vital for trustworthiness.

- Fairness concerns arise if certain entities gain unfair advantages through proprietary algorithms[4].Furthermore,the rapid evolution prompts regulators worldwide to develop frameworks ensuring responsible deployment while preventing manipulative practices [6].

Potential Risks & Future Outlook

While machine learning enhances analytical capabilities significantly:

Market Volatility: Increased reliance might lead systems collectively reacting during sharp moves could exacerbate swings [5].

Regulatory Hurdles: Governments need adaptive policies addressing transparency standards for AI-based trading tools [6].

Job Displacement: Automation may reduce demand for manual analysts but also creates new roles focused on model development/oversight [7].

Looking ahead—from 2018’s initial applications up until recent years—the integration between deep learning techniques like CNNs/RNNs with real-time analytics continues expanding rapidly[8][9][10]. As these technologies mature further—with improved interpretability—they will likely become indispensable components within sophisticated crypto trading strategies while necessitating careful regulation and ethical oversight.

References

- "Deep Learning for Financial Time Series Forecasting" by S.S Iyengar et al., 2020

2."AI-Powered Trading Platforms in Cryptocurrency Markets" by J.D Lee et al., 2022

3."Real-Time Analysis of Financial Markets Using Edge Computing" by M.A Khan et al., 2023

4."Ethical Considerations in AI-Driven Financial Markets" by A.K Singh et al., 2023

5."Market Volatility and AI in Financial Markets" R.M Patel et al., 2022

6."Regulatory Frameworks for AI in Finance" E.J Brown et al., 2023

7."Job Displacement in Financial Sector Due to Automation" T.S Kim et al., 2022

8."Machine Learning in Cryptocurrency Trading: A Review," P.K Jain et al., 2019

9."Deep Learning Techniques for Chart Pattern Recognition," S.K Gupta et al., 2021

10."Integration of Sentiment Analysis with AI-Powered Trading Platforms," J.H Lee et al., 2022

Lo

2025-05-14 15:41

How can machine learning algorithms classify chart patterns?

How Machine Learning Algorithms Classify Chart Patterns in Cryptocurrency Markets

Understanding how machine learning algorithms classify chart patterns is essential for traders, investors, and financial analysts aiming to leverage AI-driven tools for better decision-making. As cryptocurrencies continue to grow in popularity and complexity, traditional analysis methods are increasingly supplemented or replaced by advanced computational techniques. This article explores the process behind machine learning classification of chart patterns, its recent advancements, and the implications for the crypto trading landscape.

What Are Chart Patterns in Cryptocurrency Trading?

Chart patterns are visual representations of historical price movements that help traders identify potential future trends. These patterns form based on recurring behaviors in market data and can signal reversals or continuations of current trends. Common examples include head and shoulders, triangles (symmetrical, ascending, descending), wedges (rising or falling), flags, pennants, and double tops/bottoms.

Recognizing these patterns manually requires experience and skill; however, with the advent of machine learning algorithms—especially deep learning models—automatic pattern recognition has become more accurate and efficient. This technological shift allows traders to analyze vast amounts of data quickly while reducing human error.

How Do Machine Learning Algorithms Classify Chart Patterns?

Machine learning models classify chart patterns through a multi-step process that involves data collection, preprocessing, feature extraction, training, and evaluation:

Data Collection: The foundation lies in gathering extensive historical price data from various cryptocurrency exchanges. This includes open-high-low-close (OHLC) prices over different timeframes.

Data Preprocessing: Raw market data often contains noise or inconsistencies that can hinder model performance. Preprocessing involves cleaning this data—removing anomalies—and normalizing it so that features are scaled uniformly across datasets.

Feature Extraction: To enable effective classification by algorithms like neural networks or support vector machines (SVMs), relevant features must be identified from raw data:

- Technical indicators such as moving averages (MA), Relative Strength Index (RSI), Bollinger Bands

- Price derivatives like rate of change

- Pattern-specific metrics such as breakout points or trendlines

Model Training: Using labeled datasets where chart patterns have been annotated by experts or derived from algorithmic detection methods enables supervised training:

- Deep learning architectures like convolutional neural networks (CNNs) excel at recognizing spatial hierarchies within pattern images.

- Recurrent neural networks (RNNs) capture temporal dependencies inherent in sequential price movements.

Model Evaluation: After training on a subset of data ("training set"), models are tested against unseen datasets ("validation" or "test sets") to assess their accuracy using metrics such as precision, recall—and overall classification accuracy.

Recent Developments Enhancing Classification Accuracy

The field has seen significant progress due to innovations primarily driven by deep learning techniques:

Deep Learning Integration: CNNs have been particularly effective because they can analyze image-like representations of charts—such as candlestick charts—to detect complex pattern structures with high precision[1]. Similarly, RNNs handle sequential time-series data well[9].

Multi-Tool Integration: Modern platforms combine pattern recognition with sentiment analysis derived from social media feeds or news sources[2]. This holistic approach provides traders with richer insights beyond just technical signals.

Real-Time Analysis Capabilities: Advances in cloud computing infrastructure allow these models to operate continuously on live market feeds[3], enabling timely alerts when specific chart formations emerge—a critical advantage amid volatile crypto markets.

Implications for Crypto Traders

The automation brought about by machine learning not only improves detection speed but also enhances consistency compared to manual analysis—which is subjective and prone to bias[10]. Traders benefit from more reliable signals when making buy/sell decisions based on recognized chart formations validated through AI systems.

However—as with any technology—the reliance on automated classifiers introduces risks:

- Overfitting may cause models to perform poorly under novel market conditions.

- False positives could trigger unnecessary trades.

- Market volatility might amplify errors if multiple systems react simultaneously without proper safeguards [5].

Addressing Ethical Concerns & Regulatory Challenges

As AI becomes integral within financial markets—including cryptocurrencies—ethical considerations come into focus:

- Transparency about how models make decisions is vital for trustworthiness.

- Fairness concerns arise if certain entities gain unfair advantages through proprietary algorithms[4].Furthermore,the rapid evolution prompts regulators worldwide to develop frameworks ensuring responsible deployment while preventing manipulative practices [6].

Potential Risks & Future Outlook

While machine learning enhances analytical capabilities significantly:

Market Volatility: Increased reliance might lead systems collectively reacting during sharp moves could exacerbate swings [5].

Regulatory Hurdles: Governments need adaptive policies addressing transparency standards for AI-based trading tools [6].

Job Displacement: Automation may reduce demand for manual analysts but also creates new roles focused on model development/oversight [7].

Looking ahead—from 2018’s initial applications up until recent years—the integration between deep learning techniques like CNNs/RNNs with real-time analytics continues expanding rapidly[8][9][10]. As these technologies mature further—with improved interpretability—they will likely become indispensable components within sophisticated crypto trading strategies while necessitating careful regulation and ethical oversight.

References

- "Deep Learning for Financial Time Series Forecasting" by S.S Iyengar et al., 2020

2."AI-Powered Trading Platforms in Cryptocurrency Markets" by J.D Lee et al., 2022

3."Real-Time Analysis of Financial Markets Using Edge Computing" by M.A Khan et al., 2023

4."Ethical Considerations in AI-Driven Financial Markets" by A.K Singh et al., 2023

5."Market Volatility and AI in Financial Markets" R.M Patel et al., 2022

6."Regulatory Frameworks for AI in Finance" E.J Brown et al., 2023

7."Job Displacement in Financial Sector Due to Automation" T.S Kim et al., 2022

8."Machine Learning in Cryptocurrency Trading: A Review," P.K Jain et al., 2019

9."Deep Learning Techniques for Chart Pattern Recognition," S.K Gupta et al., 2021

10."Integration of Sentiment Analysis with AI-Powered Trading Platforms," J.H Lee et al., 2022

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚀 The Future of Bitcoin is closer than you think!

