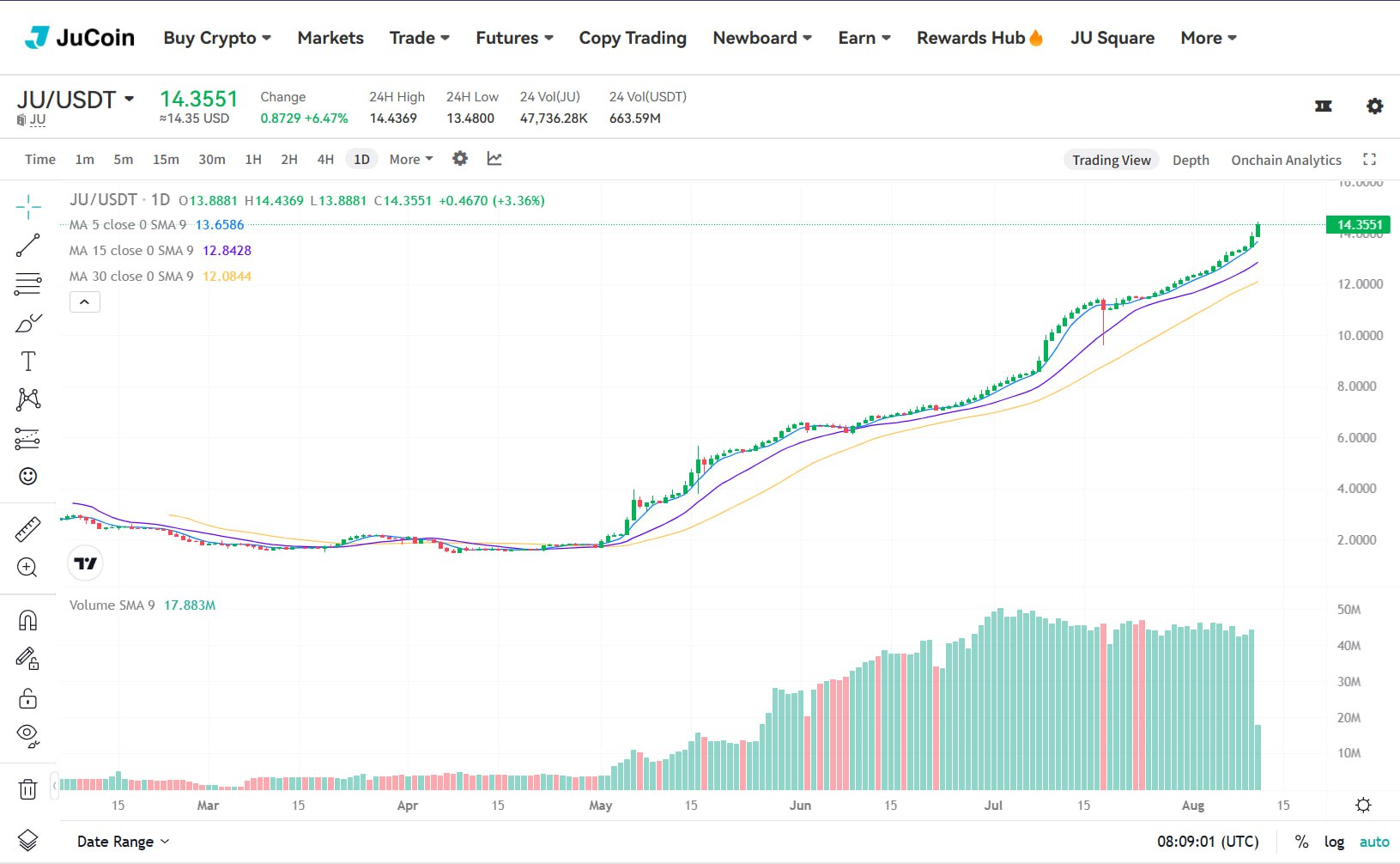

She thinks I’m thinking about other girls… but it’s the BTC bullrun. 📈 I’ve got one shot to retire my entire bloodline - emotionally unavailable until new all-time highs. BTC is king 👑

Check out our YouTube Channel 👉

#BullRun #CryptoMeme #CryptoSkits #CryptoComedy

JuCoin Media

2025-08-06 11:29

🐂 BTC Bullrun – This Is Bigger Than Me, Babe

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Asseto is committed to building a compliant bridge that brings traditional financial assets into the decentralized world. Through smart contracts and multi-stage approval processes, it achieves high security and liquidity, supporting tokenization of stocks, bonds, and other traditional assets. Here are the platform's core highlights:

💰 Three-Layer Architecture:

-

Off-Chain Compliance Layer: KYC/AML verification, fiat settlement, multi-sig custody for asset security

On-Chain Smart Contract Layer: Token issuance/transfer, oracle real-time pricing

Cross-Chain Bridging Layer: Support for Ethereum, BSC, and other multi-chain asset free flow

Modular Governance: Token holders vote to adjust compliance parameters and fee structures

🎯 Privacy & Security Guarantees: 1️⃣ Trusted Execution Environment (TEE): Encrypted user data storage, dedicated audit nodes 2️⃣ Zero-Knowledge Proofs (ZKP): Verify KYC results without exposing sensitive information on-chain 3️⃣ Multi-Signature Timelock: Cross-chain asset transfers remain fully controlled 4️⃣ Third-Party Security Audits: Regular smart contract audits and penetration testing

🏆 Asset Tokenization Process:

-

Asset Custody: Regulated custodians safeguard traditional assets

Contract Minting: On-chain mint transactions generate 1:1 pegged tokens (aStock, aBond)

Cross-Chain Distribution: Bridge tokens to target networks via cross-chain bridge

Redemption & Settlement: Users burn tokens to request redemption, off-chain releases corresponding assets

💡 $ASO Token Economics (100M Total Supply):

-

Rewards & Bribes 60%: Liquidity mining, governance proposal rewards, and "bribe" mechanisms

Public Sale (LBP) 12%: Public offering, initial liquidity foundation

Core Team 11.6%: 3-month lockup, 2-year linear vesting

Protocol Growth 10%: Ecosystem incubation, partner incentives, R&D grants

Community Incentives 4%: Early user airdrops, community activity rewards

Initial Liquidity 2.4%: Trading pair depth support

🔐 Incentive Mechanisms:

-

Staking Yield: Participate in network security verification, earn base APY

Revenue Distribution: Protocol revenues buy back ASO and distribute to stakers

Liquidity Mining: Provide liquidity in designated trading pairs for additional rewards

Governance Voting: Participate in protocol governance, "bribe" mechanism increases voting power

🌟 Dual Yield Model:

-

DeFi Yield: Participate in protocol interest sharing and liquidity mining

Traditional Yield: Connect to traditional asset dividends and coupon payments

Principal Protection: Compliance fund and multi-sig custody emergency compensation mechanism

Community Governance: ASO holders decide asset types, fee adjustments

📱 Supported Asset Types:

-

Current: Stocks, corporate bonds, government bonds, money-market instruments

Planned: Fund shares, commodities expansion

🔮 Participation Process: Complete KYC/AML verification → Deposit funds to compliant custodian account → Mint asset tokens on-chain → DeFi ecosystem applications

⚡ Redemption Service:

-

Standard Redemption: 3-5 business days

Expedited Redemption: 1-2 business days (additional fees)

🛡️ Risk Prevention:

-

Multi-entity custody for risk distribution

Regular audits for transparent operations

Off-chain redundancy backup

Compliance fund emergency mechanisms

Asseto enables traditional financial assets to seamlessly access DeFi ecosystems through innovative compliance architecture, providing investors with "fiat + crypto" composite yields while maintaining regulatory compliance, potentially accelerating traditional asset digitization.

Read the complete compliance mechanism analysis: 👇 https://blog.jucoin.com/asseto-defi-compliance/?utm_source=blog

#Asseto #ASO #CrossChain #KYC

JU Blog

2025-08-05 10:34

🏦 Asseto: Compliant Bridge Between Traditional Assets and DeFi Revolution!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are Layer-2 Scaling Solutions?