By 2030, Bitcoin could transform the financial world as we know it. Whether you’re a seasoned HODLer or just starting your crypto journey, the question is… how many will YOU own?

JuCoin Media

2025-08-13 14:49

The Future of Bitcoin 🚀 – How Many Will You Own by 2030?

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The Bank of Korea's Project Hangang CBDC pilot has been suspended after commercial banks collectively rejected further participation. Here's what happened and why it matters:

💰 Why Banks Said NO:

-

35 billion won ($26M) infrastructure costs with unclear ROI

No viable business model for commercial banks

Fear of reduced revenue from disintermediation

Preference for profitable private stablecoin alternatives

🔄 The Pivot:

-

Banks forming won-based stablecoin consortium instead

New pro-crypto government supporting private sector solutions

Bank of Korea shifting from issuer to regulator role

"Digital Currency Research Lab" renamed to "Digital Currency Team"

🎯 What This Means:

-

South Korea pioneering hybrid public-private digital currency model

Central banks worldwide watching this "wait and see" approach

Potential future: CBDCs for settlement, stablecoins for retail

Market forces driving digital currency innovation over state mandates

💡 Key Insight: This isn't a failure but a strategic realignment showing that successful digital currency adoption may require balancing public monetary policy goals with private sector commercial interests.

The Korean model could become a blueprint for other nations facing similar resistance from traditional financial institutions.

Read the full analysis: 👇 https://blog.jucoin.com/south-korea-cbdc-project-why-it-was-paused/?utm_source=blog

#SouthKorea #CBDC #Stablecoins

JU Blog

2025-08-07 10:30

South Korea CBDC Project PAUSED: Banks Choose Stablecoins Over State Digital Currency!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Oracle Manipulation Can Lead to DeFi Exploits

DeFi (Decentralized Finance) has revolutionized the way individuals access financial services by removing intermediaries and enabling peer-to-peer transactions on blockchain networks. However, this innovation comes with its own set of vulnerabilities, particularly related to the reliance on oracles—external data sources that feed real-world information into smart contracts. When these oracles are manipulated, they can become a critical point of failure, leading to severe exploits within DeFi platforms.

Understanding Oracles in DeFi

Oracles serve as bridges between off-chain data and on-chain smart contracts. They provide essential information such as asset prices, interest rates, weather data for insurance protocols, and more. Since blockchains cannot access external data directly due to their deterministic nature, oracles are necessary for enabling dynamic and real-world-aware smart contract functionalities.

There are two primary types of oracles:

- Centralized Oracles: Controlled by a single entity that supplies data.

- Decentralized Oracles: Use multiple independent nodes to aggregate and verify data before feeding it into smart contracts.

While decentralized oracles aim to reduce risks associated with trust assumptions inherent in centralized systems, both types can be vulnerable if not properly secured.

How Oracle Manipulation Occurs

Manipulating an oracle involves intentionally corrupting the integrity of the data it provides. This can happen through various methods:

- Data Tampering: Attackers alter the reported values before they reach the blockchain.

- Data Delay: Deliberately delaying updates so that outdated or manipulated information is used during critical moments.

- Data Inconsistency: Providing conflicting reports from different nodes within a decentralized oracle network.

These manipulations often target specific vulnerabilities in how oracles gather and verify their data feeds.

Impact of Oracle Manipulation on DeFi Platforms

When an oracle is compromised, it can trigger a cascade of malicious activities across DeFi applications:

Price Manipulation

Price feeds are fundamental for trading platforms like decentralized exchanges (DEXs), lending protocols, and derivatives markets. If an attacker successfully manipulates price feeds—say by artificially inflating asset prices—they can exploit arbitrage opportunities or drain liquidity pools. For example, artificially high prices might allow attackers to borrow large amounts against collateral at undervalued rates before reversing the manipulation for profit.

Loan Defaults

Many lending protocols rely heavily on accurate collateral valuation provided via oracles. If these valuations are skewed due to manipulation—such as reporting lower collateral values than actual—the protocol may wrongly liquidate assets prematurely or fail to liquidate when necessary. This exposes lenders and borrowers alike to significant financial risk.

Insurance Fraud

Insurance protocols depend on truthful external event reports (like weather conditions). Malicious actors could manipulate such reports—for instance claiming false damage—to receive payouts unjustly while causing losses elsewhere in the system’s pool funds.

Notable Incidents Demonstrating Oracle Exploits

Historical incidents highlight how vulnerable these systems remain despite ongoing security efforts:

The DAO Hack (2021): One of early notable cases where an exploit involved manipulating price feeds from an oracle system used by The DAO—a pioneering decentralized autonomous organization—leading directly to its collapse.

Ronin Network Breach (2022): The Ronin sidechain for Axie Infinity was hacked after attackers compromised its oracle infrastructure through phishing attacks; approximately $600 million worth of Ethereum-based assets were stolen due partly to unreliable oracle security measures.

Euler Finance Attack (2023): A sophisticated attack exploited vulnerabilities in Euler's protocol's reliance on flawed oracle inputs resulting in a loss exceeding $120 million—a stark reminder that even mature projects remain targets if their oracle systems aren’t robust enough.

Security Measures Against Oracle Attacks

To mitigate risks associated with oracle manipulation, several best practices have emerged within blockchain development communities:

Decentralization: Using multiple independent nodes reduces single points of failure; if one node is compromised, others maintain integrity.

Multi-party Computation (MPC): This cryptographic technique ensures sensitive computations occur securely without revealing individual inputs—making tampering more difficult.

Regular Audits & Testing: Continuous security audits help identify potential weaknesses before exploitation occurs; bug bounty programs incentivize white-hat hackers’ participation.

Economic Incentives & Penalties: Designing incentive structures discourages malicious behavior among node operators by imposing penalties for dishonest reporting.

Implementing these measures enhances resilience but does not eliminate all risks; vigilance remains essential given evolving attack vectors.

Broader Risks Posed by Vulnerable Oracles

Oracle manipulation doesn’t just threaten individual platforms—it undermines overall confidence in DeFi ecosystems:

Market Volatility

False price signals caused by manipulated feeds can lead traders astray — exacerbating volatility during critical periods like market crashes when accurate pricing is vital for stability.

User Trust Erosion

Repeated exploits diminish user confidence in DeFi’s safety mechanisms — potentially stalling adoption growth and attracting regulatory scrutiny aimed at protecting investors from systemic failures.

Smart Contract Vulnerabilities

Many exploits leverage flaws beyond just faulty data inputs—for example reentrancy attacks where malicious actors repeatedly invoke functions leading to unintended outcomes—which underscores why secure coding practices must complement robust oracle design.

By understanding how orchestrated manipulations target external data sources feeding into smart contracts—and recognizing past incidents—we see why securing these channels is paramount for sustainable growth within DeFi sectors. Combining decentralization strategies with cryptographic safeguards offers promising pathways toward reducing vulnerability exposure but requires continuous innovation aligned with evolving threat landscapes.

Ensuring Future Resilience Against Oracle-Based Attacks

As DeFi continues expanding rapidly worldwide—with billions locked across various protocols—the importance of resiliently securing your infrastructure cannot be overstated. Developers should prioritize implementing multi-layered defenses: adopting decentralized architectures wherever possible; conducting regular audits; employing cryptographic techniques like MPC; fostering community-driven bug bounty programs; and staying informed about emerging threats through active research collaborations.

By doing so—and maintaining transparency about security practices—DeFi projects will better protect users’ assets while reinforcing industry credibility amid increasing regulatory attention worldwide.

JCUSER-IC8sJL1q

2025-05-14 07:40

How can oracle manipulation lead to DeFi exploits?

How Oracle Manipulation Can Lead to DeFi Exploits

DeFi (Decentralized Finance) has revolutionized the way individuals access financial services by removing intermediaries and enabling peer-to-peer transactions on blockchain networks. However, this innovation comes with its own set of vulnerabilities, particularly related to the reliance on oracles—external data sources that feed real-world information into smart contracts. When these oracles are manipulated, they can become a critical point of failure, leading to severe exploits within DeFi platforms.

Understanding Oracles in DeFi

Oracles serve as bridges between off-chain data and on-chain smart contracts. They provide essential information such as asset prices, interest rates, weather data for insurance protocols, and more. Since blockchains cannot access external data directly due to their deterministic nature, oracles are necessary for enabling dynamic and real-world-aware smart contract functionalities.

There are two primary types of oracles:

- Centralized Oracles: Controlled by a single entity that supplies data.

- Decentralized Oracles: Use multiple independent nodes to aggregate and verify data before feeding it into smart contracts.

While decentralized oracles aim to reduce risks associated with trust assumptions inherent in centralized systems, both types can be vulnerable if not properly secured.

How Oracle Manipulation Occurs

Manipulating an oracle involves intentionally corrupting the integrity of the data it provides. This can happen through various methods:

- Data Tampering: Attackers alter the reported values before they reach the blockchain.

- Data Delay: Deliberately delaying updates so that outdated or manipulated information is used during critical moments.

- Data Inconsistency: Providing conflicting reports from different nodes within a decentralized oracle network.

These manipulations often target specific vulnerabilities in how oracles gather and verify their data feeds.

Impact of Oracle Manipulation on DeFi Platforms

When an oracle is compromised, it can trigger a cascade of malicious activities across DeFi applications:

Price Manipulation

Price feeds are fundamental for trading platforms like decentralized exchanges (DEXs), lending protocols, and derivatives markets. If an attacker successfully manipulates price feeds—say by artificially inflating asset prices—they can exploit arbitrage opportunities or drain liquidity pools. For example, artificially high prices might allow attackers to borrow large amounts against collateral at undervalued rates before reversing the manipulation for profit.

Loan Defaults

Many lending protocols rely heavily on accurate collateral valuation provided via oracles. If these valuations are skewed due to manipulation—such as reporting lower collateral values than actual—the protocol may wrongly liquidate assets prematurely or fail to liquidate when necessary. This exposes lenders and borrowers alike to significant financial risk.

Insurance Fraud

Insurance protocols depend on truthful external event reports (like weather conditions). Malicious actors could manipulate such reports—for instance claiming false damage—to receive payouts unjustly while causing losses elsewhere in the system’s pool funds.

Notable Incidents Demonstrating Oracle Exploits

Historical incidents highlight how vulnerable these systems remain despite ongoing security efforts:

The DAO Hack (2021): One of early notable cases where an exploit involved manipulating price feeds from an oracle system used by The DAO—a pioneering decentralized autonomous organization—leading directly to its collapse.

Ronin Network Breach (2022): The Ronin sidechain for Axie Infinity was hacked after attackers compromised its oracle infrastructure through phishing attacks; approximately $600 million worth of Ethereum-based assets were stolen due partly to unreliable oracle security measures.

Euler Finance Attack (2023): A sophisticated attack exploited vulnerabilities in Euler's protocol's reliance on flawed oracle inputs resulting in a loss exceeding $120 million—a stark reminder that even mature projects remain targets if their oracle systems aren’t robust enough.

Security Measures Against Oracle Attacks

To mitigate risks associated with oracle manipulation, several best practices have emerged within blockchain development communities:

Decentralization: Using multiple independent nodes reduces single points of failure; if one node is compromised, others maintain integrity.

Multi-party Computation (MPC): This cryptographic technique ensures sensitive computations occur securely without revealing individual inputs—making tampering more difficult.

Regular Audits & Testing: Continuous security audits help identify potential weaknesses before exploitation occurs; bug bounty programs incentivize white-hat hackers’ participation.

Economic Incentives & Penalties: Designing incentive structures discourages malicious behavior among node operators by imposing penalties for dishonest reporting.

Implementing these measures enhances resilience but does not eliminate all risks; vigilance remains essential given evolving attack vectors.

Broader Risks Posed by Vulnerable Oracles

Oracle manipulation doesn’t just threaten individual platforms—it undermines overall confidence in DeFi ecosystems:

Market Volatility

False price signals caused by manipulated feeds can lead traders astray — exacerbating volatility during critical periods like market crashes when accurate pricing is vital for stability.

User Trust Erosion

Repeated exploits diminish user confidence in DeFi’s safety mechanisms — potentially stalling adoption growth and attracting regulatory scrutiny aimed at protecting investors from systemic failures.

Smart Contract Vulnerabilities

Many exploits leverage flaws beyond just faulty data inputs—for example reentrancy attacks where malicious actors repeatedly invoke functions leading to unintended outcomes—which underscores why secure coding practices must complement robust oracle design.

By understanding how orchestrated manipulations target external data sources feeding into smart contracts—and recognizing past incidents—we see why securing these channels is paramount for sustainable growth within DeFi sectors. Combining decentralization strategies with cryptographic safeguards offers promising pathways toward reducing vulnerability exposure but requires continuous innovation aligned with evolving threat landscapes.

Ensuring Future Resilience Against Oracle-Based Attacks

As DeFi continues expanding rapidly worldwide—with billions locked across various protocols—the importance of resiliently securing your infrastructure cannot be overstated. Developers should prioritize implementing multi-layered defenses: adopting decentralized architectures wherever possible; conducting regular audits; employing cryptographic techniques like MPC; fostering community-driven bug bounty programs; and staying informed about emerging threats through active research collaborations.

By doing so—and maintaining transparency about security practices—DeFi projects will better protect users’ assets while reinforcing industry credibility amid increasing regulatory attention worldwide.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Large and Active Is the Crypto Online Community?

The online community surrounding cryptocurrencies has experienced exponential growth over the past decade. From early adopters and tech enthusiasts to institutional investors and industry professionals, this digital ecosystem is diverse, vibrant, and constantly evolving. Understanding its size and activity levels provides valuable insights into how cryptocurrencies are shaping financial markets, technological innovation, and social discourse today.

The Scope of the Crypto Community on Social Media Platforms

Social media platforms serve as primary hubs for crypto discussions, news sharing, and community building. Reddit stands out as one of the most active platforms with dedicated subreddits such as r/CryptoCurrency and r/Bitcoin hosting over 2 million subscribers collectively. These forums facilitate real-time discussions about market trends, technological developments, regulatory updates, and investment strategies.

Twitter also plays a crucial role in amplifying crypto conversations. Influential figures like Elon Musk or Vitalik Buterin command millions of followers who engage with their posts regularly. This high-profile activity not only boosts visibility but also influences market sentiment—highlighting Twitter’s importance in shaping public perception of cryptocurrencies.

Beyond social media giants, specialized forums like Bitcointalk have historically served as spaces for technical debates among developers while news-focused websites such as CoinDesk or CoinTelegraph provide in-depth analysis that attracts industry insiders seeking reliable information.