Layer-2 scaling solutions are innovative technologies designed to improve the capacity and efficiency of blockchain networks, especially Ethereum. As blockchain technology has gained widespread adoption, the limitations of its underlying architecture have become more apparent. These solutions operate on top of the main blockchain (Layer 1) to handle transactions off-chain or in a more scalable manner, thereby alleviating congestion and reducing transaction costs.

In essence, Layer-2 solutions aim to process many transactions outside the main chain while still maintaining security and decentralization. This approach allows users to enjoy faster transaction speeds and lower fees without compromising the integrity of the network. They are crucial for enabling mainstream adoption of decentralized applications (dApps), DeFi platforms, and other blockchain-based services that require high throughput.

Why Are Layer-2 Solutions Necessary for Blockchain Networks?

Blockchain networks like Ethereum face inherent scalability challenges due to their design. The core issue stems from how transactions are processed on Layer 1—every transaction must be validated by all nodes in the network before being added to a block. As user activity increases, this process causes network congestion, leading to slower processing times and higher gas fees.

High transaction costs can make using blockchain applications prohibitively expensive for everyday users or small-scale developers. For instance, during periods of high demand, gas fees on Ethereum can spike dramatically, making simple transfers or interactions with smart contracts costly.

Layer-2 solutions address these issues by shifting most transactional load off-chain or onto secondary layers that can process multiple transactions simultaneously before settling them back onto Layer 1 periodically. This not only reduces congestion but also enhances user experience by providing faster confirmation times and significantly lower costs—key factors for broader adoption.

Types of Layer-2 Scaling Solutions

There are several distinct approaches within layer-2 scaling strategies:

Off-Chain Transactions

State Channels

State channels enable participants to conduct numerous transactions privately without broadcasting each one individually on the main chain. Only opening and closing balances need on-chain validation; all intermediate steps occur off-chain within a secure channel established between parties.

Payment Channels

A subset focused specifically on transferring funds efficiently between two parties through an off-chain channel—examples include Lightning Network for Bitcoin or Raiden Network for Ethereum.

Sidechains

Sidechains are independent blockchains linked securely with their parent chain via bridges or two-way pegs. They operate separately but periodically synchronize with the main chain through cryptographic proofs or validators’ consensus mechanisms. Sidechains allow developers flexibility in customizing features such as consensus algorithms while processing transactions independently from Ethereum’s mainnet.

Rollups

Rollups represent a promising class of layer-2 solutions that bundle multiple transactions into a single batch before submitting it back onto Layer 1:

- Optimistic Rollups: Assume transactions are valid unless challenged within a challenge period; they rely heavily on fraud proofs.

- ZK-Rollups (Zero-Knowledge Rollups): Use cryptographic proofs called zero-knowledge proofs to verify batches instantly without revealing individual transaction details—offering both scalability benefits and privacy enhancements.

Each type offers trade-offs regarding security guarantees, complexity, cost-efficiency, and privacy considerations—all vital factors influencing their suitability across different use cases.

Recent Developments in Layer-2 Technologies

The evolution of layer-2 solutions is closely tied with ongoing upgrades within Ethereum itself:

Transitioning to Proof-of-Stake (PoS)

Ethereum's move from proof-of-work (PoW) towards proof-of-stake aims at reducing energy consumption while improving scalability through shard chains combined with rollup integrations—a significant step toward sustainable growth alongside layer-two innovations.

Adoption Trends

Major projects like Optimism and Arbitrum have successfully implemented optimistic rollup frameworks that enable fast finality at low costs while maintaining strong security models aligned with Ethereum’s standards. Polygon has also emerged as an alternative sidechain solution offering fast settlement times suitable for gaming dApps or microtransactions due to its high throughput capabilities.

Regulatory Environment Impact

As governments worldwide develop clearer regulations around cryptocurrencies—and potential compliance requirements—the development landscape may shift accordingly: fostering innovation where regulatory clarity exists but potentially hindering progress where restrictions tighten around certain types of decentralized activities involving cross-border payments or privacy-preserving features offered by some layer-two protocols.

Challenges Facing Layer-Two Scaling Solutions

Despite their advantages, deploying effective layer-two systems involves overcoming several hurdles:

- Security Risks: While designed carefully, some implementations might introduce vulnerabilities if not properly audited—for example: compromised bridges connecting sidechains could threaten overall ecosystem safety.

- Interoperability Issues: Ensuring seamless communication among various layer-two protocols remains complex; fragmented ecosystems could hinder user experience if interoperability isn’t prioritized.

- User Adoption Barriers: For widespread acceptance beyond crypto enthusiasts—and into mainstream markets—layer-two tools must demonstrate clear benefits such as ease-of-use alongside tangible cost savings; otherwise skeptics may hesitate transitioning from traditional methods.

The Future Outlook for Blockchain Scalability

Layer-2 scaling solutions will continue evolving rapidly as part of broader efforts toward achieving mass adoption in decentralized finance (DeFi), non-fungible tokens (NFTs), gaming platforms—and beyond. Their success hinges not only on technological robustness but also regulatory support that fosters innovation while protecting consumers’ interests.

Emerging trends suggest increased integration between different types of second-layer protocols—for example: combining rollups with state channels—to optimize performance further across diverse application scenarios. Additionally, advancements in cryptography—including zero knowledge proofs—are likely to enhance privacy features alongside scalability improvements.

By addressing current limitations related to security risks and interoperability challenges through ongoing research & development efforts—and fostering clearer regulatory frameworks—the ecosystem can unlock new levels of efficiency necessary for mainstream acceptance.

This comprehensive overview underscores why layered scaling strategies are pivotal—not just technical upgrades but foundational enablers—to realize blockchain’s full potential at scale responsibly and securely.

JCUSER-F1IIaxXA

2025-05-22 09:39

What are layer-2 scaling solutions, and why are they necessary?

What Are Layer-2 Scaling Solutions?

Layer-2 scaling solutions are innovative technologies designed to improve the capacity and efficiency of blockchain networks, especially Ethereum. As blockchain technology has gained widespread adoption, the limitations of its underlying architecture have become more apparent. These solutions operate on top of the main blockchain (Layer 1) to handle transactions off-chain or in a more scalable manner, thereby alleviating congestion and reducing transaction costs.

In essence, Layer-2 solutions aim to process many transactions outside the main chain while still maintaining security and decentralization. This approach allows users to enjoy faster transaction speeds and lower fees without compromising the integrity of the network. They are crucial for enabling mainstream adoption of decentralized applications (dApps), DeFi platforms, and other blockchain-based services that require high throughput.

Why Are Layer-2 Solutions Necessary for Blockchain Networks?

Blockchain networks like Ethereum face inherent scalability challenges due to their design. The core issue stems from how transactions are processed on Layer 1—every transaction must be validated by all nodes in the network before being added to a block. As user activity increases, this process causes network congestion, leading to slower processing times and higher gas fees.

High transaction costs can make using blockchain applications prohibitively expensive for everyday users or small-scale developers. For instance, during periods of high demand, gas fees on Ethereum can spike dramatically, making simple transfers or interactions with smart contracts costly.

Layer-2 solutions address these issues by shifting most transactional load off-chain or onto secondary layers that can process multiple transactions simultaneously before settling them back onto Layer 1 periodically. This not only reduces congestion but also enhances user experience by providing faster confirmation times and significantly lower costs—key factors for broader adoption.

Types of Layer-2 Scaling Solutions

There are several distinct approaches within layer-2 scaling strategies:

Off-Chain Transactions

State Channels

State channels enable participants to conduct numerous transactions privately without broadcasting each one individually on the main chain. Only opening and closing balances need on-chain validation; all intermediate steps occur off-chain within a secure channel established between parties.

Payment Channels

A subset focused specifically on transferring funds efficiently between two parties through an off-chain channel—examples include Lightning Network for Bitcoin or Raiden Network for Ethereum.

Sidechains

Sidechains are independent blockchains linked securely with their parent chain via bridges or two-way pegs. They operate separately but periodically synchronize with the main chain through cryptographic proofs or validators’ consensus mechanisms. Sidechains allow developers flexibility in customizing features such as consensus algorithms while processing transactions independently from Ethereum’s mainnet.