Quantifying Memberships And Engagement Levels

The sheer number of participants underscores the community's vastness: Over 2 million users participate actively on Reddit alone across various subreddits dedicated to different aspects of crypto—ranging from trading tips to blockchain technology discussions. On Twitter, many accounts related to cryptocurrency boast millions of followers; some influencers reach tens of millions globally.

This widespread engagement indicates not only a large user base but also high levels of interaction—comments on posts, live debates during market swings—and continuous content creation that sustains interest across multiple channels.

Recent Developments Impacting Community Activity

Several recent events have significantly influenced online engagement within the crypto space:

Regulatory Changes: Governments worldwide are implementing new rules affecting how cryptocurrencies can be traded or issued. For example, recent rulings by U.S. regulators like the SEC regarding token classifications create uncertainty but also spark extensive online debate about future compliance requirements.

Market Volatility: Cryptocurrencies are known for their rapid price fluctuations—sometimes within hours—which fuels lively discussions among traders trying to interpret trends or predict future movements.

Technological Innovations: Advances such as blockchain scalability solutions (e.g., sharding) or decentralized finance (DeFi) protocols generate buzz within communities eager to understand new opportunities or risks associated with these technologies.

These factors contribute both positively by increasing activity during periods of excitement—and negatively when uncertainty leads to skepticism or concern among users.

Challenges Facing The Crypto Online Community

Despite its size and vibrancy, the community faces notable challenges:

Regulatory Uncertainty: Lack of clear global regulations can cause confusion among investors and developers alike; this ambiguity sometimes results in hesitation or panic selling.

Security Risks: As DeFi protocols grow more popular—they often involve significant sums—the risk for hacks increases too. Security breaches can lead to substantial financial losses which ripple through online forums affecting confidence.

Market Manipulation: The high volatility makes it easier for malicious actors to manipulate prices through coordinated pump-and-dump schemes—a concern frequently discussed across social platforms that impacts trustworthiness perceptions within the community.

Addressing these issues requires ongoing dialogue between regulators, technologists—and active participation from informed members who advocate transparency and security best practices.

Historical Milestones That Shaped Online Engagement

Understanding how far this community has come helps contextualize current activity levels:

- In 2009: Bitcoin was introduced by Satoshi Nakamoto—a pivotal moment sparking initial interest.

- In 2017: Bitcoin’s price surged toward an all-time high near $20K—triggering global attention.

- During 2020: The COVID-19 pandemic accelerated interest in cryptocurrencies as alternative assets amid economic uncertainty.

- Recent years saw major events like TerraUSD’s collapse in 2022 causing widespread discussion about stability risks; meanwhile regulatory frameworks like Europe’s MiCA regulation introduced in 2023 continue fueling debate around compliance standards globally.

These milestones reflect moments where online engagement spiked due to curiosity about technological breakthroughs or concerns over market stability—all contributing factors behind current community size & activity levels today.

Measuring The Growth And Future Outlook Of Cryptocurrency Communities

As digital assets become more mainstream—with institutional players entering markets—the size and influence of online communities are expected to expand further Nonetheless maintaining credibility requires addressing ongoing challenges related especially regulatory clarity & security measures While fostering informed participation remains key for sustainable growth These communities will likely continue evolving alongside technological innovations & legislative developments shaping tomorrow's cryptocurrency landscape

JCUSER-F1IIaxXA

2025-05-11 10:08

How large and active is its online community?

How Large and Active Is the Crypto Online Community?

The online community surrounding cryptocurrencies has experienced exponential growth over the past decade. From early adopters and tech enthusiasts to institutional investors and industry professionals, this digital ecosystem is diverse, vibrant, and constantly evolving. Understanding its size and activity levels provides valuable insights into how cryptocurrencies are shaping financial markets, technological innovation, and social discourse today.

The Scope of the Crypto Community on Social Media Platforms

Social media platforms serve as primary hubs for crypto discussions, news sharing, and community building. Reddit stands out as one of the most active platforms with dedicated subreddits such as r/CryptoCurrency and r/Bitcoin hosting over 2 million subscribers collectively. These forums facilitate real-time discussions about market trends, technological developments, regulatory updates, and investment strategies.

Twitter also plays a crucial role in amplifying crypto conversations. Influential figures like Elon Musk or Vitalik Buterin command millions of followers who engage with their posts regularly. This high-profile activity not only boosts visibility but also influences market sentiment—highlighting Twitter’s importance in shaping public perception of cryptocurrencies.

Beyond social media giants, specialized forums like Bitcointalk have historically served as spaces for technical debates among developers while news-focused websites such as CoinDesk or CoinTelegraph provide in-depth analysis that attracts industry insiders seeking reliable information.

Quantifying Memberships And Engagement Levels

The sheer number of participants underscores the community's vastness: Over 2 million users participate actively on Reddit alone across various subreddits dedicated to different aspects of crypto—ranging from trading tips to blockchain technology discussions. On Twitter, many accounts related to cryptocurrency boast millions of followers; some influencers reach tens of millions globally.

This widespread engagement indicates not only a large user base but also high levels of interaction—comments on posts, live debates during market swings—and continuous content creation that sustains interest across multiple channels.

Recent Developments Impacting Community Activity

Several recent events have significantly influenced online engagement within the crypto space:

Regulatory Changes: Governments worldwide are implementing new rules affecting how cryptocurrencies can be traded or issued. For example, recent rulings by U.S. regulators like the SEC regarding token classifications create uncertainty but also spark extensive online debate about future compliance requirements.

Market Volatility: Cryptocurrencies are known for their rapid price fluctuations—sometimes within hours—which fuels lively discussions among traders trying to interpret trends or predict future movements.

Technological Innovations: Advances such as blockchain scalability solutions (e.g., sharding) or decentralized finance (DeFi) protocols generate buzz within communities eager to understand new opportunities or risks associated with these technologies.

These factors contribute both positively by increasing activity during periods of excitement—and negatively when uncertainty leads to skepticism or concern among users.

Challenges Facing The Crypto Online Community

Despite its size and vibrancy, the community faces notable challenges:

Regulatory Uncertainty: Lack of clear global regulations can cause confusion among investors and developers alike; this ambiguity sometimes results in hesitation or panic selling.

Security Risks: As DeFi protocols grow more popular—they often involve significant sums—the risk for hacks increases too. Security breaches can lead to substantial financial losses which ripple through online forums affecting confidence.

Market Manipulation: The high volatility makes it easier for malicious actors to manipulate prices through coordinated pump-and-dump schemes—a concern frequently discussed across social platforms that impacts trustworthiness perceptions within the community.

Addressing these issues requires ongoing dialogue between regulators, technologists—and active participation from informed members who advocate transparency and security best practices.

Historical Milestones That Shaped Online Engagement

Understanding how far this community has come helps contextualize current activity levels:

- In 2009: Bitcoin was introduced by Satoshi Nakamoto—a pivotal moment sparking initial interest.

- In 2017: Bitcoin’s price surged toward an all-time high near $20K—triggering global attention.

- During 2020: The COVID-19 pandemic accelerated interest in cryptocurrencies as alternative assets amid economic uncertainty.

- Recent years saw major events like TerraUSD’s collapse in 2022 causing widespread discussion about stability risks; meanwhile regulatory frameworks like Europe’s MiCA regulation introduced in 2023 continue fueling debate around compliance standards globally.

These milestones reflect moments where online engagement spiked due to curiosity about technological breakthroughs or concerns over market stability—all contributing factors behind current community size & activity levels today.

Measuring The Growth And Future Outlook Of Cryptocurrency Communities

As digital assets become more mainstream—with institutional players entering markets—the size and influence of online communities are expected to expand further Nonetheless maintaining credibility requires addressing ongoing challenges related especially regulatory clarity & security measures While fostering informed participation remains key for sustainable growth These communities will likely continue evolving alongside technological innovations & legislative developments shaping tomorrow's cryptocurrency landscape

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What is the Funding Rate in Perpetual Futures?

The funding rate is a fundamental concept in perpetual futures trading, especially within cryptocurrency markets. It acts as a mechanism to keep the price of perpetual contracts aligned with the underlying asset's spot price. Unlike traditional futures, which have fixed expiration dates, perpetual futures are designed to trade indefinitely. This unique feature necessitates a system—namely, the funding rate—to maintain market stability and liquidity over time.

In essence, the funding rate represents periodic payments exchanged between traders holding long and short positions based on prevailing market conditions. When used correctly, it helps prevent significant deviations between the futures contract price and the actual market value of the underlying asset.

How Does the Funding Rate Work?

The primary purpose of the funding rate is to balance supply and demand within perpetual futures markets. It operates on a regular schedule—often every 8 hours—where traders either pay or receive fees depending on their position type (long or short) and current market dynamics.

If traders collectively believe that prices will rise above spot prices, long positions tend to dominate. To prevent excessive divergence from real-world prices, exchanges implement a positive funding rate where longs pay shorts periodically. Conversely, if futures prices fall below spot prices due to bearish sentiment or other factors, negative funding rates may occur where shorts pay longs.

This payment flow incentivizes traders' behavior: high positive rates encourage some longs to close their positions or take profits while attracting more shorts; negative rates do just the opposite by encouraging longs to hold onto their positions despite unfavorable conditions.

Calculation of Funding Rates

Understanding how funding rates are calculated provides insight into their role in maintaining equilibrium:

- Basis Difference: The core component involves calculating the difference between current spot prices and futures contract prices.

- Interest Rate Component: Some models incorporate an interest component reflecting borrowing costs.

- Premium/Discount Adjustment: The calculation considers whether contracts are trading at a premium (above spot) or discount (below spot).

Most exchanges compute this rate every 8 hours using real-time data from both markets. The formula varies slightly across platforms but generally follows this pattern:

Funding Rate = (Futures Price - Spot Price) / Spot Price * Adjustment FactorWhere adjustments account for interest rates and other market factors specific to each exchange’s methodology.

Why Is The Funding Rate Important for Traders?

For traders engaged in perpetual futures trading, understanding how funding impacts profitability is crucial:

- Cost Management: A positive funding rate means holding long positions incurs periodic costs; negative rates mean short sellers face similar charges.

- Strategy Planning: Anticipating changes in fundings can influence entry/exit points—for example, avoiding entering new long positions when high positive rates are expected.

- Risk Control: Sudden spikes or drops in fundings often signal shifts in market sentiment or volatility; monitoring these can help mitigate potential losses.

Moreover, since these payments happen automatically at scheduled intervals through exchange mechanisms like wallet deductions or credits, they directly affect net gains/losses over time.

Impact of Market Volatility on Funding Rates

Market volatility significantly influences how often and how drastically funding rates fluctuate:

- During periods of rapid price swings—such as during major news events—the spread between spot and future prices widens temporarily.

- These fluctuations cause corresponding jumps in financing costs for traders holding open positions.

- High volatility environments often see increased frequency of large positive or negative fundings as markets attempt self-correction mechanisms quickly respond to changing sentiments.

Such dynamics underscore why active monitoring becomes essential during turbulent times—they can dramatically alter profitability prospects for leveraged trades.

Regulatory Changes Affecting Funding Rates

Regulatory developments also play an influential role by shaping overall market sentiment—and consequently impacting funds' flow patterns:

- New rules around derivatives trading may impose restrictions that influence leverage limits,

- Changes requiring greater transparency could lead exchanges to modify calculation methods,

- Regulatory crackdowns might reduce overall trading activity affecting liquidity levels,

These factors indirectly impact how frequently and intensely funds change hands via differentials like those seen through varying funding rates across jurisdictions.

Risks Associated with Funding Rates

While beneficial for maintaining equilibrium under normal conditions,

extreme scenarios involving abnormal fundings pose risks such as:

- Market Destabilization: Excessively high positive/negative fundings may trigger mass liquidations if traders cannot sustain costs,

- Manipulation Potential: Some actors might attempt strategies exploiting predictable patterns within fee calculations,

- Trader Behavior Shifts: Unexpected changes could lead investors toward riskier behaviors like overleveraging before adverse shifts occur,

Therefore, prudent risk management practices—including setting stop-loss orders—is vital when operating under volatile conditions influenced by fluctuating fundings.

By grasping what determines your costs related to persistent holdings—and recognizing broader influences such as volatility trends—they become invaluable tools for informed decision-making within cryptocurrency derivatives markets.

Key Takeaways:

- The funding rate aligns perpetual contract pricing with underlying assets’ real-time values.

- Calculated regularly based on premium/discounts relative to spot prices.

- Impacts trader profitability directly through periodic payments.

- Fluctuates with market volatility & regulatory environment changes.

Staying aware of these dynamics enhances strategic planning—whether you're hedging risks or seeking arbitrage opportunities—in today’s fast-paced crypto landscape.

Semantic & LSI Keywords:

Perpetual swaps | Cryptocurrency derivatives | Futures contract pricing | Market liquidity | Trading fees | Leverage trading | Crypto regulation impacts | Volatility effects on derivatives

kai

2025-05-09 16:09

What is the funding rate in perpetual futures?

What is the Funding Rate in Perpetual Futures?

The funding rate is a fundamental concept in perpetual futures trading, especially within cryptocurrency markets. It acts as a mechanism to keep the price of perpetual contracts aligned with the underlying asset's spot price. Unlike traditional futures, which have fixed expiration dates, perpetual futures are designed to trade indefinitely. This unique feature necessitates a system—namely, the funding rate—to maintain market stability and liquidity over time.

In essence, the funding rate represents periodic payments exchanged between traders holding long and short positions based on prevailing market conditions. When used correctly, it helps prevent significant deviations between the futures contract price and the actual market value of the underlying asset.

How Does the Funding Rate Work?

The primary purpose of the funding rate is to balance supply and demand within perpetual futures markets. It operates on a regular schedule—often every 8 hours—where traders either pay or receive fees depending on their position type (long or short) and current market dynamics.

If traders collectively believe that prices will rise above spot prices, long positions tend to dominate. To prevent excessive divergence from real-world prices, exchanges implement a positive funding rate where longs pay shorts periodically. Conversely, if futures prices fall below spot prices due to bearish sentiment or other factors, negative funding rates may occur where shorts pay longs.

This payment flow incentivizes traders' behavior: high positive rates encourage some longs to close their positions or take profits while attracting more shorts; negative rates do just the opposite by encouraging longs to hold onto their positions despite unfavorable conditions.

Calculation of Funding Rates

Understanding how funding rates are calculated provides insight into their role in maintaining equilibrium:

- Basis Difference: The core component involves calculating the difference between current spot prices and futures contract prices.

- Interest Rate Component: Some models incorporate an interest component reflecting borrowing costs.

- Premium/Discount Adjustment: The calculation considers whether contracts are trading at a premium (above spot) or discount (below spot).

Most exchanges compute this rate every 8 hours using real-time data from both markets. The formula varies slightly across platforms but generally follows this pattern:

Funding Rate = (Futures Price - Spot Price) / Spot Price * Adjustment FactorWhere adjustments account for interest rates and other market factors specific to each exchange’s methodology.

Why Is The Funding Rate Important for Traders?