Rollups

Rollups represent a promising class of layer-2 solutions that bundle multiple transactions into a single batch before submitting it back onto Layer 1:

- Optimistic Rollups: Assume transactions are valid unless challenged within a challenge period; they rely heavily on fraud proofs.

- ZK-Rollups (Zero-Knowledge Rollups): Use cryptographic proofs called zero-knowledge proofs to verify batches instantly without revealing individual transaction details—offering both scalability benefits and privacy enhancements.

Each type offers trade-offs regarding security guarantees, complexity, cost-efficiency, and privacy considerations—all vital factors influencing their suitability across different use cases.

Recent Developments in Layer-2 Technologies

The evolution of layer-2 solutions is closely tied with ongoing upgrades within Ethereum itself:

Transitioning to Proof-of-Stake (PoS)

Ethereum's move from proof-of-work (PoW) towards proof-of-stake aims at reducing energy consumption while improving scalability through shard chains combined with rollup integrations—a significant step toward sustainable growth alongside layer-two innovations.

Adoption Trends

Major projects like Optimism and Arbitrum have successfully implemented optimistic rollup frameworks that enable fast finality at low costs while maintaining strong security models aligned with Ethereum’s standards. Polygon has also emerged as an alternative sidechain solution offering fast settlement times suitable for gaming dApps or microtransactions due to its high throughput capabilities.

Regulatory Environment Impact

As governments worldwide develop clearer regulations around cryptocurrencies—and potential compliance requirements—the development landscape may shift accordingly: fostering innovation where regulatory clarity exists but potentially hindering progress where restrictions tighten around certain types of decentralized activities involving cross-border payments or privacy-preserving features offered by some layer-two protocols.

Challenges Facing Layer-Two Scaling Solutions

Despite their advantages, deploying effective layer-two systems involves overcoming several hurdles:

- Security Risks: While designed carefully, some implementations might introduce vulnerabilities if not properly audited—for example: compromised bridges connecting sidechains could threaten overall ecosystem safety.

- Interoperability Issues: Ensuring seamless communication among various layer-two protocols remains complex; fragmented ecosystems could hinder user experience if interoperability isn’t prioritized.

- User Adoption Barriers: For widespread acceptance beyond crypto enthusiasts—and into mainstream markets—layer-two tools must demonstrate clear benefits such as ease-of-use alongside tangible cost savings; otherwise skeptics may hesitate transitioning from traditional methods.

The Future Outlook for Blockchain Scalability

Layer-2 scaling solutions will continue evolving rapidly as part of broader efforts toward achieving mass adoption in decentralized finance (DeFi), non-fungible tokens (NFTs), gaming platforms—and beyond. Their success hinges not only on technological robustness but also regulatory support that fosters innovation while protecting consumers’ interests.

Emerging trends suggest increased integration between different types of second-layer protocols—for example: combining rollups with state channels—to optimize performance further across diverse application scenarios. Additionally, advancements in cryptography—including zero knowledge proofs—are likely to enhance privacy features alongside scalability improvements.

By addressing current limitations related to security risks and interoperability challenges through ongoing research & development efforts—and fostering clearer regulatory frameworks—the ecosystem can unlock new levels of efficiency necessary for mainstream acceptance.

This comprehensive overview underscores why layered scaling strategies are pivotal—not just technical upgrades but foundational enablers—to realize blockchain’s full potential at scale responsibly and securely.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is DBSCAN and How Does It Detect Unusual Market Conditions?

Understanding DBSCAN: A Key Clustering Algorithm in Financial Analysis

DBSCAN, which stands for Density-Based Spatial Clustering of Applications with Noise, is a powerful clustering technique widely used in data analysis across various fields, including finance. Unlike traditional clustering algorithms that rely on distance metrics alone, DBSCAN emphasizes the density of data points to identify meaningful groups and outliers. This makes it particularly effective for detecting anomalies or unusual patterns within complex financial datasets.

In the context of market conditions, DBSCAN helps analysts uncover hidden structures by grouping similar assets or price movements based on their density. When applied correctly, it can reveal sudden shifts—such as abrupt price spikes or drops—that may signal underlying risks or emerging trends. Its ability to distinguish between typical market behavior and anomalies makes it an invaluable tool for traders, risk managers, and financial researchers aiming to stay ahead of market volatility.

How Does DBSCAN Work? Core Concepts Explained

The core strength of DBSCAN lies in its approach to clustering through density estimation. The algorithm requires two main parameters: epsilon (Eps) and MinPts.

- Epsilon (Eps): Defines the maximum radius within which points are considered neighbors. Essentially, if two points are within this distance from each other, they are potential members of the same cluster.

- MinPts: Specifies the minimum number of neighboring points needed to form a dense region that qualifies as a cluster.

The process begins by selecting an unvisited point in the dataset. If this point has at least MinPts neighbors within Eps distance—meaning it's part of a dense region—it becomes a core point around which a cluster forms. The algorithm then recursively searches for all neighboring points connected through these dense regions until no new members can be added.

Points that do not meet these criteria—either because they lack enough neighbors or are isolated—are classified as noise or outliers. These noise points often represent unusual events such as sudden market shocks or irregular trading activity when analyzing financial data.

Applying DBSCAN to Market Data: Practical Use Cases

In financial markets, applying DBSCAN offers several practical advantages:

Detecting Market Anomalies: Sudden price swings often manifest as noise points outside established clusters. Identifying these outliers promptly allows traders and risk managers to respond quickly before minor fluctuations escalate into significant losses.

Pattern Recognition: By grouping similar stocks based on performance metrics like volatility or returns over time, investors can identify sectors exhibiting correlated behaviors—helpful for diversification strategies.

Risk Management: Outlier detection helps assess potential vulnerabilities within portfolios by highlighting assets behaving abnormally compared to their peers—a crucial aspect during volatile periods like economic downturns or geopolitical crises.

Real-Time Monitoring: Advances in computational power enable real-time implementation of DBSCAN algorithms on streaming data feeds from stock exchanges and cryptocurrency markets; this facilitates immediate identification of abnormal trading patterns requiring swift action.

Recent Innovations Enhancing Market Analysis with DBSCAN

Over recent years, integration with machine learning techniques has significantly expanded what’s possible with DBSCAN:

- Combining neural networks with density-based clustering improves pattern recognition accuracy amid noisy datasets typical in high-frequency trading environments.

- Implementing online versions allows continuous updating without reprocessing entire datasets—a necessity given rapid market changes.

- In cryptocurrency markets especially—the high volatility combined with complex trading behaviors makes anomaly detection critical; here too, adaptations of DBSCAN help identify manipulative activities like pump-and-dump schemes before they cause widespread impact.

Challenges & Limitations When Using DBSCAN

Despite its strengths, deploying DBSCAN effectively requires careful consideration:

False Positives: Sometimes normal variations get misclassified as anomalies due to inappropriate parameter settings (Eps/MinPts), leading traders astray.

Data Quality Dependency: Poorly cleaned data—with missing values or errors—can distort clustering results significantly; hence preprocessing is vital before application.

Parameter Sensitivity: Choosing optimal Eps and MinPts values isn’t straightforward; improper tuning may result in either over-clustering (merging distinct patterns) or under-clustering (missing relevant groupings).

Furthermore, regulatory considerations demand transparency when deploying such algorithms in finance; explainability remains essential for compliance purposes while maintaining trust among stakeholders.

Key Facts About DBSCAN's Role in Financial Markets

Some quick facts highlight its importance:

- Developed by Martin Ester et al., 1996 — marking its inception over two decades ago but still highly relevant today

- Focuses on density rather than mere proximity

- Parameters Eps and MinPts critically influence outcomes

- Effective at isolating noise/outliers indicative of abnormal market activity

Historical Timeline & Future Outlook

Since its introduction in 1996 by Ester et al., research has progressively adapted DBSAN for more sophisticated applications:

- Early 2010s:* Gained popularity among quantitative analysts seeking robust anomaly detection tools

- Recent years:* Integration into machine learning frameworks enhanced predictive capabilities

- Present:* Real-time analytics powered by cloud computing enables instant response mechanisms during volatile periods

Looking ahead , ongoing developments aim at improving parameter selection automation through meta-learning techniques while expanding applicability across diverse asset classes—from equities to cryptocurrencies—and integrating explainability features aligned with regulatory standards.