For traders engaged in perpetual futures trading, understanding how funding impacts profitability is crucial:

- Cost Management: A positive funding rate means holding long positions incurs periodic costs; negative rates mean short sellers face similar charges.

- Strategy Planning: Anticipating changes in fundings can influence entry/exit points—for example, avoiding entering new long positions when high positive rates are expected.

- Risk Control: Sudden spikes or drops in fundings often signal shifts in market sentiment or volatility; monitoring these can help mitigate potential losses.

Moreover, since these payments happen automatically at scheduled intervals through exchange mechanisms like wallet deductions or credits, they directly affect net gains/losses over time.

Impact of Market Volatility on Funding Rates

Market volatility significantly influences how often and how drastically funding rates fluctuate:

- During periods of rapid price swings—such as during major news events—the spread between spot and future prices widens temporarily.

- These fluctuations cause corresponding jumps in financing costs for traders holding open positions.

- High volatility environments often see increased frequency of large positive or negative fundings as markets attempt self-correction mechanisms quickly respond to changing sentiments.

Such dynamics underscore why active monitoring becomes essential during turbulent times—they can dramatically alter profitability prospects for leveraged trades.

Regulatory Changes Affecting Funding Rates

Regulatory developments also play an influential role by shaping overall market sentiment—and consequently impacting funds' flow patterns:

- New rules around derivatives trading may impose restrictions that influence leverage limits,

- Changes requiring greater transparency could lead exchanges to modify calculation methods,

- Regulatory crackdowns might reduce overall trading activity affecting liquidity levels,

These factors indirectly impact how frequently and intensely funds change hands via differentials like those seen through varying funding rates across jurisdictions.

Risks Associated with Funding Rates

While beneficial for maintaining equilibrium under normal conditions,

extreme scenarios involving abnormal fundings pose risks such as:

- Market Destabilization: Excessively high positive/negative fundings may trigger mass liquidations if traders cannot sustain costs,

- Manipulation Potential: Some actors might attempt strategies exploiting predictable patterns within fee calculations,

- Trader Behavior Shifts: Unexpected changes could lead investors toward riskier behaviors like overleveraging before adverse shifts occur,

Therefore, prudent risk management practices—including setting stop-loss orders—is vital when operating under volatile conditions influenced by fluctuating fundings.

By grasping what determines your costs related to persistent holdings—and recognizing broader influences such as volatility trends—they become invaluable tools for informed decision-making within cryptocurrency derivatives markets.

Key Takeaways:

- The funding rate aligns perpetual contract pricing with underlying assets’ real-time values.

- Calculated regularly based on premium/discounts relative to spot prices.

- Impacts trader profitability directly through periodic payments.

- Fluctuates with market volatility & regulatory environment changes.

Staying aware of these dynamics enhances strategic planning—whether you're hedging risks or seeking arbitrage opportunities—in today’s fast-paced crypto landscape.

Semantic & LSI Keywords:

Perpetual swaps | Cryptocurrency derivatives | Futures contract pricing | Market liquidity | Trading fees | Leverage trading | Crypto regulation impacts | Volatility effects on derivatives

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Is the Development Process for the Bitcoin Core Client Managed?

The development of the Bitcoin Core client is a cornerstone of maintaining the security, stability, and innovation within the Bitcoin network. As an open-source project, it relies heavily on a community-driven approach that emphasizes transparency and collaborative effort. Anyone with programming skills can contribute to its codebase, which fosters a diverse pool of developers from around the world. This inclusivity ensures that multiple perspectives are considered when implementing new features or fixing bugs.

The process begins with proposals for changes known as Bitcoin Improvement Proposals (BIPs). These are detailed documents suggesting modifications to enhance functionality or security. Once a BIP is drafted, it undergoes rigorous review by experienced developers through pull requests on GitHub—a platform central to managing contributions. Each proposed change must pass thorough code reviews to ensure adherence to quality standards and prevent vulnerabilities.

Bitcoin Core follows a structured release cycle typically every six months. This regular schedule allows for systematic updates that include bug fixes, performance improvements, and sometimes new features like privacy enhancements or scalability solutions. Before any release goes live, comprehensive testing—both automated and manual—is conducted across various environments to verify stability and security integrity.

Continuous integration tools play an essential role in early detection of issues during development stages. They automatically run tests whenever code changes are submitted, helping maintain high-quality standards throughout the project lifecycle. The collaborative nature combined with disciplined processes ensures that Bitcoin Core remains robust against potential threats while evolving in response to technological advancements.

Funding Mechanisms Supporting Bitcoin Core Development

Sustaining ongoing development efforts requires significant financial resources; however, unlike many proprietary software projects, Bitcoin Core relies predominantly on community-based funding models rather than corporate sponsorships alone. Donations from individual users form one of its primary income streams—these voluntary contributions help cover operational costs such as server hosting and developer stipends.

In addition to direct donations from enthusiasts worldwide, grants also play an important role in supporting specific initiatives within the project’s roadmap. Various organizations dedicated to advancing blockchain technology provide targeted funding for research or feature implementation efforts aligned with their strategic goals.

Corporate sponsorships further bolster development capacity by financially supporting key contributors who work full-time on core improvements. Notable companies like Blockstream and Chaincode Labs sponsor individual developers or entire teams involved in critical areas such as scalability upgrades or security enhancements—this model helps attract talent capable of handling complex technical challenges efficiently.

Bitcoin Improvement Proposals (BIPs) often require substantial resources when they introduce significant protocol changes—for example, upgrades like Taproot—which improve transaction privacy and efficiency have been funded through this combination of donations and sponsorships over recent years.

Recent Developments Shaping Bitcoin Core’s Future

Over recent years, several major upgrades have marked milestones in enhancing Bitcoin's capabilities through core development efforts backed by community support:

Taproot Upgrade (2021): One of the most notable advancements was implementing Taproot—a protocol upgrade designed to improve transaction privacy while increasing scalability options on-chain. Its successful deployment was made possible through coordinated community funding efforts involving both donations from users keen on improving network efficiency—and sponsorships from organizations committed to long-term sustainability.

SegWit2x Controversy: In 2017 there was significant debate surrounding SegWit2x—a proposed hard fork intended initially for increasing block size limits—but faced opposition due mainly to concerns about decentralization risks and security implications among different stakeholder groups within the ecosystem leading ultimately toward abandonment in favor of Segregated Witness (SegWit). This episode underscored how community consensus—or lack thereof—can influence development trajectories.

Lightning Network Integration: Ongoing work aims at integrating off-chain solutions like Lightning Network into core software infrastructure—to facilitate faster transactions at lower fees without congesting main chain blocks—highlighting continuous innovation driven by collaborative effort.

Security Enhancements: The team actively works on fortifying wallet management systems against emerging threats such as 51% attacks while improving resistance mechanisms overall—a vital aspect given cryptocurrency's value proposition as digital gold.

These developments exemplify how collective input—from volunteers’ coding contributions supported by organizational backing—drives forward-looking improvements aligned with user needs for increased privacy, speed, safety—and broader adoption potential.

Challenges Facing Development Funding & Community Dynamics

Despite its strengths rooted in openness and collaboration—the decentralized nature introduces unique challenges:

Community Disagreements: Divergent opinions among stakeholders regarding technical directions can cause delays or fragmentation within development teams—as seen during controversies like SegWit2x—that may hinder timely progress.

Funding Uncertainty: Heavy reliance on voluntary donations means fluctuations can impact resource availability; if donor interest wanes or organizational priorities shift away from supporting core devs financially—project momentum might slow down.