Leveraging Knowledge Effectively

For investors seeking deeper insights into how unusual market conditions develop—and how best to respond—understanding tools like DBSAN is crucial . By recognizing patterns hidden beneath raw numerical data , professionals can better anticipate risks , optimize portfolio resilience , and adapt swiftly amidst unpredictable economic landscapes . As technology continues evolving rapidly , staying informed about advances such as real-time anomaly detection will remain central to successful financial analysis.

This comprehensive overview aims at equipping users—from novice analysts exploring advanced methods—to seasoned professionals refining their risk management strategies—with clear explanations rooted firmly in current research trends surrounding DBSAN’s role within modern finance systems

JCUSER-WVMdslBw

2025-05-14 17:40

What is DBSCAN and how does it identify unusual market conditions?

What Is DBSCAN and How Does It Detect Unusual Market Conditions?

Understanding DBSCAN: A Key Clustering Algorithm in Financial Analysis

DBSCAN, which stands for Density-Based Spatial Clustering of Applications with Noise, is a powerful clustering technique widely used in data analysis across various fields, including finance. Unlike traditional clustering algorithms that rely on distance metrics alone, DBSCAN emphasizes the density of data points to identify meaningful groups and outliers. This makes it particularly effective for detecting anomalies or unusual patterns within complex financial datasets.

In the context of market conditions, DBSCAN helps analysts uncover hidden structures by grouping similar assets or price movements based on their density. When applied correctly, it can reveal sudden shifts—such as abrupt price spikes or drops—that may signal underlying risks or emerging trends. Its ability to distinguish between typical market behavior and anomalies makes it an invaluable tool for traders, risk managers, and financial researchers aiming to stay ahead of market volatility.

How Does DBSCAN Work? Core Concepts Explained

The core strength of DBSCAN lies in its approach to clustering through density estimation. The algorithm requires two main parameters: epsilon (Eps) and MinPts.

- Epsilon (Eps): Defines the maximum radius within which points are considered neighbors. Essentially, if two points are within this distance from each other, they are potential members of the same cluster.

- MinPts: Specifies the minimum number of neighboring points needed to form a dense region that qualifies as a cluster.

The process begins by selecting an unvisited point in the dataset. If this point has at least MinPts neighbors within Eps distance—meaning it's part of a dense region—it becomes a core point around which a cluster forms. The algorithm then recursively searches for all neighboring points connected through these dense regions until no new members can be added.

Points that do not meet these criteria—either because they lack enough neighbors or are isolated—are classified as noise or outliers. These noise points often represent unusual events such as sudden market shocks or irregular trading activity when analyzing financial data.

Applying DBSCAN to Market Data: Practical Use Cases

In financial markets, applying DBSCAN offers several practical advantages:

Detecting Market Anomalies: Sudden price swings often manifest as noise points outside established clusters. Identifying these outliers promptly allows traders and risk managers to respond quickly before minor fluctuations escalate into significant losses.

Pattern Recognition: By grouping similar stocks based on performance metrics like volatility or returns over time, investors can identify sectors exhibiting correlated behaviors—helpful for diversification strategies.

Risk Management: Outlier detection helps assess potential vulnerabilities within portfolios by highlighting assets behaving abnormally compared to their peers—a crucial aspect during volatile periods like economic downturns or geopolitical crises.

Real-Time Monitoring: Advances in computational power enable real-time implementation of DBSCAN algorithms on streaming data feeds from stock exchanges and cryptocurrency markets; this facilitates immediate identification of abnormal trading patterns requiring swift action.

Recent Innovations Enhancing Market Analysis with DBSCAN

Over recent years, integration with machine learning techniques has significantly expanded what’s possible with DBSCAN:

- Combining neural networks with density-based clustering improves pattern recognition accuracy amid noisy datasets typical in high-frequency trading environments.

- Implementing online versions allows continuous updating without reprocessing entire datasets—a necessity given rapid market changes.

- In cryptocurrency markets especially—the high volatility combined with complex trading behaviors makes anomaly detection critical; here too, adaptations of DBSCAN help identify manipulative activities like pump-and-dump schemes before they cause widespread impact.

Challenges & Limitations When Using DBSCAN

Despite its strengths, deploying DBSCAN effectively requires careful consideration:

False Positives: Sometimes normal variations get misclassified as anomalies due to inappropriate parameter settings (Eps/MinPts), leading traders astray.

Data Quality Dependency: Poorly cleaned data—with missing values or errors—can distort clustering results significantly; hence preprocessing is vital before application.

Parameter Sensitivity: Choosing optimal Eps and MinPts values isn’t straightforward; improper tuning may result in either over-clustering (merging distinct patterns) or under-clustering (missing relevant groupings).

Furthermore, regulatory considerations demand transparency when deploying such algorithms in finance; explainability remains essential for compliance purposes while maintaining trust among stakeholders.

Key Facts About DBSCAN's Role in Financial Markets

Some quick facts highlight its importance:

- Developed by Martin Ester et al., 1996 — marking its inception over two decades ago but still highly relevant today

- Focuses on density rather than mere proximity

- Parameters Eps and MinPts critically influence outcomes

- Effective at isolating noise/outliers indicative of abnormal market activity

Historical Timeline & Future Outlook

Since its introduction in 1996 by Ester et al., research has progressively adapted DBSAN for more sophisticated applications:

- Early 2010s:* Gained popularity among quantitative analysts seeking robust anomaly detection tools

- Recent years:* Integration into machine learning frameworks enhanced predictive capabilities

- Present:* Real-time analytics powered by cloud computing enables instant response mechanisms during volatile periods

Looking ahead , ongoing developments aim at improving parameter selection automation through meta-learning techniques while expanding applicability across diverse asset classes—from equities to cryptocurrencies—and integrating explainability features aligned with regulatory standards.

Leveraging Knowledge Effectively

For investors seeking deeper insights into how unusual market conditions develop—and how best to respond—understanding tools like DBSAN is crucial . By recognizing patterns hidden beneath raw numerical data , professionals can better anticipate risks , optimize portfolio resilience , and adapt swiftly amidst unpredictable economic landscapes . As technology continues evolving rapidly , staying informed about advances such as real-time anomaly detection will remain central to successful financial analysis.

This comprehensive overview aims at equipping users—from novice analysts exploring advanced methods—to seasoned professionals refining their risk management strategies—with clear explanations rooted firmly in current research trends surrounding DBSAN’s role within modern finance systems

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

✨ JuChain supports multiple independent Launchpad dApps for Meme token creation, fair launch, and trading.

Here are 3 representative examples: CookPump.ai, Juicy.Meme, and Schili.Meme — what they do and how they work.

👉 Learn more: https://x.com/juchain101/status/1958026182563361106

#JuChain #JuChainVietnam #CookPump #JuicyMeme #Schili #JuToken #Launchpad #MemeToken #Crypto #Blockchain #Web3 #BuildOnJuChain

Lee Jucoin

2025-08-20 12:01

✨ Overview of Launchpad dApps on #JuChain

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

+140x ROI depuis le lancement — du jamais vu dans le marché actuel. Merci à tous les builders, holders & believers Le sommet ? Ce n’est que le départ. Jusqu’au 12 août, 19h00 (UTC+8)

Carmelita

2025-08-11 21:33

$JU explose un nouveau record : 14 $ franchis !

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Digital platform fanC partners with fintech company Initech to launch Korea's groundbreaking 1:1 won-pegged stablecoin. Currently in test phase for internal members and partners, KRWIN aims to revolutionize Korean digital payments and cross-border transactions.