Regulatory Pressures: As governments worldwide tighten regulations around cryptocurrencies—including anti-money laundering measures—they could impose restrictions affecting donation channels or create legal uncertainties impacting open-source projects’ operations globally.

Addressing these issues requires transparent governance structures coupled with diversified funding strategies—including institutional partnerships—to ensure resilience amid evolving external pressures.

How Open Source Principles Ensure Security & Transparency

One key reason behind Bitcoin’s resilience lies in its open-source foundation: anyone can scrutinize source code for vulnerabilities; this transparency fosters trustworthiness crucial for financial systems handling billions worth of assets daily. Regular peer reviews enable rapid identification—and patching—of bugs before exploitation occurs; this collective vigilance enhances overall network robustness over time.

Furthermore: active engagement from global developer communities accelerates innovation cycles while maintaining high-security standards necessary under E-A-T principles (Expertise–Authoritativeness–Trustworthiness). By openly sharing updates via repositories like GitHub—and documenting decision-making processes transparently—the project builds credibility among users ranging from casual investors up through institutional stakeholders seeking reliable infrastructure.

Future Outlook: Sustaining Innovation Amid Challenges

Looking ahead involves balancing continuous technological advancement with sustainable funding models amidst regulatory landscapes shifting globally:

- Increasing integration between Lightning Network solutions promises faster payments suitable even for microtransactions

- Privacy-focused features will likely remain priorities given rising demand

- Efforts toward decentralizing governance could mitigate risks associated with concentrated influence

To sustain momentum:

- Maintaining diverse sources of support—including grants alongside donations—is essential

- Fostering inclusive participation across geographies enhances resilience

- Emphasizing transparent decision-making aligns well with user expectations rooted in trust

By adhering closely to open-source best practices combined with innovative technical roadmaps supported by broad-based backing—all underpinned by strong ethical standards—the future looks promising despite inevitable hurdles.

This overview provides clarity into how foundational principles shape ongoing developments within Bitcoin Core—from management practices grounded in transparency & collaboration—to funding strategies ensuring sustained growth amid external pressures—all vital components underpinning one of today’s most influential blockchain projects worldwide

JCUSER-F1IIaxXA

2025-05-11 06:09

How is the development process for the Bitcoin (BTC) Core client managed and funded?

How Is the Development Process for the Bitcoin Core Client Managed?

The development of the Bitcoin Core client is a cornerstone of maintaining the security, stability, and innovation within the Bitcoin network. As an open-source project, it relies heavily on a community-driven approach that emphasizes transparency and collaborative effort. Anyone with programming skills can contribute to its codebase, which fosters a diverse pool of developers from around the world. This inclusivity ensures that multiple perspectives are considered when implementing new features or fixing bugs.

The process begins with proposals for changes known as Bitcoin Improvement Proposals (BIPs). These are detailed documents suggesting modifications to enhance functionality or security. Once a BIP is drafted, it undergoes rigorous review by experienced developers through pull requests on GitHub—a platform central to managing contributions. Each proposed change must pass thorough code reviews to ensure adherence to quality standards and prevent vulnerabilities.

Bitcoin Core follows a structured release cycle typically every six months. This regular schedule allows for systematic updates that include bug fixes, performance improvements, and sometimes new features like privacy enhancements or scalability solutions. Before any release goes live, comprehensive testing—both automated and manual—is conducted across various environments to verify stability and security integrity.

Continuous integration tools play an essential role in early detection of issues during development stages. They automatically run tests whenever code changes are submitted, helping maintain high-quality standards throughout the project lifecycle. The collaborative nature combined with disciplined processes ensures that Bitcoin Core remains robust against potential threats while evolving in response to technological advancements.

Funding Mechanisms Supporting Bitcoin Core Development

Sustaining ongoing development efforts requires significant financial resources; however, unlike many proprietary software projects, Bitcoin Core relies predominantly on community-based funding models rather than corporate sponsorships alone. Donations from individual users form one of its primary income streams—these voluntary contributions help cover operational costs such as server hosting and developer stipends.

In addition to direct donations from enthusiasts worldwide, grants also play an important role in supporting specific initiatives within the project’s roadmap. Various organizations dedicated to advancing blockchain technology provide targeted funding for research or feature implementation efforts aligned with their strategic goals.

Corporate sponsorships further bolster development capacity by financially supporting key contributors who work full-time on core improvements. Notable companies like Blockstream and Chaincode Labs sponsor individual developers or entire teams involved in critical areas such as scalability upgrades or security enhancements—this model helps attract talent capable of handling complex technical challenges efficiently.

Bitcoin Improvement Proposals (BIPs) often require substantial resources when they introduce significant protocol changes—for example, upgrades like Taproot—which improve transaction privacy and efficiency have been funded through this combination of donations and sponsorships over recent years.

Recent Developments Shaping Bitcoin Core’s Future

Over recent years, several major upgrades have marked milestones in enhancing Bitcoin's capabilities through core development efforts backed by community support:

Taproot Upgrade (2021): One of the most notable advancements was implementing Taproot—a protocol upgrade designed to improve transaction privacy while increasing scalability options on-chain. Its successful deployment was made possible through coordinated community funding efforts involving both donations from users keen on improving network efficiency—and sponsorships from organizations committed to long-term sustainability.

SegWit2x Controversy: In 2017 there was significant debate surrounding SegWit2x—a proposed hard fork intended initially for increasing block size limits—but faced opposition due mainly to concerns about decentralization risks and security implications among different stakeholder groups within the ecosystem leading ultimately toward abandonment in favor of Segregated Witness (SegWit). This episode underscored how community consensus—or lack thereof—can influence development trajectories.

Lightning Network Integration: Ongoing work aims at integrating off-chain solutions like Lightning Network into core software infrastructure—to facilitate faster transactions at lower fees without congesting main chain blocks—highlighting continuous innovation driven by collaborative effort.

Security Enhancements: The team actively works on fortifying wallet management systems against emerging threats such as 51% attacks while improving resistance mechanisms overall—a vital aspect given cryptocurrency's value proposition as digital gold.

These developments exemplify how collective input—from volunteers’ coding contributions supported by organizational backing—drives forward-looking improvements aligned with user needs for increased privacy, speed, safety—and broader adoption potential.

Challenges Facing Development Funding & Community Dynamics

Despite its strengths rooted in openness and collaboration—the decentralized nature introduces unique challenges:

Community Disagreements: Divergent opinions among stakeholders regarding technical directions can cause delays or fragmentation within development teams—as seen during controversies like SegWit2x—that may hinder timely progress.

Funding Uncertainty: Heavy reliance on voluntary donations means fluctuations can impact resource availability; if donor interest wanes or organizational priorities shift away from supporting core devs financially—project momentum might slow down.

Regulatory Pressures: As governments worldwide tighten regulations around cryptocurrencies—including anti-money laundering measures—they could impose restrictions affecting donation channels or create legal uncertainties impacting open-source projects’ operations globally.

Addressing these issues requires transparent governance structures coupled with diversified funding strategies—including institutional partnerships—to ensure resilience amid evolving external pressures.

How Open Source Principles Ensure Security & Transparency

One key reason behind Bitcoin’s resilience lies in its open-source foundation: anyone can scrutinize source code for vulnerabilities; this transparency fosters trustworthiness crucial for financial systems handling billions worth of assets daily. Regular peer reviews enable rapid identification—and patching—of bugs before exploitation occurs; this collective vigilance enhances overall network robustness over time.