💰 Core Architecture:

-

Multi-signature custody with equivalent won reserves off-chain

Smart contracts on Ethereum and BNB Chain

1:1 peg maintained through multi-party signature confirmation

Third-party audited security with on-chain audit report hashes

🔒 Security & Compliance Features:

-

Strict KYC/AML verification process

Real-time monitoring with suspicious activity alerts

Account freeze capabilities for anomalous transactions

Trademark filed with Korean Intellectual Property Office

🎯 Current Use Cases in Testing:

-

Payment Settlement: Real-time e-commerce and offline merchant payments

Cross-Border Remittance: Low-cost international transfers for Korean businesses

Tourism Spending: Direct payments at Korean merchants and travel platforms

Content & Entertainment: Virtual gifts and premium content purchases on fanC

⚡ Test Phase Highlights:

-

Internal employees and designated partners only

Multi-chain compatibility testing (Ethereum + BNB Chain)

Scenario-linked testing across payment contexts

48-hour response commitment for user feedback

📈 2025 Roadmap:

-

Q4 2025: Public beta launch and exchange listings (KLAYswap, Bithumb, Upbit)

Ecosystem partnerships with financial institutions and e-commerce platforms

Layer-2 integration for reduced costs and higher TPS

Regulatory sandbox participation for compliance validation

🚀 Future Vision:

-

SME payments and supply-chain finance integration

Community governance module for token holder voting

Expansion to other East Asian markets

Dynamic interest rates and automatic clearing functions

💡 Market Position: As Korea's first won-pegged stablecoin, KRWIN combines traditional finance with Web3 technology, offering first-mover advantage in localized payments and regulatory compliance. This positions it to capture significant market share in the regional stablecoin ecosystem.

The bridge between Korean won and crypto is here - KRWIN is paving the way for mainstream adoption of digital currency in South Korea!

Read the full technical breakdown: 👇 https://blog.jucoin.com/krwin-korean-stablecoin/

#KRWIN #KoreanStablecoin #Stablecoin #KRW

JU Blog

2025-08-06 10:51

KRWIN: Korea's First Won-Pegged Stablecoin Goes Live!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

📣 $JU is more than just a token — it’s your voice on JuChain. 😍 Holding $JU means:

🔹 Contributing to network consensus

🔹 Voting on governance upgrades

🔹 Shaping the future of the JuChain ecosystem

💥 It’s a builder’s token, a user’s token, and the key to governance. The more you hold and participate, the more you co-create the future of #JuChain.

👉 Trade $JU now: https://jucoin.com/en/trade/ju_usdt

#JuChain #JuChainVietnam #JUtoken #Governance #BlockchainCommunity #CryptoVietnam #Web3 #TokenUtility #BuildOnJuChain

Lee Jucoin

2025-08-20 12:00

📣 $JU is more than just a token — it’s your voice on JuChain!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Can I Trade from the TradingView Mobile App?

Understanding Trading Capabilities on the Mobile Platform

TradingView is renowned for its advanced charting tools, real-time market data, and vibrant community features. While it excels as a platform for analysis and discussion, many users wonder whether they can execute trades directly through the mobile app. The short answer is that TradingView itself does not function as a brokerage or trading platform; instead, it acts as an analytical hub that integrates with various brokerages to facilitate trading.

TradingView's primary role is providing comprehensive technical analysis tools, alerts, and social features. Its mobile app allows users to monitor markets on-the-go with real-time data and perform detailed charting. However, executing trades requires connecting your TradingView account to a supported broker or trading service.

Does TradingView Support Direct Trading?

As of now, TradingView does not offer in-app trade execution within its mobile application independently. Instead, it relies on integrations with third-party brokers that support API connections or direct integration through their platforms. This means that while you can analyze charts and set alerts via the app seamlessly, placing actual buy or sell orders typically involves redirecting to your broker’s platform—either their website or dedicated trading app.

Many popular brokers such as Interactive Brokers, Tradestation, OANDA (for forex), and others have integrated with TradingView’s ecosystem. When linked correctly:

- Users can initiate trades directly from the chart interface.

- Orders are sent securely through the connected brokerage account.

- Trade execution happens within the broker’s environment rather than solely within TradingView.

This setup provides a streamlined experience where traders can analyze markets visually in TradingView while executing trades via their preferred brokerage platform.

How to Set Up Trade Execution Using Your Broker

To enable trading from your mobile device using TradingView:

- Choose a Supported Broker: Verify if your preferred broker supports integration with TradingView.

- Connect Your Account: Within the desktop or web version of TradingView (most integrations are set up here), link your brokerage account by following specific instructions provided by both platforms.

- Use Compatible Apps: On mobile devices—iOS or Android—you’ll typically access trade execution through either:

- The browser-based version of your broker’s platform

- Their dedicated mobile app

- Trade via Chart Interface: Once connected:

- Tap on charts in the mobile app

- Use order buttons embedded within supported charts

- Place buy/sell orders directly from these interfaces

It’s important to note that some functionalities may be limited compared to full desktop versions due to screen size constraints but generally remain sufficient for active traders.

Limitations of Mobile-Based Trade Execution

While integrating with brokers enables trading from smartphones using the Trading View ecosystem:

- Not all brokers support full API-based order placement via mobile apps.

- Some advanced order types (e.g., complex options strategies) might be restricted.

- The process often involves switching between apps—Trading View for analysis and another app for order placement—which could introduce delays during volatile market conditions.

Additionally, security measures like two-factor authentication (2FA) are essential when executing trades remotely; ensure both your broker's security protocols are robust before relying heavily on this setup.

Benefits of Using Mobile Apps for Analysis & Limited Trades

Even if you cannot execute every type of trade directly within the native mobile application without third-party links:

- You gain quick access to real-time data across multiple asset classes including stocks, cryptocurrencies, forex pairs,

- You can set custom alerts based on price movements,

- Engage actively in community discussions,

- And prepare orders which you then execute swiftly through linked brokerage accounts outside of Traderview's environment,

This hybrid approach offers flexibility suited for both casual investors monitoring markets casually and professional traders requiring rapid decision-making capabilities.

Security Considerations When Trading Via Mobile Devices

Executing financial transactions over smartphones introduces specific risks related to data privacy and security breaches. To mitigate these concerns:

- Use strong passwords combined with biometric authentication where available.

- Enable two-factor authentication (2FA) provided by most reputable brokers.

- Keep your device updated with latest OS patches.

- Avoid public Wi-Fi networks when performing sensitive operations unless utilizing VPNs.5.. Regularly review activity logs provided by your brokerage accounts for unauthorized access attempts.

By adhering to best practices in cybersecurity hygiene — especially when linking multiple platforms — traders can safely conduct transactions remotely without exposing themselves unnecessarily.

The Future Outlook: Will In-App Direct Trades Become Standard?

Given recent developments emphasizing seamless user experiences across financial apps—including enhanced API integrations—the possibility exists that future versions of Traderview might incorporate more direct trade execution capabilities into its native apps across all devices including mobiles.. However,

Currently,

the emphasis remains on combining powerful analysis tools within Traderview while leveraging trusted third-party brokers’ infrastructure for actual trade placement..

This layered approach ensures high-quality analytical features alongside secure transaction processing—a model likely to persist until fully integrated solutions become universally available across all regions and asset classes..

Summary

While you cannot currently place trades directly inside Traderview's official iOS or Android applications without external links,

the platform facilitates efficient analysis combined with seamless integration into supported brokerage services enabling quick trade execution from smartphones.. As technology advances—and regulatory environments evolve—the scope of what is possible will expand further making remote trading even more accessible via intuitive mobile interfaces designed specifically around trader needs..

Lo

2025-05-26 23:10

Can I trade from the TradingView mobile app?

Can I Trade from the TradingView Mobile App?

Understanding Trading Capabilities on the Mobile Platform

TradingView is renowned for its advanced charting tools, real-time market data, and vibrant community features. While it excels as a platform for analysis and discussion, many users wonder whether they can execute trades directly through the mobile app. The short answer is that TradingView itself does not function as a brokerage or trading platform; instead, it acts as an analytical hub that integrates with various brokerages to facilitate trading.

TradingView's primary role is providing comprehensive technical analysis tools, alerts, and social features. Its mobile app allows users to monitor markets on-the-go with real-time data and perform detailed charting. However, executing trades requires connecting your TradingView account to a supported broker or trading service.

Does TradingView Support Direct Trading?

As of now, TradingView does not offer in-app trade execution within its mobile application independently. Instead, it relies on integrations with third-party brokers that support API connections or direct integration through their platforms. This means that while you can analyze charts and set alerts via the app seamlessly, placing actual buy or sell orders typically involves redirecting to your broker’s platform—either their website or dedicated trading app.

Many popular brokers such as Interactive Brokers, Tradestation, OANDA (for forex), and others have integrated with TradingView’s ecosystem. When linked correctly:

- Users can initiate trades directly from the chart interface.

- Orders are sent securely through the connected brokerage account.

- Trade execution happens within the broker’s environment rather than solely within TradingView.

This setup provides a streamlined experience where traders can analyze markets visually in TradingView while executing trades via their preferred brokerage platform.

How to Set Up Trade Execution Using Your Broker

To enable trading from your mobile device using TradingView:

- Choose a Supported Broker: Verify if your preferred broker supports integration with TradingView.

- Connect Your Account: Within the desktop or web version of TradingView (most integrations are set up here), link your brokerage account by following specific instructions provided by both platforms.

- Use Compatible Apps: On mobile devices—iOS or Android—you’ll typically access trade execution through either:

- The browser-based version of your broker’s platform

- Their dedicated mobile app

- Trade via Chart Interface: Once connected:

- Tap on charts in the mobile app

- Use order buttons embedded within supported charts

- Place buy/sell orders directly from these interfaces

It’s important to note that some functionalities may be limited compared to full desktop versions due to screen size constraints but generally remain sufficient for active traders.

Limitations of Mobile-Based Trade Execution

While integrating with brokers enables trading from smartphones using the Trading View ecosystem:

- Not all brokers support full API-based order placement via mobile apps.

- Some advanced order types (e.g., complex options strategies) might be restricted.

- The process often involves switching between apps—Trading View for analysis and another app for order placement—which could introduce delays during volatile market conditions.

Additionally, security measures like two-factor authentication (2FA) are essential when executing trades remotely; ensure both your broker's security protocols are robust before relying heavily on this setup.

Benefits of Using Mobile Apps for Analysis & Limited Trades

Even if you cannot execute every type of trade directly within the native mobile application without third-party links:

- You gain quick access to real-time data across multiple asset classes including stocks, cryptocurrencies, forex pairs,

- You can set custom alerts based on price movements,

- Engage actively in community discussions,

- And prepare orders which you then execute swiftly through linked brokerage accounts outside of Traderview's environment,

This hybrid approach offers flexibility suited for both casual investors monitoring markets casually and professional traders requiring rapid decision-making capabilities.

Security Considerations When Trading Via Mobile Devices

Executing financial transactions over smartphones introduces specific risks related to data privacy and security breaches. To mitigate these concerns:

- Use strong passwords combined with biometric authentication where available.

- Enable two-factor authentication (2FA) provided by most reputable brokers.

- Keep your device updated with latest OS patches.

- Avoid public Wi-Fi networks when performing sensitive operations unless utilizing VPNs.5.. Regularly review activity logs provided by your brokerage accounts for unauthorized access attempts.

By adhering to best practices in cybersecurity hygiene — especially when linking multiple platforms — traders can safely conduct transactions remotely without exposing themselves unnecessarily.

The Future Outlook: Will In-App Direct Trades Become Standard?

Given recent developments emphasizing seamless user experiences across financial apps—including enhanced API integrations—the possibility exists that future versions of Traderview might incorporate more direct trade execution capabilities into its native apps across all devices including mobiles.. However,

Currently,

the emphasis remains on combining powerful analysis tools within Traderview while leveraging trusted third-party brokers’ infrastructure for actual trade placement..

This layered approach ensures high-quality analytical features alongside secure transaction processing—a model likely to persist until fully integrated solutions become universally available across all regions and asset classes..

Summary

While you cannot currently place trades directly inside Traderview's official iOS or Android applications without external links,

the platform facilitates efficient analysis combined with seamless integration into supported brokerage services enabling quick trade execution from smartphones.. As technology advances—and regulatory environments evolve—the scope of what is possible will expand further making remote trading even more accessible via intuitive mobile interfaces designed specifically around trader needs..

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Backed by YZi Labs, HashKey Capital, and Mirana Ventures, Sidekick revolutionizes crypto trading by integrating livestreams with real-time on-chain transactions. No more switching between platforms - watch, learn, and trade all in one seamless experience!

🎯 Core Innovation - "Watch-and-Trade":

-

Live market insights via streaming "Kickers" (hosts)

One-click trading directly within video streams

Real-time charts and order panels embedded in videos

Multi-chain support: Ethereum, Solana, BSC, and more

⚡ How It Works:

-

MetaTx Technology: Bundles all interactions into single on-chain transaction

Real-Time Execution: Live prices, wallet balances, and trade signals in stream

Instant Receipts: Contract confirmations shown directly in livestream

Zero Latency: No protocol switches, reduced gas fees

💰 $K Token Economics (1B Total Supply):

-

Ecosystem Growth: 20% (200M $K)

Community Incentives: 20% (200M $K)

Foundation: 16% (160M $K)

Core Contributors: 15% (150M $K)

Investors: 20% (200M $K)

Initial Circulation: 111.3M $K (11.13%)

🔒 Security & Compliance:

-

Third-party audited smart contracts with on-chain proof

MetaTx simulation prevents re-entrancy and slippage attacks

Multi-sig and time-lock for critical upgrades

Optional zero-knowledge KYC/AML for privacy compliance

🚀 Future Ecosystem:

-

Global Expansion: 500+ Kickers across education, gaming, DeFi

Platform Integration: Zapper, Zerion, OKX Wallet compatibility

DAO Governance: $K holders control rewards and feature roadmaps

AI Agent Support: Smart signals for Kickers, personalized advice for viewers

💡 Revenue Model:

-

Kickers earn through real-time revenue shares and $K rewards

Viewers earn token incentives for trading activity

Platform fees distributed to $K stakers

Tipping and premium feature unlocks

🎮 Use Cases:

-

Educational trading streams with instant execution

Gaming tournaments with live betting and rewards

DeFi project launches with real-time community trading

Expert analysis with follow-along trading capabilities

The future of crypto trading isn't just about charts and orders - it's about community, education, and seamless interaction. Sidekick transforms passive viewing into active earning through the world's first truly integrated LiveFi experience!

Read the complete platform analysis: 👇 https://blog.jucoin.com/sidekick-livefi-analysis/

#Sidekick #LiveFi #DeFi

JU Blog

2025-08-06 10:56

📺 Sidekick: World's First LiveFi Platform - Trade While You Watch!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How to Extend Common-Size Analysis to Cash Flows

Understanding a company's financial health is crucial for investors, analysts, and managers alike. Traditionally, common-size analysis has been a staple in evaluating income statements and balance sheets by expressing each line item as a percentage of total revenue or assets. However, extending this analytical approach to cash flow statements offers deeper insights into how companies generate and use cash—an essential factor in assessing long-term sustainability. This article explores how to effectively perform common-size analysis on cash flows, its significance, recent trends influencing its application, and potential pitfalls.

What Is Common-Size Analysis in Financial Statements?

Common-size analysis simplifies the comparison of financial statements across different companies or periods by converting absolute figures into percentages relative to a base figure—such as total revenue for income statements or total assets for balance sheets. This normalization allows stakeholders to identify patterns, trends, and anomalies that might be obscured when looking solely at raw numbers. For example, two firms with similar revenues might have vastly different expense structures; common-size analysis makes these differences more transparent.

Extending Common-Size Analysis to Cash Flow Statements

Applying the same principle to cash flow statements involves expressing each line item—like cash from operations or capital expenditures—as a percentage of the relevant total cash flow category (operating activities, investing activities, or financing activities). For instance:

- Cash from Operating Activities / Total Cash Flows from Operations

- Capital Expenditures / Total Cash Flows from Investing Activities

- Dividends Paid / Total Cash Flows from Financing Activities

This approach reveals the composition of a company's cash flows over time or compared across peers. It helps identify whether growth is driven primarily by operational efficiency or external financing sources and whether investments are sustainable relative to incoming cash.

Why Is Extending Common-Size Analysis Important?

Performing common-size analysis on cash flows provides several strategic advantages:

Assessing Financial Sustainability: By examining what proportion of total operating cash flow is generated internally versus reliance on external funding (debt issuance), stakeholders can gauge if a company’s core operations are self-sustaining.

Identifying Investment Patterns: Analyzing capital expenditure as part of investing activities highlights whether growth investments are aligned with available internal funds.

Detecting Risks: A high proportion of financing outflows like debt repayment may signal increased leverage risks; conversely, declining operational inflow percentages could indicate deteriorating business performance.

Benchmarking Industry Norms: Different sectors have unique typical ratios—for example, tech firms often reinvest heavily through capital expenditures while retail businesses may prioritize inventory management reflected in their operating cash flows.

Recent Trends Enhancing Cash Flow Common-Size Analysis

Advancements in technology have significantly improved how we perform this type of analysis:

Modern financial software automates calculations across large datasets quickly and accurately.

Enhanced disclosure requirements under regulations such as ASC 606 (Revenue Recognition) and ASC 842 (Leases) provide more detailed data about inflows and outflows—making it easier for analysts to conduct precise common-size evaluations.

Furthermore, there's an increasing emphasis on ESG factors influencing corporate reporting practices related not only to environmental impact but also social governance aspects tied directly into their liquidity profiles.

Industry-Specific Considerations

Different industries exhibit distinct characteristics when it comes to theircash flow profiles:

Technology Sector: High research & development costs lead companies here often show significant capital expenditures relativeto their overall operating inflow during expansion phases.Retail Sector: Inventory management plays an essential role; thus,cash used in working capital changes can dominate the statement.Manufacturing & Capital Goods: These industries typically require substantial investmentsin property plant equipment (PP&E), reflected prominently within investing activities'cash flows.

Understanding these nuances ensures that comparisons remain meaningful rather than misleading due tothe inherent industry differences.

Potential Challenges When Using Common-Size Cash Flow Analysis

While extending this method offers valuable insights,it also presents challenges that users must recognize:

Misleading Indicators: Companies with high capital expenditures might appear inefficient if industry norms aren’t considered properly.Investors should adjust expectations accordingly.

Overreliance on Ratios: Focusing solelyon ratios without considering profitability metrics like net income can give an incomplete pictureof financial health.

Short-Term Variability: Seasonal fluctuationsor one-time events can distort ratios temporarily; analyzing multiple periods helps smooth out such anomalies.

4.. Debt Structures & Off-Balance Sheet Items: Complex financing arrangements may not be fully captured through simple ratio analyses but still influence liquidity positions significantly.

Applying Best Practices for Effective Use

To maximize the benefitsof extending common-size analysisto your evaluation process consider these best practices:

– Always compare ratios against industry benchmarksand historical datafor context– Use multi-period analysesto identify trends rather than snapshot views– Combine ratio insightswith qualitative assessments regarding management strategiesand market conditions– Be cautious interpreting results during extraordinary eventsor economic downturns

Final Thoughts: Enhancing Financial Insights Through Extended Analysis

Extending common-size analysis beyond traditional income statement and balance sheet evaluations into the realmofcash flows enriches your understandingof corporate liquidity dynamicsand investment sustainability.It enables investorsand managers alike todetect underlying strengthsor vulnerabilitiesthat might otherwise go unnoticed when relying solelyon absolute figures.This comprehensive approach aligns well with modern analytical standards emphasizing transparency,and it supports better-informed decision-making amid increasingly complex financial landscapes.

By staying awareof recent technological developmentsand regulatory changes—and understanding industry-specific nuances—you can leverage extendedcommon-sizecash flow analyses effectively while avoiding potential pitfalls.This strategic insight ultimately contributes toward building robust investment portfolios,and fostering sound corporate governance rootedin thoroughfinancial scrutiny

kai

2025-05-19 13:01

How to extend common-size analysis to cash flows?

How to Extend Common-Size Analysis to Cash Flows

Understanding a company's financial health is crucial for investors, analysts, and managers alike. Traditionally, common-size analysis has been a staple in evaluating income statements and balance sheets by expressing each line item as a percentage of total revenue or assets. However, extending this analytical approach to cash flow statements offers deeper insights into how companies generate and use cash—an essential factor in assessing long-term sustainability. This article explores how to effectively perform common-size analysis on cash flows, its significance, recent trends influencing its application, and potential pitfalls.

What Is Common-Size Analysis in Financial Statements?

Common-size analysis simplifies the comparison of financial statements across different companies or periods by converting absolute figures into percentages relative to a base figure—such as total revenue for income statements or total assets for balance sheets. This normalization allows stakeholders to identify patterns, trends, and anomalies that might be obscured when looking solely at raw numbers. For example, two firms with similar revenues might have vastly different expense structures; common-size analysis makes these differences more transparent.

Extending Common-Size Analysis to Cash Flow Statements

Applying the same principle to cash flow statements involves expressing each line item—like cash from operations or capital expenditures—as a percentage of the relevant total cash flow category (operating activities, investing activities, or financing activities). For instance:

- Cash from Operating Activities / Total Cash Flows from Operations

- Capital Expenditures / Total Cash Flows from Investing Activities

- Dividends Paid / Total Cash Flows from Financing Activities

This approach reveals the composition of a company's cash flows over time or compared across peers. It helps identify whether growth is driven primarily by operational efficiency or external financing sources and whether investments are sustainable relative to incoming cash.

Why Is Extending Common-Size Analysis Important?

Performing common-size analysis on cash flows provides several strategic advantages:

Assessing Financial Sustainability: By examining what proportion of total operating cash flow is generated internally versus reliance on external funding (debt issuance), stakeholders can gauge if a company’s core operations are self-sustaining.

Identifying Investment Patterns: Analyzing capital expenditure as part of investing activities highlights whether growth investments are aligned with available internal funds.

Detecting Risks: A high proportion of financing outflows like debt repayment may signal increased leverage risks; conversely, declining operational inflow percentages could indicate deteriorating business performance.

Benchmarking Industry Norms: Different sectors have unique typical ratios—for example, tech firms often reinvest heavily through capital expenditures while retail businesses may prioritize inventory management reflected in their operating cash flows.

Recent Trends Enhancing Cash Flow Common-Size Analysis

Advancements in technology have significantly improved how we perform this type of analysis:

Modern financial software automates calculations across large datasets quickly and accurately.

Enhanced disclosure requirements under regulations such as ASC 606 (Revenue Recognition) and ASC 842 (Leases) provide more detailed data about inflows and outflows—making it easier for analysts to conduct precise common-size evaluations.

Furthermore, there's an increasing emphasis on ESG factors influencing corporate reporting practices related not only to environmental impact but also social governance aspects tied directly into their liquidity profiles.

Industry-Specific Considerations

Different industries exhibit distinct characteristics when it comes to theircash flow profiles:

Technology Sector: High research & development costs lead companies here often show significant capital expenditures relativeto their overall operating inflow during expansion phases.Retail Sector: Inventory management plays an essential role; thus,cash used in working capital changes can dominate the statement.Manufacturing & Capital Goods: These industries typically require substantial investmentsin property plant equipment (PP&E), reflected prominently within investing activities'cash flows.

Understanding these nuances ensures that comparisons remain meaningful rather than misleading due tothe inherent industry differences.

Potential Challenges When Using Common-Size Cash Flow Analysis

While extending this method offers valuable insights,it also presents challenges that users must recognize:

Misleading Indicators: Companies with high capital expenditures might appear inefficient if industry norms aren’t considered properly.Investors should adjust expectations accordingly.

Overreliance on Ratios: Focusing solelyon ratios without considering profitability metrics like net income can give an incomplete pictureof financial health.

Short-Term Variability: Seasonal fluctuationsor one-time events can distort ratios temporarily; analyzing multiple periods helps smooth out such anomalies.

4.. Debt Structures & Off-Balance Sheet Items: Complex financing arrangements may not be fully captured through simple ratio analyses but still influence liquidity positions significantly.

Applying Best Practices for Effective Use

To maximize the benefitsof extending common-size analysisto your evaluation process consider these best practices:

– Always compare ratios against industry benchmarksand historical datafor context– Use multi-period analysesto identify trends rather than snapshot views– Combine ratio insightswith qualitative assessments regarding management strategiesand market conditions– Be cautious interpreting results during extraordinary eventsor economic downturns

Final Thoughts: Enhancing Financial Insights Through Extended Analysis

Extending common-size analysis beyond traditional income statement and balance sheet evaluations into the realmofcash flows enriches your understandingof corporate liquidity dynamicsand investment sustainability.It enables investorsand managers alike todetect underlying strengthsor vulnerabilitiesthat might otherwise go unnoticed when relying solelyon absolute figures.This comprehensive approach aligns well with modern analytical standards emphasizing transparency,and it supports better-informed decision-making amid increasingly complex financial landscapes.

By staying awareof recent technological developmentsand regulatory changes—and understanding industry-specific nuances—you can leverage extendedcommon-sizecash flow analyses effectively while avoiding potential pitfalls.This strategic insight ultimately contributes toward building robust investment portfolios,and fostering sound corporate governance rootedin thoroughfinancial scrutiny

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What is the Engle-Granger Two-Step Method for Cointegration Analysis?

The Engle-Granger two-step method is a fundamental econometric technique used to identify long-term relationships between non-stationary time series data. Developed by Clive Granger and Robert Engle in the late 1980s, this approach has become a cornerstone in analyzing economic and financial data where understanding equilibrium relationships over time is crucial. Its simplicity and effectiveness have made it widely adopted among researchers, policymakers, and financial analysts.

Understanding Cointegration in Time Series Data

Before diving into the specifics of the Engle-Granger method, it's essential to grasp what cointegration entails. In time series analysis, many economic variables—such as GDP, inflation rates, or stock prices—exhibit non-stationary behavior. This means their statistical properties change over time; they may trend upward or downward or fluctuate unpredictably around a changing mean.

However, some non-stationary variables move together in such a way that their linear combination remains stationary—that is, their relationship persists over the long run despite short-term fluctuations. This phenomenon is known as cointegration. Recognizing cointegrated variables allows economists to model these relationships accurately and make meaningful forecasts about their future behavior.

The Two Main Steps of the Engle-Granger Method

The process involves two sequential steps designed to test whether such long-run equilibrium relationships exist:

Step 1: Testing for Unit Roots

Initially, each individual time series must be tested for stationarity using unit root tests like Augmented Dickey-Fuller (ADF) or Phillips-Perron tests. These tests determine whether each variable contains a unit root—a hallmark of non-stationarity. If both series are found to be non-stationary (i.e., they have unit roots), then proceeding with cointegration testing makes sense because stationary linear combinations might exist.

Step 2: Conducting the Cointegration Test

Once confirmed that individual series are non-stationary but integrated of order one (I(1)), researchers regress one variable on others using ordinary least squares (OLS). The residuals from this regression represent deviations from the estimated long-run relationship. If these residuals are stationary—meaning they do not exhibit trends—they indicate that the original variables are cointegrated.

This step effectively checks if there's an underlying equilibrium relationship binding these variables together over time—a critical insight when modeling economic systems like exchange rates versus interest rates or income versus consumption.

Significance and Applications of the Method

Since its introduction by Granger and Engle in 1987 through their influential paper "Cointegration and Error Correction," this methodology has profoundly impacted econometrics research across various fields including macroeconomics, finance, and international economics.

For example:

- Analyzing how GDP relates to inflation rates

- Examining stock prices relative to dividends

- Investigating exchange rate movements against interest differentials

By identifying stable long-term relationships amid volatile short-term movements, policymakers can design more effective interventions while investors can develop strategies based on persistent market linkages.

Limitations of the Engle-Granger Approach

Despite its widespread use and intuitive appeal, several limitations should be acknowledged:

Linearity Assumption: The method assumes that relationships between variables are linear; real-world data often involve nonlinear dynamics.

Sensitivity to Outliers: Outliers can distort regression results leading to incorrect conclusions about stationarity of residuals.

Single Cointegrating Vector: It only detects one cointegrating vector at a time; if multiple vectors exist among several variables simultaneously influencing each other’s dynamics more complex models like Johansen's procedure may be necessary.

These limitations highlight why researchers often complement it with alternative methods when dealing with complex datasets involving multiple interrelated factors.

Recent Developments & Alternatives in Cointegration Analysis

Advancements since its inception include techniques capable of handling multiple cointegrating vectors simultaneously—most notably Johansen's procedure—which offers greater flexibility for multivariate systems. Additionally:

- Researchers now leverage machine learning algorithms alongside traditional econometric tools

- Robust methods address issues related to outliers or structural breaks within data

Such innovations improve accuracy but also require more sophisticated software tools and expertise compared to basic applications of Engel-Granger’s approach.

Practical Implications for Economists & Financial Analysts

Correctly identifying whether two or more economic indicators share a stable long-run relationship influences decision-making significantly:

Economic Policy: Misidentifying relationships could lead policymakers astray—for example, assuming causality where none exists might result in ineffective policies.

Financial Markets: Investors relying on flawed assumptions about asset co-movements risk losses if they misinterpret transient correlations as permanent links.

Therefore, understanding both how-to apply these methods correctly—and recognizing when alternative approaches are needed—is vital for producing reliable insights from econometric analyses.

In summary: The Engle-Granger two-step method remains an essential tool within econometrics due to its straightforward implementation for detecting cointegration between pairs of variables. While newer techniques offer broader capabilities suited for complex datasets with multiple relations or nonlinearities—and technological advancements facilitate easier computation—the core principles behind this approach continue underpin much empirical research today. For anyone involved in analyzing economic phenomena where understanding persistent relationships matters most—from policy formulation through investment strategy—it provides foundational knowledge critical for accurate modeling and forecasting efforts alike.

JCUSER-WVMdslBw

2025-05-14 17:20

What is the Engle-Granger two-step method for cointegration analysis?

What is the Engle-Granger Two-Step Method for Cointegration Analysis?

The Engle-Granger two-step method is a fundamental econometric technique used to identify long-term relationships between non-stationary time series data. Developed by Clive Granger and Robert Engle in the late 1980s, this approach has become a cornerstone in analyzing economic and financial data where understanding equilibrium relationships over time is crucial. Its simplicity and effectiveness have made it widely adopted among researchers, policymakers, and financial analysts.

Understanding Cointegration in Time Series Data

Before diving into the specifics of the Engle-Granger method, it's essential to grasp what cointegration entails. In time series analysis, many economic variables—such as GDP, inflation rates, or stock prices—exhibit non-stationary behavior. This means their statistical properties change over time; they may trend upward or downward or fluctuate unpredictably around a changing mean.

However, some non-stationary variables move together in such a way that their linear combination remains stationary—that is, their relationship persists over the long run despite short-term fluctuations. This phenomenon is known as cointegration. Recognizing cointegrated variables allows economists to model these relationships accurately and make meaningful forecasts about their future behavior.

The Two Main Steps of the Engle-Granger Method

The process involves two sequential steps designed to test whether such long-run equilibrium relationships exist:

Step 1: Testing for Unit Roots

Initially, each individual time series must be tested for stationarity using unit root tests like Augmented Dickey-Fuller (ADF) or Phillips-Perron tests. These tests determine whether each variable contains a unit root—a hallmark of non-stationarity. If both series are found to be non-stationary (i.e., they have unit roots), then proceeding with cointegration testing makes sense because stationary linear combinations might exist.

Step 2: Conducting the Cointegration Test

Once confirmed that individual series are non-stationary but integrated of order one (I(1)), researchers regress one variable on others using ordinary least squares (OLS). The residuals from this regression represent deviations from the estimated long-run relationship. If these residuals are stationary—meaning they do not exhibit trends—they indicate that the original variables are cointegrated.

This step effectively checks if there's an underlying equilibrium relationship binding these variables together over time—a critical insight when modeling economic systems like exchange rates versus interest rates or income versus consumption.

Significance and Applications of the Method

Since its introduction by Granger and Engle in 1987 through their influential paper "Cointegration and Error Correction," this methodology has profoundly impacted econometrics research across various fields including macroeconomics, finance, and international economics.

For example:

- Analyzing how GDP relates to inflation rates

- Examining stock prices relative to dividends