Furthermore: active engagement from global developer communities accelerates innovation cycles while maintaining high-security standards necessary under E-A-T principles (Expertise–Authoritativeness–Trustworthiness). By openly sharing updates via repositories like GitHub—and documenting decision-making processes transparently—the project builds credibility among users ranging from casual investors up through institutional stakeholders seeking reliable infrastructure.

Future Outlook: Sustaining Innovation Amid Challenges

Looking ahead involves balancing continuous technological advancement with sustainable funding models amidst regulatory landscapes shifting globally:

- Increasing integration between Lightning Network solutions promises faster payments suitable even for microtransactions

- Privacy-focused features will likely remain priorities given rising demand

- Efforts toward decentralizing governance could mitigate risks associated with concentrated influence

To sustain momentum:

- Maintaining diverse sources of support—including grants alongside donations—is essential

- Fostering inclusive participation across geographies enhances resilience

- Emphasizing transparent decision-making aligns well with user expectations rooted in trust

By adhering closely to open-source best practices combined with innovative technical roadmaps supported by broad-based backing—all underpinned by strong ethical standards—the future looks promising despite inevitable hurdles.

This overview provides clarity into how foundational principles shape ongoing developments within Bitcoin Core—from management practices grounded in transparency & collaboration—to funding strategies ensuring sustained growth amid external pressures—all vital components underpinning one of today’s most influential blockchain projects worldwide

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

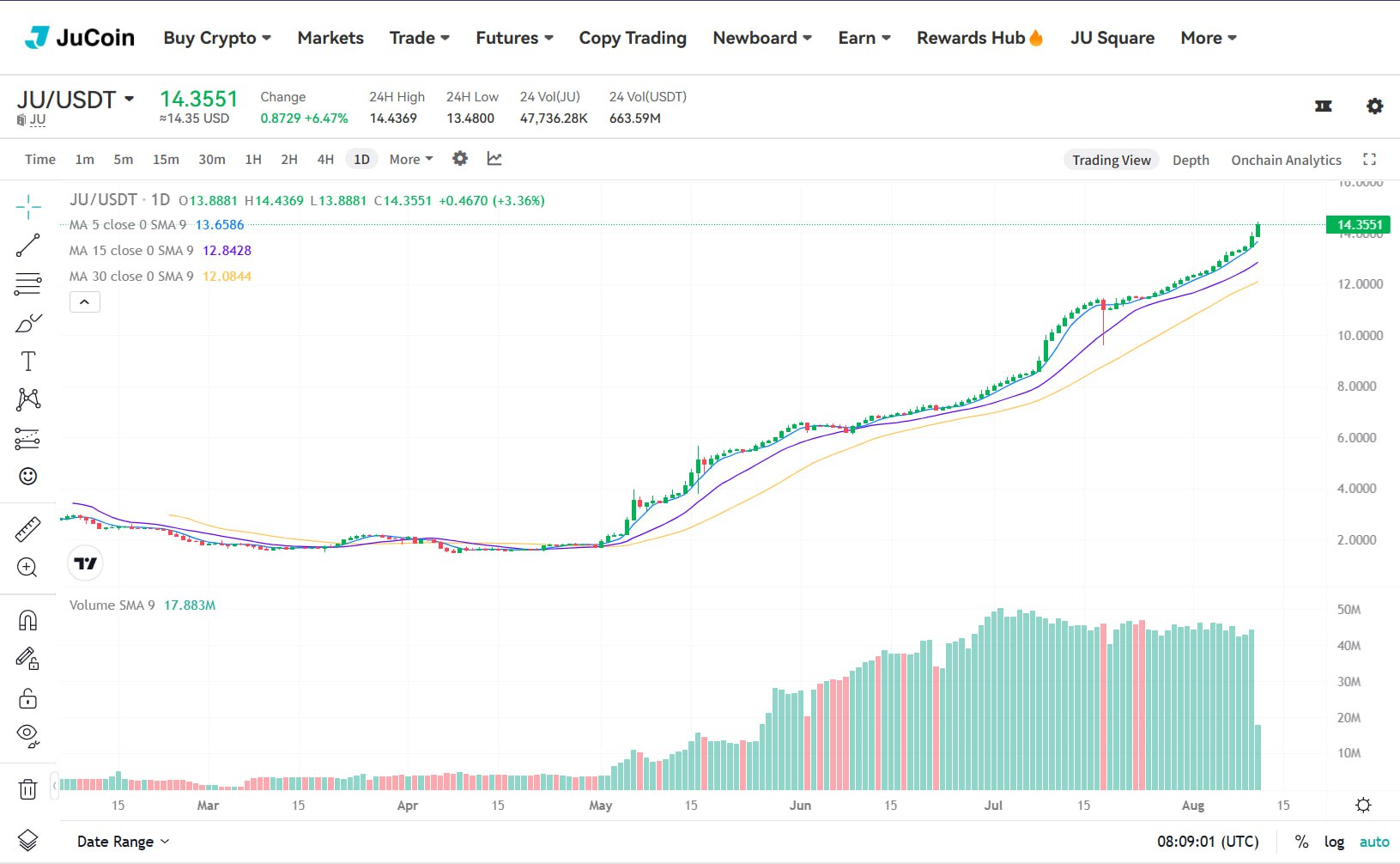

+140x ROI depuis le lancement — du jamais vu dans le marché actuel. Merci à tous les builders, holders & believers Le sommet ? Ce n’est que le départ. Jusqu’au 12 août, 19h00 (UTC+8)

Carmelita

2025-08-11 21:33

$JU explose un nouveau record : 14 $ franchis !

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is the Difference Between a Hardware Wallet and a Software Wallet?

Understanding Cryptocurrency Storage Options

As cryptocurrencies become more mainstream, securing digital assets has become a top priority for investors and users alike. The two primary types of wallets used to store cryptocurrencies are hardware wallets and software wallets. Each offers distinct advantages and disadvantages, making it essential to understand their differences to choose the best option for your needs.

Hardware Wallets: Physical Devices for Secure Storage

A hardware wallet is a physical device designed specifically to securely store private keys offline. These devices often resemble USB drives or small electronic gadgets, making them portable and easy to carry. Because they keep private keys disconnected from internet-connected devices, hardware wallets significantly reduce exposure to online threats such as hacking or malware.

Key features of hardware wallets include enhanced security through offline storage, resistance against phishing attacks (since private keys are never exposed online), and user-friendly interfaces that simplify managing multiple cryptocurrencies. Popular models like Ledger Nano X, Trezor Model T, and KeepKey exemplify this category’s focus on security combined with ease of use.

Hardware wallets are particularly suitable for long-term investors or those holding substantial amounts of cryptocurrency because they prioritize safeguarding assets from cyber threats. However, they typically come at a higher cost compared to software options but provide peace of mind through robust physical protection.

Software Wallets: Digital Applications for Convenience

In contrast, software wallets are applications installed on computers or mobile devices that manage cryptocurrency holdings digitally. They can be desktop applications like Electrum, mobile apps such as Coinbase Wallet, or browser extensions like MetaMask. These wallets offer quick access to funds with just a few clicks or taps.

The main advantage of software wallets lies in their convenience—they’re easy to set up and use without requiring specialized technical knowledge. Users can access their crypto holdings anytime from any device connected to the internet—making them ideal for daily transactions or trading activities.

However, this accessibility comes with increased security risks; since private keys are stored on internet-connected devices—whether on desktops or smartphones—they’re more vulnerable to malware infections or phishing scams if proper precautions aren’t taken. Cost-wise, most software wallets are free or inexpensive but require diligent security practices by users.

Contextual Considerations: Security vs Accessibility

Choosing between hardware and software wallets depends largely on individual priorities regarding security versus convenience: