✅ Just 4 simple steps to start your reward journey:

1️⃣ Open JuCoin app, go to “Discover”

2️⃣ Find JU Node & tap to enter

3️⃣ In JU Node page, select “Buy”

4️⃣ Complete payment with USDT or AIC to start receiving $JU daily

💡 Pro Tip: Higher Hashrate → Higher Rewards! 🔥

#JuCoin #JucoinVietnam #JUHashRate #Crypto #DeFi #Web3 #Blockchain

Lee Jucoin

2025-08-19 06:41

🚀 Want your $JU to keep growing? Start with JU Hashrate today! 🌟

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The crypto market experienced significant losses in August 2025, with most major tokens posting notable declines. Here's what's driving the downturn and what investors need to know:

💰 Major Losses Overview:

-

Bitcoin (BTC): -8% to $113,562

Ethereum (ETH): -5.2% to $4,166

Cardano (ADA): -6.3% to $0.8526

XRP: -3.77% to $2.89

Dogecoin (DOGE): -2.21% to $0.2127

🎯 Key Market Drivers:

1️⃣ Jackson Hole Uncertainty: Fed rate cut expectations dropped from 98% to 15%, dampening institutional risk appetite

2️⃣ ETF Volatility: Ethereum ETFs saw $196.6 million outflows after a record $2.8 billion inflow the previous week

3️⃣ Regulatory Delays: Stalled altcoin ETF approvals and unclear stablecoin legislation adding market anxiety

4️⃣ Technical Liquidations: Over $1.2 billion in long positions liquidated as Bitcoin hit resistance at $124,000

🚨 Security Concerns:

-

AI-powered wallet drainers targeting developers

$2.17 billion in crypto hacks recorded in 2025

GreedyBear exploit affecting 150+ fake browser extensions

🏆 Biggest Altcoin Losers (24h):

-

Gari Network (GARI): -23.15%

Useless Coin (USELESS): -17.98%

League of Kingdoms Arena (LOKA): -10.03%

Livepeer (LPT): -9.90%

💡 What's Next:

-

All eyes on Powell's Jackson Hole speech for Fed policy signals

ETF flows remain key indicator for short-term price action

Most analysts view this as temporary correction, not trend reversal

Long-term fundamentals remain intact despite current volatility

The market correction appears driven by macro uncertainty rather than fundamental crypto weaknesses. Investors are consolidating positions ahead of key policy announcements.

Read the complete market analysis with detailed charts and expert insights: 👇 https://blog.jucoin.com/crypto-losses-recent-key-market-declines-explained/

#CryptoLosses #Bitcoin #Ethereum

JU Blog

2025-08-20 10:37

📉 Crypto Market Takes Sharp Hit: Major Tokens Down 3-8% This Week

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How to Evaluate the Sustainability of Net Income

Understanding whether a company's net income is sustainable is essential for investors, analysts, and business leaders aiming to gauge long-term financial health. Sustainable net income indicates that a company can maintain its profitability over time without depleting resources or risking environmental and social responsibilities. This article explores key factors, recent trends, and practical methods to assess the sustainability of net income effectively.

What Does Sustainability in Net Income Mean?

Sustainability in net income refers to a company's ability to generate consistent profits over an extended period while balancing economic viability with environmental stewardship and social responsibility. Unlike short-term earnings spikes driven by one-off events or market anomalies, sustainable net income reflects underlying operational strength and strategic resilience.

Achieving this balance involves evaluating not just financial metrics but also how environmental practices and societal impacts influence long-term performance. Investors increasingly prioritize companies that demonstrate responsible management of resources alongside steady profitability.

Key Financial Indicators for Assessing Sustainability

Financial health forms the foundation of sustainable net income. Several indicators help determine whether a company's profits are likely to persist:

- Profitability Trends: Consistent or growing profit margins suggest stable operations capable of weathering market fluctuations.

- Cash Flow Stability: Positive cash flow ensures ongoing liquidity necessary for investments, debt repayment, and operational needs.

- Debt Levels: Maintaining manageable debt ratios prevents financial distress; excessive leverage can threaten future earnings stability.

Regular analysis of these metrics helps identify companies with resilient financial structures capable of supporting sustained profitability.

Economic Factors Influencing Long-Term Profitability

Beyond internal finances, external economic conditions significantly impact a company's ability to sustain its net income:

- Market Position & Competitive Advantage: Firms with strong brand recognition or unique offerings are better positioned for ongoing revenue streams.

- Revenue Diversification: Relying on multiple sources reduces vulnerability; if one segment underperforms, others can offset losses.

- Regulatory Environment Compliance: Adherence to laws minimizes legal risks and potential penalties that could erode profits.

Monitoring these factors provides insight into how well-positioned a company is within its industry landscape for enduring success.

The Role of Environmental Responsibility in Financial Sustainability

Environmental considerations are increasingly integral when assessing long-term profitability. Companies investing in green initiatives—such as renewable energy adoption or waste reduction—can lower operational costs while enhancing reputation among eco-conscious consumers.

Supply chain management also plays a crucial role; environmentally responsible sourcing mitigates risks related to resource depletion or regulatory sanctions due to unsustainable practices. Incorporating sustainability into core strategies not only benefits society but also supports stable profit generation by reducing exposure to environmental liabilities.

Recent Developments Impacting Net Income Sustainability

Recent corporate reports highlight contrasting scenarios illustrating the importance of sustainability:

In early 2025, Check Point Software Technologies showcased robust financial results exceeding expectations during Q1 2025[1]. Their strong earnings reflect effective management strategies aligned with both growth objectives and sustainability principles.

Conversely, Everest Group experienced challenges during the same period[2], reporting an increased combined ratio (102.7%), signaling potential strain on their profitability margins which could threaten future earnings stability if trends persist.

These examples underscore how current performance metrics serve as vital indicators when evaluating long-term viability — emphasizing the need for continuous monitoring beyond surface-level figures.

Risks That Threaten Net Income Longevity

Several risks can undermine efforts toward maintaining sustainable profits:

Financial Distress from High Debt Levels: Excessive borrowing hampers flexibility; interest obligations may divert funds from growth initiatives.

Regulatory Penalties & Non-compliance: Failure to meet environmental standards exposes firms to fines that directly reduce profit margins.

Environmental & Reputational Risks: Environmental damage incidents can lead not only legal consequences but also loss of customer trust impacting sales longevity.

Proactively managing these risks through strategic planning enhances resilience against unforeseen disruptions affecting long-term earnings stability.

Practical Strategies for Evaluating Net Income Sustainability

To accurately assess whether a company's profits are sustainable over time:

- Analyze historical financial statements focusing on profit consistency and cash flow patterns.

- Review industry position—market share data—and diversification strategies employed by the firm.

- Examine corporate social responsibility (CSR) reports highlighting green initiatives and supply chain ethics.

- Monitor regulatory compliance records alongside any penalties incurred historically.

- Stay updated on macroeconomic trends influencing sector-specific demand cycles or resource availability.

Combining quantitative data with qualitative insights offers a comprehensive view essential for informed decision-making regarding investment or strategic planning.

Keywords:sustainable net income | financial health | economic sustainability | environmental impact | cash flow analysis | risk assessment | corporate responsibility | long-term profitability

JCUSER-F1IIaxXA

2025-05-19 17:00

How to evaluate the sustainability of net income?

How to Evaluate the Sustainability of Net Income

Understanding whether a company's net income is sustainable is essential for investors, analysts, and business leaders aiming to gauge long-term financial health. Sustainable net income indicates that a company can maintain its profitability over time without depleting resources or risking environmental and social responsibilities. This article explores key factors, recent trends, and practical methods to assess the sustainability of net income effectively.

What Does Sustainability in Net Income Mean?

Sustainability in net income refers to a company's ability to generate consistent profits over an extended period while balancing economic viability with environmental stewardship and social responsibility. Unlike short-term earnings spikes driven by one-off events or market anomalies, sustainable net income reflects underlying operational strength and strategic resilience.

Achieving this balance involves evaluating not just financial metrics but also how environmental practices and societal impacts influence long-term performance. Investors increasingly prioritize companies that demonstrate responsible management of resources alongside steady profitability.

Key Financial Indicators for Assessing Sustainability

Financial health forms the foundation of sustainable net income. Several indicators help determine whether a company's profits are likely to persist:

- Profitability Trends: Consistent or growing profit margins suggest stable operations capable of weathering market fluctuations.

- Cash Flow Stability: Positive cash flow ensures ongoing liquidity necessary for investments, debt repayment, and operational needs.

- Debt Levels: Maintaining manageable debt ratios prevents financial distress; excessive leverage can threaten future earnings stability.

Regular analysis of these metrics helps identify companies with resilient financial structures capable of supporting sustained profitability.

Economic Factors Influencing Long-Term Profitability

Beyond internal finances, external economic conditions significantly impact a company's ability to sustain its net income:

- Market Position & Competitive Advantage: Firms with strong brand recognition or unique offerings are better positioned for ongoing revenue streams.

- Revenue Diversification: Relying on multiple sources reduces vulnerability; if one segment underperforms, others can offset losses.

- Regulatory Environment Compliance: Adherence to laws minimizes legal risks and potential penalties that could erode profits.

Monitoring these factors provides insight into how well-positioned a company is within its industry landscape for enduring success.

The Role of Environmental Responsibility in Financial Sustainability

Environmental considerations are increasingly integral when assessing long-term profitability. Companies investing in green initiatives—such as renewable energy adoption or waste reduction—can lower operational costs while enhancing reputation among eco-conscious consumers.

Supply chain management also plays a crucial role; environmentally responsible sourcing mitigates risks related to resource depletion or regulatory sanctions due to unsustainable practices. Incorporating sustainability into core strategies not only benefits society but also supports stable profit generation by reducing exposure to environmental liabilities.

Recent Developments Impacting Net Income Sustainability

Recent corporate reports highlight contrasting scenarios illustrating the importance of sustainability:

In early 2025, Check Point Software Technologies showcased robust financial results exceeding expectations during Q1 2025[1]. Their strong earnings reflect effective management strategies aligned with both growth objectives and sustainability principles.

Conversely, Everest Group experienced challenges during the same period[2], reporting an increased combined ratio (102.7%), signaling potential strain on their profitability margins which could threaten future earnings stability if trends persist.

These examples underscore how current performance metrics serve as vital indicators when evaluating long-term viability — emphasizing the need for continuous monitoring beyond surface-level figures.

Risks That Threaten Net Income Longevity

Several risks can undermine efforts toward maintaining sustainable profits:

Financial Distress from High Debt Levels: Excessive borrowing hampers flexibility; interest obligations may divert funds from growth initiatives.

Regulatory Penalties & Non-compliance: Failure to meet environmental standards exposes firms to fines that directly reduce profit margins.

Environmental & Reputational Risks: Environmental damage incidents can lead not only legal consequences but also loss of customer trust impacting sales longevity.

Proactively managing these risks through strategic planning enhances resilience against unforeseen disruptions affecting long-term earnings stability.

Practical Strategies for Evaluating Net Income Sustainability

To accurately assess whether a company's profits are sustainable over time:

- Analyze historical financial statements focusing on profit consistency and cash flow patterns.

- Review industry position—market share data—and diversification strategies employed by the firm.

- Examine corporate social responsibility (CSR) reports highlighting green initiatives and supply chain ethics.

- Monitor regulatory compliance records alongside any penalties incurred historically.

- Stay updated on macroeconomic trends influencing sector-specific demand cycles or resource availability.

Combining quantitative data with qualitative insights offers a comprehensive view essential for informed decision-making regarding investment or strategic planning.

Keywords:sustainable net income | financial health | economic sustainability | environmental impact | cash flow analysis | risk assessment | corporate responsibility | long-term profitability

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🔐 Les banques ne pourront plus couper l’accès aux clients légitimes, y compris dans les **actifs numériques**.

#CryptoPolicy #DigitalAssets #Web3

Carmelita

2025-08-07 20:18

🇺🇸 Trump signe un décret interdisant le “debanking politique”.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

InterLink introduces an innovative dual-token architecture that separates compliance from participation, creating a sustainable ecosystem where institutions and individuals thrive together. Here's the breakthrough approach:

🏛️ $ITL Token (Compliance Layer):

-

1 billion total supply for institutions and ecosystem funds

Staking required for "Human Layer" access rights

Reputation-based validation prevents malicious nodes

Institutional holders earn transaction fee shares

👥 $ITLG Token (Incentive Layer):

-

10 billion supply: 80% for human nodes, 20% for governance

Earned through facial recognition verification + referrals

Daily mining rewards based on activity and contributions

Powers DAO governance with 1 token = 1 vote

🚀 Key Innovation - Human Node Validation:

-

Facial recognition prevents bot farming

Social referral system ensures authentic users

Activity scoring rewards genuine participation

Avoids PoW/PoS centralization risks

⚖️ DAO Governance Features:

-

Linear voting prevents whale domination

Smart contract auto-execution

Full on-chain transparency

Community-driven protocol evolution

🌍 Real-World Applications:

-

Humanitarian Aid: Direct peer-to-peer payments to disaster victims

Financial Inclusion: Digital payments for unbanked populations

Data Monetization: Secure data licensing for $ITLG rewards

Social Governance: Community polls and collaborative projects

📈 2025 Roadmap:

-

50+ country expansion with regional validator nodes

Cross-chain bridges to Ethereum, Avalanche, Cosmos

Human Layer SDK for developers

InterLink Rating (IR) system for enhanced autonomy

💡 Why It Matters: This dual-token approach solves the age-old problem of balancing institutional compliance with genuine user participation. While institutions provide stability through $ITL staking, real users drive network vitality through $ITLG incentives - creating the first truly human-centered DeFi ecosystem.

The future of crypto isn't just about code - it's about people. InterLink proves that sustainable tokenomics must center on human validation and authentic participation.

Read the complete tokenomics breakdown: 👇 https://blog.jucoin.com/interlink-dual-tokenomics/

#InterLink #DualToken #DeFi #DAO #Tokenomics

JU Blog

2025-08-06 10:45

🔗 InterLink's Revolutionary Dual-Token Model: Human-Centered DeFi!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What is Anti-Money Laundering (AML)?

Anti-Money Laundering (AML) encompasses a set of laws, regulations, and procedures designed to prevent the process of disguising illegally obtained funds as legitimate income. Money laundering typically involves three key stages: placement, layering, and integration. During placement, illicit cash is introduced into the financial system—often through banks or other financial institutions. Layering involves complex transactions that obscure the origin of the money by moving it across various accounts or jurisdictions. Finally, in the integration stage, the laundered money re-enters the economy as seemingly legitimate funds.

The primary goal of AML measures is to detect and deter these activities before they can cause widespread harm to financial systems and economies. Criminal enterprises involved in activities like drug trafficking, terrorism financing, human trafficking, or corruption rely heavily on money laundering to legitimize their profits. Therefore, effective AML policies are essential for maintaining transparency within financial markets and safeguarding against criminal exploitation.

Regulatory Frameworks for AML

Internationally recognized standards shape AML efforts worldwide. The Financial Action Task Force (FATF), established in 1989 during a G7 summit, plays a pivotal role by setting global guidelines aimed at combating money laundering and terrorist financing. Countries adopt these standards into their national laws to create cohesive enforcement mechanisms.

In addition to FATF's recommendations, regional bodies such as the European Union have enacted directives like AMLD4 (2016) and AMLD6 (2023), which strengthen due diligence requirements and expand reporting obligations for financial institutions operating within their jurisdictions. In countries like the United States, agencies such as FinCEN enforce compliance with these regulations through monitoring reports from banks and other entities.

Financial Institutions' Responsibilities

Banks are at the forefront of implementing AML measures because they serve as primary gateways for illicit funds entering or leaving legal channels. Their responsibilities include verifying customer identities through Know Your Customer (KYC) procedures—collecting information about clients’ backgrounds—and continuously monitoring transactions for suspicious activity patterns.

When unusual transactions are detected—such as large cash deposits inconsistent with a customer’s profile—they must be reported promptly via Suspicious Activity Reports (SARs). These reports help authorities investigate potential cases of money laundering or related crimes before significant damage occurs.

Cryptocurrency Exchanges: New Frontiers in AML

The rise of cryptocurrencies has introduced both opportunities and challenges in anti-money laundering efforts. Digital assets offer anonymity features that can facilitate illegal activities if not properly regulated; hence regulators worldwide are developing specific guidelines tailored for crypto exchanges.

For example:

- The U.S Securities and Exchange Commission (SEC) has issued directives requiring cryptocurrency platforms to implement robust KYC/AML protocols.

- European regulators have also increased scrutiny over digital asset service providers under existing anti-money laundering frameworks.

Technological Innovations Enhancing Compliance

Advancements in technology play an increasingly vital role in strengthening AML compliance programs:

- Artificial Intelligence (AI) algorithms analyze transaction data rapidly to identify suspicious behavior.

- Machine Learning models adapt over time based on new data patterns.

- Automated reporting tools streamline submission processes for regulatory authorities.These innovations enable institutions not only to improve detection accuracy but also reduce operational costs associated with manual oversight.

Recent Developments Shaping Future Policies

Regulatory landscapes continue evolving amid technological progress:

- In 2022, a prominent cryptocurrency exchange faced a $50 million fine from U.S authorities due to violations related to inadequate KYC/AML practices.

- The European Union’s Sixth Anti-Money Laundering Directive (AMLD6), implemented in 2023, expanded scope by including virtual asset service providers under stricter compliance requirements.Additionally,the ongoing debate around stablecoins highlights concerns regarding their potential misuse for cross-border money laundering schemes—a topic gaining attention among policymakers like Senator Elizabeth Warren who advocate for tighter safeguards against illicit finance flows involving digital assets.

Impacts of Non-Compliance

Failure by financial institutions or crypto platforms to adhere strictly to AML regulations can lead not only to hefty fines but also severe reputational damage that may threaten long-term viability:

- Fines reaching hundreds of millions USD

- Loss of licensing privileges

- Increased scrutiny from regulatorsMoreover,non-compliance undermines public trust in financial systems overall—a critical factor considering how interconnected global markets have become today.

Historical Milestones & Ongoing Challenges

Since its inception during G7 meetings in 1970—and subsequent establishment of FATF—the fight against money laundering has seen significant milestones:

- Introduction of international standards guiding national policies

- Implementation phases across different regions

- Adoption of advanced technological solutionsDespite progress made over decades,challenges persist due mainly to evolving methods employed by criminals who exploit emerging technologies like cryptocurrencies or decentralized finance platforms—necessitating continuous updates on regulatory frameworks alongside innovative detection tools.

Why Robust Anti-Money Laundering Measures Matter?

Effective AML policies protect economies from being exploited by criminal enterprises while fostering transparency within global finance networks. They help prevent funding terrorism campaigns that threaten security worldwide; safeguard consumer interests; uphold market integrity; promote fair competition among businesses; ensure compliance with international obligations—all crucial components underpinning stable economic growth.

Key Takeaways:

Money laundering involves three stages: placement into banks/accounts → layering through complex transactions → integration into legitimate economy.

International bodies such as FATF set standards adopted globally via national legislation

Financial institutions must verify identities using KYC processes & monitor transactions actively

Emerging technologies like AI enhance detection capabilities

Cryptocurrency exchanges face increasing regulation amid concerns over anonymity features facilitating illegal activities

By understanding these core aspects—and recognizing ongoing developments—you can better appreciate why strong anti-money laundering measures remain vital components within modern financial regulation frameworks.

Semantic & LSI Keywords:

Money Laundering Prevention | Financial Crime Detection | Cryptocurrency Regulation | KYC Procedures | Suspicious Activity Reporting | Digital Asset Compliance | Global Regulatory Standards | Fintech & Anti-Money Laundering | Blockchain Transparency Measures

JCUSER-F1IIaxXA

2025-05-15 01:43

What is Anti-Money Laundering (AML)?

What is Anti-Money Laundering (AML)?

Anti-Money Laundering (AML) encompasses a set of laws, regulations, and procedures designed to prevent the process of disguising illegally obtained funds as legitimate income. Money laundering typically involves three key stages: placement, layering, and integration. During placement, illicit cash is introduced into the financial system—often through banks or other financial institutions. Layering involves complex transactions that obscure the origin of the money by moving it across various accounts or jurisdictions. Finally, in the integration stage, the laundered money re-enters the economy as seemingly legitimate funds.

The primary goal of AML measures is to detect and deter these activities before they can cause widespread harm to financial systems and economies. Criminal enterprises involved in activities like drug trafficking, terrorism financing, human trafficking, or corruption rely heavily on money laundering to legitimize their profits. Therefore, effective AML policies are essential for maintaining transparency within financial markets and safeguarding against criminal exploitation.

Regulatory Frameworks for AML

Internationally recognized standards shape AML efforts worldwide. The Financial Action Task Force (FATF), established in 1989 during a G7 summit, plays a pivotal role by setting global guidelines aimed at combating money laundering and terrorist financing. Countries adopt these standards into their national laws to create cohesive enforcement mechanisms.

In addition to FATF's recommendations, regional bodies such as the European Union have enacted directives like AMLD4 (2016) and AMLD6 (2023), which strengthen due diligence requirements and expand reporting obligations for financial institutions operating within their jurisdictions. In countries like the United States, agencies such as FinCEN enforce compliance with these regulations through monitoring reports from banks and other entities.

Financial Institutions' Responsibilities

Banks are at the forefront of implementing AML measures because they serve as primary gateways for illicit funds entering or leaving legal channels. Their responsibilities include verifying customer identities through Know Your Customer (KYC) procedures—collecting information about clients’ backgrounds—and continuously monitoring transactions for suspicious activity patterns.

When unusual transactions are detected—such as large cash deposits inconsistent with a customer’s profile—they must be reported promptly via Suspicious Activity Reports (SARs). These reports help authorities investigate potential cases of money laundering or related crimes before significant damage occurs.

Cryptocurrency Exchanges: New Frontiers in AML

The rise of cryptocurrencies has introduced both opportunities and challenges in anti-money laundering efforts. Digital assets offer anonymity features that can facilitate illegal activities if not properly regulated; hence regulators worldwide are developing specific guidelines tailored for crypto exchanges.

For example:

- The U.S Securities and Exchange Commission (SEC) has issued directives requiring cryptocurrency platforms to implement robust KYC/AML protocols.

- European regulators have also increased scrutiny over digital asset service providers under existing anti-money laundering frameworks.

Technological Innovations Enhancing Compliance

Advancements in technology play an increasingly vital role in strengthening AML compliance programs:

- Artificial Intelligence (AI) algorithms analyze transaction data rapidly to identify suspicious behavior.

- Machine Learning models adapt over time based on new data patterns.

- Automated reporting tools streamline submission processes for regulatory authorities.These innovations enable institutions not only to improve detection accuracy but also reduce operational costs associated with manual oversight.

Recent Developments Shaping Future Policies

Regulatory landscapes continue evolving amid technological progress:

- In 2022, a prominent cryptocurrency exchange faced a $50 million fine from U.S authorities due to violations related to inadequate KYC/AML practices.

- The European Union’s Sixth Anti-Money Laundering Directive (AMLD6), implemented in 2023, expanded scope by including virtual asset service providers under stricter compliance requirements.Additionally,the ongoing debate around stablecoins highlights concerns regarding their potential misuse for cross-border money laundering schemes—a topic gaining attention among policymakers like Senator Elizabeth Warren who advocate for tighter safeguards against illicit finance flows involving digital assets.

Impacts of Non-Compliance

Failure by financial institutions or crypto platforms to adhere strictly to AML regulations can lead not only to hefty fines but also severe reputational damage that may threaten long-term viability:

- Fines reaching hundreds of millions USD

- Loss of licensing privileges

- Increased scrutiny from regulatorsMoreover,non-compliance undermines public trust in financial systems overall—a critical factor considering how interconnected global markets have become today.

Historical Milestones & Ongoing Challenges

Since its inception during G7 meetings in 1970—and subsequent establishment of FATF—the fight against money laundering has seen significant milestones:

- Introduction of international standards guiding national policies

- Implementation phases across different regions

- Adoption of advanced technological solutionsDespite progress made over decades,challenges persist due mainly to evolving methods employed by criminals who exploit emerging technologies like cryptocurrencies or decentralized finance platforms—necessitating continuous updates on regulatory frameworks alongside innovative detection tools.

Why Robust Anti-Money Laundering Measures Matter?

Effective AML policies protect economies from being exploited by criminal enterprises while fostering transparency within global finance networks. They help prevent funding terrorism campaigns that threaten security worldwide; safeguard consumer interests; uphold market integrity; promote fair competition among businesses; ensure compliance with international obligations—all crucial components underpinning stable economic growth.

Key Takeaways:

Money laundering involves three stages: placement into banks/accounts → layering through complex transactions → integration into legitimate economy.

International bodies such as FATF set standards adopted globally via national legislation

Financial institutions must verify identities using KYC processes & monitor transactions actively

Emerging technologies like AI enhance detection capabilities

Cryptocurrency exchanges face increasing regulation amid concerns over anonymity features facilitating illegal activities

By understanding these core aspects—and recognizing ongoing developments—you can better appreciate why strong anti-money laundering measures remain vital components within modern financial regulation frameworks.

Semantic & LSI Keywords:

Money Laundering Prevention | Financial Crime Detection | Cryptocurrency Regulation | KYC Procedures | Suspicious Activity Reporting | Digital Asset Compliance | Global Regulatory Standards | Fintech & Anti-Money Laundering | Blockchain Transparency Measures

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

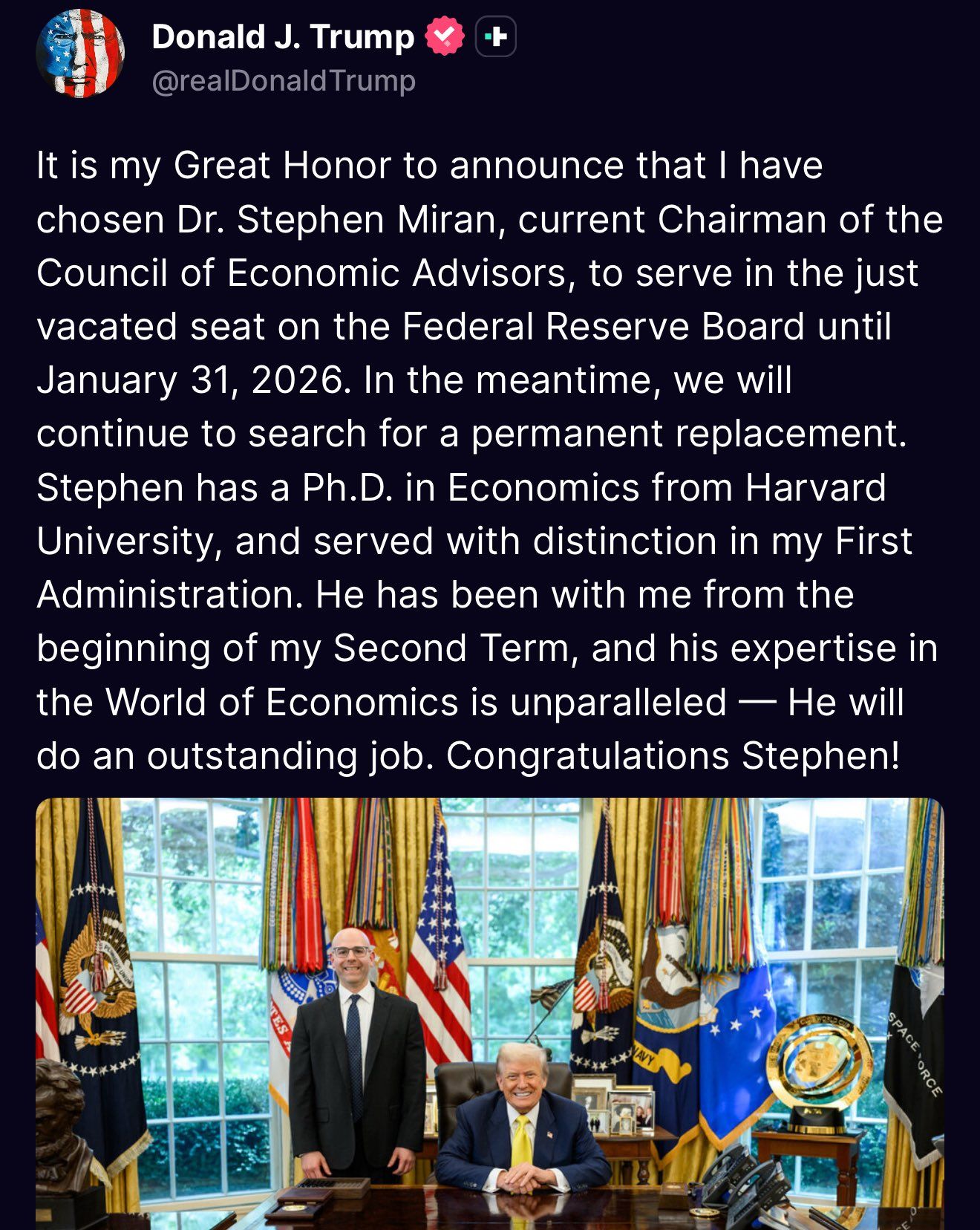

Miran est connu pour son soutien affiché à $BTC, avec son désormais culte : *“#Bitcoin fixes this”*.

Un défenseur du Web3 à la table du FOMC ? Le narratif devient réalité.

#Bitcoin #CryptoPolicy #BTC

Carmelita

2025-08-07 21:15

🚨 Trump propose Stephen Miran, économiste pro-Bitcoin, pour le poste de gouverneur à la Fed.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How to Apply Forensic Analysis to Detect Fraud

Fraudulent activities pose a significant threat to individuals, businesses, and financial institutions worldwide. As fraud schemes become more sophisticated—especially with the rise of digital assets like cryptocurrencies—traditional detection methods often fall short. Forensic analysis has emerged as a vital approach in uncovering and preventing these crimes. This article explores how forensic analysis can be effectively applied to detect fraud, emphasizing practical techniques, recent technological advancements, and best practices.

Understanding the Role of Forensic Analysis in Fraud Detection

Forensic analysis involves applying scientific principles and investigative techniques to examine evidence related to fraudulent activities. Its primary goal is to verify the authenticity of transactions, documents, or digital footprints that may indicate deception or illegal activity. In financial contexts, forensic analysts scrutinize complex transaction data and digital artifacts to identify anomalies that suggest fraud.

This process is crucial not only for criminal investigations but also for corporate compliance efforts aimed at preventing internal misconduct or external scams. Given the increasing complexity of financial transactions—particularly with online banking, mobile payments, and cryptocurrencies—advanced forensic methods are essential for effective detection.

Key Techniques Used in Forensic Fraud Investigation

Applying forensic analysis requires a combination of specialized tools and methodologies tailored to different types of evidence:

Digital Forensics

Digital forensics involves analyzing electronic devices such as computers, smartphones, servers, emails, text messages, and online activity logs. By recovering deleted files or tracing IP addresses involved in suspicious transactions, investigators can build a timeline of events that reveal fraudulent schemes.

Data Analysis & Machine Learning

Data analytics leverages statistical models and machine learning algorithms capable of sifting through vast datasets quickly. These tools help identify patterns or outliers—such as unusual transaction volumes or irregular account behaviors—that may signal fraudulent activity.

Document Examination

Analyzing physical or digital documents is critical when verifying paperwork associated with transactions. Experts look for inconsistencies like misspellings, formatting errors (anachronisms), altered signatures—or other signs indicating forgery—that could point toward document fraud.

Applying Forensic Techniques Step-by-Step

To effectively detect fraud using forensic analysis:

- Identify Suspicious Activity: Start by monitoring transactional data for anomalies such as unexpected large transfers or irregular access patterns.

- Collect Evidence: Gather relevant digital artifacts (emails; transaction logs; metadata) while maintaining chain-of-custody protocols.

- Analyze Digital Footprints: Use specialized software like EnCase or FTK to recover deleted files; trace communication channels involved.

- Perform Data Analytics: Deploy machine learning models trained on historical data sets representing normal versus fraudulent behavior.

- Examine Documents Thoroughly: Cross-check documentation against known standards; look for discrepancies indicating tampering.

- Correlate Findings: Integrate insights from various sources—digital traces plus document reviews—to form a comprehensive picture.

- Report & Act: Summarize findings clearly; collaborate with legal teams if necessary before taking corrective actions.

Recent Technological Advancements Enhancing Fraud Detection

The landscape of forensic investigation continues evolving rapidly thanks to innovations like blockchain technology and artificial intelligence (AI). Blockchain’s transparent ledger system allows investigators to trace cryptocurrency transactions more accurately than ever before—a significant advantage given the rise in crypto-related scams such as phishing attacks or Ponzi schemes.

AI-powered tools now assist analysts by automatically flagging suspicious patterns across massive datasets without manual intervention — improving both speed and accuracy in detecting complex fraud networks.

Additionally,, companies like Google have integrated enhanced security features into their platforms (e.g., Android 16) designed specifically to combat scams involving cryptocurrencies by alerting users about potential threats proactively.

Challenges Faced When Applying Forensic Analysis

Despite technological progress,, several hurdles remain:

- The sheer volume of digital data can overwhelm traditional investigative processes unless supported by advanced analytics tools.

- Cybercriminals continually adapt their tactics—for example,, using encrypted messaging apps—which complicates evidence collection.

- Ensuring compliance with privacy laws during investigations requires careful handling so as not infringe on individual rights while gathering sufficient evidence.

- The need for highly trained professionals who stay updated on emerging technologies adds an ongoing resource challenge within organizations seeking effective detection capabilities.

Best Practices for Effective Fraud Detection Using Forensics

To maximize success rates when applying forensic analysis:

- Maintain meticulous documentation throughout investigations—including chain-of-custody records—to ensure admissibility if legal proceedings follow.

- Invest in continuous training programs so analysts stay current with latest software updates,, cyber threats,, regulatory changes—and emerging scam tactics.

- Use layered approaches combining multiple techniques: e.g., initial pattern recognition via AI followed by detailed manual review where needed..

- Foster collaboration between IT teams,, legal advisors,, auditors—and external experts when necessary—to ensure comprehensive coverage..

By integrating these practices into your organization’s risk management framework,,, you enhance your ability not onlyto detect existing fraud but also prevent future incidents through proactive monitoring strategies..

Real-Life Examples Demonstrating Effective Application

One notable case involved authorities uncovering fake art sales linked via forged documents analyzed through forensic document examination techniques.. A Miami dealer was caught selling counterfeit Warhol artworks after investigators identified inconsistencies within paperwork—a classic example illustrating how thorough document scrutiny can expose deception even amidst sophisticated schemes..

Similarly,,, cryptocurrency exchanges increasingly rely on blockchain analytics software such as Chainalysis—which tracks illicit crypto flows—to identify scammers operating across borders.. These real-world applications highlight how combining traditional investigative skills with cutting-edge technology yields tangible results against diverse formsof financial crime..

Applying forensic analysis effectively requires understanding its core principles—from examining electronic footprintsand scrutinizing documents,to leveraging modern tech innovations—all aimed at exposing hidden fraudulent activities swiftlyand accurately.. As financial landscapes evolve—with new assets emerging—the importanceof staying ahead through continuous learningand adopting best practices cannot be overstated.. Whether dealingwith conventional financial scamsor navigating complex crypto schemes,—a strategic approach rootedin scientific investigation remains your strongest assetin safeguarding assetsand maintaining trustworthiness within your organization.or community

kai

2025-05-19 17:16

How to apply forensic analysis to detect fraud?

How to Apply Forensic Analysis to Detect Fraud

Fraudulent activities pose a significant threat to individuals, businesses, and financial institutions worldwide. As fraud schemes become more sophisticated—especially with the rise of digital assets like cryptocurrencies—traditional detection methods often fall short. Forensic analysis has emerged as a vital approach in uncovering and preventing these crimes. This article explores how forensic analysis can be effectively applied to detect fraud, emphasizing practical techniques, recent technological advancements, and best practices.

Understanding the Role of Forensic Analysis in Fraud Detection

Forensic analysis involves applying scientific principles and investigative techniques to examine evidence related to fraudulent activities. Its primary goal is to verify the authenticity of transactions, documents, or digital footprints that may indicate deception or illegal activity. In financial contexts, forensic analysts scrutinize complex transaction data and digital artifacts to identify anomalies that suggest fraud.

This process is crucial not only for criminal investigations but also for corporate compliance efforts aimed at preventing internal misconduct or external scams. Given the increasing complexity of financial transactions—particularly with online banking, mobile payments, and cryptocurrencies—advanced forensic methods are essential for effective detection.

Key Techniques Used in Forensic Fraud Investigation

Applying forensic analysis requires a combination of specialized tools and methodologies tailored to different types of evidence:

Digital Forensics

Digital forensics involves analyzing electronic devices such as computers, smartphones, servers, emails, text messages, and online activity logs. By recovering deleted files or tracing IP addresses involved in suspicious transactions, investigators can build a timeline of events that reveal fraudulent schemes.

Data Analysis & Machine Learning

Data analytics leverages statistical models and machine learning algorithms capable of sifting through vast datasets quickly. These tools help identify patterns or outliers—such as unusual transaction volumes or irregular account behaviors—that may signal fraudulent activity.

Document Examination

Analyzing physical or digital documents is critical when verifying paperwork associated with transactions. Experts look for inconsistencies like misspellings, formatting errors (anachronisms), altered signatures—or other signs indicating forgery—that could point toward document fraud.

Applying Forensic Techniques Step-by-Step

To effectively detect fraud using forensic analysis:

- Identify Suspicious Activity: Start by monitoring transactional data for anomalies such as unexpected large transfers or irregular access patterns.

- Collect Evidence: Gather relevant digital artifacts (emails; transaction logs; metadata) while maintaining chain-of-custody protocols.

- Analyze Digital Footprints: Use specialized software like EnCase or FTK to recover deleted files; trace communication channels involved.

- Perform Data Analytics: Deploy machine learning models trained on historical data sets representing normal versus fraudulent behavior.

- Examine Documents Thoroughly: Cross-check documentation against known standards; look for discrepancies indicating tampering.

- Correlate Findings: Integrate insights from various sources—digital traces plus document reviews—to form a comprehensive picture.

- Report & Act: Summarize findings clearly; collaborate with legal teams if necessary before taking corrective actions.

Recent Technological Advancements Enhancing Fraud Detection

The landscape of forensic investigation continues evolving rapidly thanks to innovations like blockchain technology and artificial intelligence (AI). Blockchain’s transparent ledger system allows investigators to trace cryptocurrency transactions more accurately than ever before—a significant advantage given the rise in crypto-related scams such as phishing attacks or Ponzi schemes.

AI-powered tools now assist analysts by automatically flagging suspicious patterns across massive datasets without manual intervention — improving both speed and accuracy in detecting complex fraud networks.

Additionally,, companies like Google have integrated enhanced security features into their platforms (e.g., Android 16) designed specifically to combat scams involving cryptocurrencies by alerting users about potential threats proactively.

Challenges Faced When Applying Forensic Analysis

Despite technological progress,, several hurdles remain:

- The sheer volume of digital data can overwhelm traditional investigative processes unless supported by advanced analytics tools.

- Cybercriminals continually adapt their tactics—for example,, using encrypted messaging apps—which complicates evidence collection.

- Ensuring compliance with privacy laws during investigations requires careful handling so as not infringe on individual rights while gathering sufficient evidence.

- The need for highly trained professionals who stay updated on emerging technologies adds an ongoing resource challenge within organizations seeking effective detection capabilities.

Best Practices for Effective Fraud Detection Using Forensics

To maximize success rates when applying forensic analysis:

- Maintain meticulous documentation throughout investigations—including chain-of-custody records—to ensure admissibility if legal proceedings follow.

- Invest in continuous training programs so analysts stay current with latest software updates,, cyber threats,, regulatory changes—and emerging scam tactics.

- Use layered approaches combining multiple techniques: e.g., initial pattern recognition via AI followed by detailed manual review where needed..

- Foster collaboration between IT teams,, legal advisors,, auditors—and external experts when necessary—to ensure comprehensive coverage..

By integrating these practices into your organization’s risk management framework,,, you enhance your ability not onlyto detect existing fraud but also prevent future incidents through proactive monitoring strategies..

Real-Life Examples Demonstrating Effective Application

One notable case involved authorities uncovering fake art sales linked via forged documents analyzed through forensic document examination techniques.. A Miami dealer was caught selling counterfeit Warhol artworks after investigators identified inconsistencies within paperwork—a classic example illustrating how thorough document scrutiny can expose deception even amidst sophisticated schemes..

Similarly,,, cryptocurrency exchanges increasingly rely on blockchain analytics software such as Chainalysis—which tracks illicit crypto flows—to identify scammers operating across borders.. These real-world applications highlight how combining traditional investigative skills with cutting-edge technology yields tangible results against diverse formsof financial crime..

Applying forensic analysis effectively requires understanding its core principles—from examining electronic footprintsand scrutinizing documents,to leveraging modern tech innovations—all aimed at exposing hidden fraudulent activities swiftlyand accurately.. As financial landscapes evolve—with new assets emerging—the importanceof staying ahead through continuous learningand adopting best practices cannot be overstated.. Whether dealingwith conventional financial scamsor navigating complex crypto schemes,—a strategic approach rootedin scientific investigation remains your strongest assetin safeguarding assetsand maintaining trustworthiness within your organization.or community

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

👉 Invite, Deposit, Trade to get Hash Power & share $50,000 Prize Pool! 🚀

⏰ Time: 19:00 19/08/2025 – 19:00 28/08/2025 (UTC+7)

✅ Event 1: Invite friends, get Hash Power and reward up to 100 JU!

✅ Event 2: Exclusive for Newbies – 100% Deposit Cashback!

✅ Event 3: Trade to share $50,000 Prize Pool!

🔸 Register for JuCoin now: https://bit.ly/3BVxlZ2

🔸 Join now: https://www.jucoin.com/en/landing-page/SpotEvent0818

👉 Details: https://support.jucoin.blog/hc/en-001/articles/49891489208729

#JuCoin #JuCoinVietnam #CryptoRewards #Airdrop #Crypto #DeFi #Web3 #Blockchain

Lee Jucoin

2025-08-19 06:42

📣 "JuCoin Triple Rewards" event is officially launched! 🎉

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

⏳Countdown: 4 Days! The JuCoin Million Airdrop Invitation Boost is on!

Open the event page, click “Share” to quickly invite friends, and accelerate your reward growth.

This is your last chance to overtake — don’t miss it!

👉 Quick Share: https://bit.ly/40NWXjH

👉 Đăng ký Jucoin ngay: https://www.jucoin.com/pro/PARTNER

#JuCoin #JucoinVietnam #Airdrop

Lee Jucoin

2025-08-12 11:14

JuCoin Million Airdrop Plan🚀

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Opening Range Defines Intraday Support and Resistance Levels

Understanding how to identify support and resistance levels is fundamental for successful intraday trading. One of the most effective tools traders use for this purpose is the opening range (OR). By analyzing the initial price action during the first few minutes of trading, traders can gain valuable insights into potential market direction and key levels that may influence future price movements. This article explores how opening range helps define intraday support and resistance, backed by recent developments and practical strategies.

What Is Opening Range in Intraday Trading?

The opening range refers to the high and low prices established during a specific initial period after a security's market opens—typically within the first 30 to 60 minutes of trading. During this window, traders observe how prices fluctuate before committing to larger positions. The highest price reached during this period marks one boundary, while the lowest sets another. These two points create a "range" that serves as a benchmark for subsequent trading activity.

This initial phase captures early market sentiment—whether buyers or sellers dominate—and provides clues about potential trends or consolidations throughout the day. Because markets often react strongly at open due to overnight news or economic releases, analyzing this early data offers an edge in predicting intraday support and resistance levels.

How Does Opening Range Help Identify Support & Resistance?

Support and resistance are critical concepts in technical analysis—they represent price levels where buying or selling pressure tends to halt or reverse trends. The opening range plays a pivotal role here because it establishes immediate reference points based on real-time market behavior.

- Support Level: If prices decline toward the lower boundary of the opening range but fail to break below it, that level may act as support—a floor preventing further declines.

- Resistance Level: Conversely, if prices rise toward the upper boundary but struggle to surpass it, that level can serve as resistance—a ceiling limiting upward movement.

When prices break above or below these boundaries with significant volume, it often signals a shift in momentum—either confirming continuation beyond these levels or indicating reversal opportunities.

For example:

- A breakout above the opening high suggests bullish strength; traders might see this as an entry point for long positions.

- A breakdown below the opening low could signal bearish sentiment; traders might consider shorting or exiting longs.

By monitoring whether prices respect these boundaries within their respective ranges—or break through them—traders can make more informed decisions about entry and exit points during active hours.

Practical Strategies Using Opening Range

Traders employ various strategies centered around opening range analysis:

Range Trading:

- Buy near support (opening low)

- Sell near resistance (opening high)

- Use tight stop-loss orders just outside these boundaries

Breakout Trading:

- Enter trades when price breaks above resistance or below support with increased volume

- Confirm breakout validity with other indicators like RSI or moving averages

Fade Strategy:

- Trade against false breakouts by betting on reversals when price quickly re-enters previous ranges

Adjusting Stops & Targets:

- Use openings' high/low as dynamic stop-loss points

- Set profit targets based on measured distance between open-range boundaries

These approaches help manage risk effectively while capitalizing on predictable intraday patterns derived from early market activity.

Recent Advances Enhancing Opening Range Analysis

Technological progress has significantly improved how traders utilize opening ranges:

- Modern trading platforms provide real-time data feeds enabling precise calculation of initial highs/lows.

- Algorithmic tools now automatically identify key breakout moments based on predefined criteria.

- Integration with other technical indicators such as Bollinger Bands, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), enhances confirmation signals.

- Increased adoption in volatile markets like cryptocurrencies demonstrates its versatility; crypto's rapid moves make early-range analysis particularly valuable for quick decision-making.

Furthermore, machine learning models are being developed to analyze historical patterns related to open-range behavior across different assets—adding predictive power beyond traditional methods.

Risks & Limitations of Relying Solely on Opening Range

While powerful, relying exclusively on opening range analysis carries risks:

- Overdependence may lead traders astray if unexpected news causes sudden volatility outside established ranges.

- Market manipulation tactics such as "spoofing" can artificially influence perceived support/resistance levels at open.

- False breakouts are common; not all breaches result in sustained moves—requiring confirmation from additional indicators.

Therefore, it's crucial always to combine OR-based insights with broader technical frameworks—including trend analysis and volume studies—to improve accuracy while managing risk effectively.

Applying Support & Resistance Levels Derived from Opening Range

In practice:

- Observe initial trade activity closely during first hour after market opens.

- Mark highest (resistance) and lowest (support) points reached within this period.

- Watch for signs of breakout beyond these bounds — confirmed by increased volume — which could signal strong directional moves.

- Use these levels dynamically throughout your trading session—for setting stops/limits—and adapt quickly if new information emerges.

Final Thoughts: Enhancing Intraday Strategies With Opening Range Insights

The ability of closing-in-time data from an asset’s first few minutes offers invaluable guidance for defining intraday support/resistance zones through its establishing of key thresholds reflective of current market sentiment—not just historical averages but real-time reactions at open sessions enable more responsive decision-making processes than static chart patterns alone would permit.

By integrating modern technological tools alongside traditional technical principles—including careful validation via multiple indicators—you elevate your capacity not only to recognize potential turning points but also craft disciplined strategies aligned with evolving conditions—all essential elements underpinning sustainable success in active day-trading environments.

JCUSER-IC8sJL1q

2025-05-14 04:46

How can opening range define intraday support/resistance levels?

How Opening Range Defines Intraday Support and Resistance Levels

Understanding how to identify support and resistance levels is fundamental for successful intraday trading. One of the most effective tools traders use for this purpose is the opening range (OR). By analyzing the initial price action during the first few minutes of trading, traders can gain valuable insights into potential market direction and key levels that may influence future price movements. This article explores how opening range helps define intraday support and resistance, backed by recent developments and practical strategies.

What Is Opening Range in Intraday Trading?

The opening range refers to the high and low prices established during a specific initial period after a security's market opens—typically within the first 30 to 60 minutes of trading. During this window, traders observe how prices fluctuate before committing to larger positions. The highest price reached during this period marks one boundary, while the lowest sets another. These two points create a "range" that serves as a benchmark for subsequent trading activity.

This initial phase captures early market sentiment—whether buyers or sellers dominate—and provides clues about potential trends or consolidations throughout the day. Because markets often react strongly at open due to overnight news or economic releases, analyzing this early data offers an edge in predicting intraday support and resistance levels.

How Does Opening Range Help Identify Support & Resistance?

Support and resistance are critical concepts in technical analysis—they represent price levels where buying or selling pressure tends to halt or reverse trends. The opening range plays a pivotal role here because it establishes immediate reference points based on real-time market behavior.

- Support Level: If prices decline toward the lower boundary of the opening range but fail to break below it, that level may act as support—a floor preventing further declines.

- Resistance Level: Conversely, if prices rise toward the upper boundary but struggle to surpass it, that level can serve as resistance—a ceiling limiting upward movement.

When prices break above or below these boundaries with significant volume, it often signals a shift in momentum—either confirming continuation beyond these levels or indicating reversal opportunities.

For example:

- A breakout above the opening high suggests bullish strength; traders might see this as an entry point for long positions.

- A breakdown below the opening low could signal bearish sentiment; traders might consider shorting or exiting longs.

By monitoring whether prices respect these boundaries within their respective ranges—or break through them—traders can make more informed decisions about entry and exit points during active hours.

Practical Strategies Using Opening Range

Traders employ various strategies centered around opening range analysis:

Range Trading:

- Buy near support (opening low)

- Sell near resistance (opening high)

- Use tight stop-loss orders just outside these boundaries

Breakout Trading:

- Enter trades when price breaks above resistance or below support with increased volume

- Confirm breakout validity with other indicators like RSI or moving averages

Fade Strategy:

- Trade against false breakouts by betting on reversals when price quickly re-enters previous ranges

Adjusting Stops & Targets:

- Use openings' high/low as dynamic stop-loss points

- Set profit targets based on measured distance between open-range boundaries

These approaches help manage risk effectively while capitalizing on predictable intraday patterns derived from early market activity.

Recent Advances Enhancing Opening Range Analysis

Technological progress has significantly improved how traders utilize opening ranges:

- Modern trading platforms provide real-time data feeds enabling precise calculation of initial highs/lows.

- Algorithmic tools now automatically identify key breakout moments based on predefined criteria.

- Integration with other technical indicators such as Bollinger Bands, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), enhances confirmation signals.

- Increased adoption in volatile markets like cryptocurrencies demonstrates its versatility; crypto's rapid moves make early-range analysis particularly valuable for quick decision-making.

Furthermore, machine learning models are being developed to analyze historical patterns related to open-range behavior across different assets—adding predictive power beyond traditional methods.

Risks & Limitations of Relying Solely on Opening Range

While powerful, relying exclusively on opening range analysis carries risks:

- Overdependence may lead traders astray if unexpected news causes sudden volatility outside established ranges.

- Market manipulation tactics such as "spoofing" can artificially influence perceived support/resistance levels at open.

- False breakouts are common; not all breaches result in sustained moves—requiring confirmation from additional indicators.

Therefore, it's crucial always to combine OR-based insights with broader technical frameworks—including trend analysis and volume studies—to improve accuracy while managing risk effectively.

Applying Support & Resistance Levels Derived from Opening Range

In practice:

- Observe initial trade activity closely during first hour after market opens.

- Mark highest (resistance) and lowest (support) points reached within this period.

- Watch for signs of breakout beyond these bounds — confirmed by increased volume — which could signal strong directional moves.

- Use these levels dynamically throughout your trading session—for setting stops/limits—and adapt quickly if new information emerges.

Final Thoughts: Enhancing Intraday Strategies With Opening Range Insights

The ability of closing-in-time data from an asset’s first few minutes offers invaluable guidance for defining intraday support/resistance zones through its establishing of key thresholds reflective of current market sentiment—not just historical averages but real-time reactions at open sessions enable more responsive decision-making processes than static chart patterns alone would permit.

By integrating modern technological tools alongside traditional technical principles—including careful validation via multiple indicators—you elevate your capacity not only to recognize potential turning points but also craft disciplined strategies aligned with evolving conditions—all essential elements underpinning sustainable success in active day-trading environments.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Understanding Beta: A Key Measure of Market Sensitivity

Beta is a fundamental concept in finance that helps investors understand how sensitive a security or portfolio is to movements in the overall market. It quantifies the degree to which an asset's price fluctuates relative to market changes, providing insight into its systematic risk. This metric is integral to modern portfolio theory (MPT), enabling investors to assess potential risks and returns more accurately.

In essence, beta acts as a gauge of volatility compared to the broader market index, such as the S&P 500. A beta value of 1 indicates that the security tends to move in tandem with the market—if the market rises or falls by 10%, so does this asset. A beta greater than 1 suggests higher volatility; for example, a beta of 1.5 implies that when the market increases by 10%, this security might increase by approximately 15%. Conversely, a beta less than 1 indicates lower sensitivity; for instance, a beta of 0.5 means it moves only half as much as the overall market.

Understanding what beta represents allows investors and financial analysts to evaluate how individual securities contribute to overall portfolio risk and performance. It also plays an essential role in constructing diversified portfolios aimed at balancing risk exposure against expected returns.

How Is Beta Calculated?

The calculation of beta involves statistical measures derived from historical return data:

- Covariance between an asset’s returns and those of the overall market.

- Variance of the market’s returns.

Mathematically, it is expressed as:

Beta = Covariance (Asset Returns, Market Returns) / Variance (Market Returns)This formula captures how closely an asset's price movements are linked with broader economic trends represented by benchmark indices like stocks or cryptocurrencies markets.

Financial platforms often provide pre-calculated betas based on extensive historical data analysis. However, it's important for investors and analysts to recognize that past performance does not always predict future behavior—especially in highly volatile markets like cryptocurrencies where rapid shifts can occur due to external factors such as regulatory news or technological developments.

The Role of Market Sensitivity in Investment Strategies

Market sensitivity directly influences investment decisions because it reflects how much an asset's value responds during different phases of economic cycles:

- Risk Assessment: High-beta assets tend to be more volatile but offer higher potential returns during bullish periods.

- Diversification: Combining low-beta assets with high-beta ones can help balance risk within a portfolio.

- Performance Benchmarking: Comparing an investment’s actual return against its expected movement based on its beta provides insights into managerial skill or mispricing.

Investors aiming for aggressive growth may prefer high-beta securities because they amplify gains when markets perform well but come with increased downside risks during downturns. Conversely, conservative investors might favor low-beta investments that tend not to fluctuate wildly even amid turbulent markets.

By understanding these dynamics through beta analysis, investors can tailor their strategies according to their risk tolerance levels while aligning with long-term financial goals.

Beta Beyond Traditional Markets: Focus on Cryptocurrencies

While initially developed for traditional stock markets, recent years have seen increasing application of beta analysis within cryptocurrency investing—a sector characterized by extreme volatility and rapid innovation. Cryptocurrencies like Bitcoin and Ethereum exhibit significant price swings driven by factors such as technological updates (e.g., network upgrades), regulatory developments across jurisdictions, macroeconomic trends affecting fiat currencies’ strength—and speculative trading behaviors fueled by social media hype.

In this context:

- Cryptocurrencies often display higher betas compared with traditional assets due primarily to their unpredictable nature.

- Regulatory uncertainty can cause sudden spikes or drops in prices—impacting their measured sensitivity.

- Technological advancements may either increase adoption (potentially lowering perceived risk) or introduce new vulnerabilities affecting stability metrics like beta.

As crypto markets mature further—with increased institutional participation—the relevance and accuracy of using measures like beta will improve but must be interpreted carefully given their unique characteristics compared with conventional equities or bonds.

Recent Trends Impacting Cryptocurrency Betas

The cryptocurrency landscape has experienced notable fluctuations over recent years:

The bull run from late 2020 through early 2021 saw Bitcoin reach all-time highs amid widespread institutional interest.

Subsequent corrections throughout late 2021 into early 2022 reflected heightened volatility driven partly by regulatory crackdowns globally and macroeconomic shifts such as rising interest rates.

These events underscore why understanding crypto-specific betas is crucial—they help quantify how sensitive digital assets are relative not just historically but also under evolving conditions influencing future performance expectations.

Risks Associated With Using Beta for Crypto Market Analysis

Applying traditional financial metrics like beta within cryptocurrency markets involves certain limitations:

Potential Pitfalls Include:

High Volatility & Manipulation: Crypto prices are susceptible not only due to genuine supply-demand dynamics but also through manipulation tactics such as pump-and-dump schemes which distort true sensitivities.

Regulatory Uncertainty: Sudden policy changes can drastically alter perceived risks—leading cryptos' betas astray from underlying fundamentals temporarily.

Limited Historical Data: Many newer cryptocurrencies lack extensive historical records necessary for reliable statistical calculations; thus estimates may be less accurate than those available for established stocks.

Despite these challenges, incorporating crypto-specific adjustments—such as shorter look-back periods or alternative measures—can improve insights derived frombeta analyses.

Managing Risks When Using Beta Metrics

To mitigate issues associated with high crypto-market volatility:

Combine multiple indicators alongsidebeta—for example , volume trends , sentiment analysis ,and macroeconomic factors .

Regularly update your calculations reflecting recent data rather than relying solely on long-term averages .

Use scenario analysis — assessing potential outcomes under different hypothetical conditions—to better understand possible sensitivities .

How Investors Can Use Beta Effectively

For both traditional equity portfolios and emerging digital assets strategies , understanding each security’sbeta helps craft balanced approaches aligned with personal risk appetite . Here are some practical tips :

Assess Risk Tolerance: Determine whether you prefer investments that amplify gains during bullish phases but also expose you more significantly during downturns—or if you favor steadier options less affected by broad-market swings .

Construct Diversified Portfolios: Mix high-betasecuritieswith lower-betasecuritiesto achieve desired exposure levels without overconcentrating on volatile segments .

Monitor Changes Over Time: Keep trackofbetavalues regularly sincemarketconditionsandassetvolatilities evolve . Adjust your holdings accordinglyto maintain alignmentwith your strategic objectives .

By integrating these practices into your investment process—including awareness about specific nuances relatedtocryptocurrencybetastakeholderscan make informed decisions rootedin soundrisk management principles .

Future Outlook: The Evolving Significance Of Beta

As financial markets continue evolving—with increasing integration between traditional finance sectorsand digital currencies—the importanceof measuringmarket sensitivity via metricslikebeta will grow stronger . Advances include :

Improved models incorporating real-time data analytics

– Enhanced tools leveraging machine learning algorithms

– Greater transparency around blockchain activity influencing valuation models

Furthermore,the ongoing maturationofcryptocurrencymarketswill likely leadto more standardized methodsfor calculatingand interpretingbetas,increasingtheir reliabilityfor both retailandinstitutionalinvestors alike.

Final Thoughts

Understanding whatbeta signifies—andhow it evaluatesa strategy’smarket sensitivity—is vitalfor making informedinvestment choices across diverseasset classes.In particular,the unique characteristicsofcryptocurrencies demand carefulapplicationand interpretationofthis metric.To navigate today’s complexfinancial landscape successfully requires combining quantitative toolslikebetawith qualitative insights aboutregulatory,trends,and technological developments.This holistic approach empowersinvestors tomaximizereturnswhilemanagingrisks effectivelyin bothtraditionalandin emergingmarkets.

JCUSER-F1IIaxXA

2025-05-10 00:27

What is Beta and how does it evaluate a strategy’s market sensitivity?

Understanding Beta: A Key Measure of Market Sensitivity

Beta is a fundamental concept in finance that helps investors understand how sensitive a security or portfolio is to movements in the overall market. It quantifies the degree to which an asset's price fluctuates relative to market changes, providing insight into its systematic risk. This metric is integral to modern portfolio theory (MPT), enabling investors to assess potential risks and returns more accurately.

In essence, beta acts as a gauge of volatility compared to the broader market index, such as the S&P 500. A beta value of 1 indicates that the security tends to move in tandem with the market—if the market rises or falls by 10%, so does this asset. A beta greater than 1 suggests higher volatility; for example, a beta of 1.5 implies that when the market increases by 10%, this security might increase by approximately 15%. Conversely, a beta less than 1 indicates lower sensitivity; for instance, a beta of 0.5 means it moves only half as much as the overall market.

Understanding what beta represents allows investors and financial analysts to evaluate how individual securities contribute to overall portfolio risk and performance. It also plays an essential role in constructing diversified portfolios aimed at balancing risk exposure against expected returns.

How Is Beta Calculated?

The calculation of beta involves statistical measures derived from historical return data:

- Covariance between an asset’s returns and those of the overall market.

- Variance of the market’s returns.

Mathematically, it is expressed as:

Beta = Covariance (Asset Returns, Market Returns) / Variance (Market Returns)This formula captures how closely an asset's price movements are linked with broader economic trends represented by benchmark indices like stocks or cryptocurrencies markets.

Financial platforms often provide pre-calculated betas based on extensive historical data analysis. However, it's important for investors and analysts to recognize that past performance does not always predict future behavior—especially in highly volatile markets like cryptocurrencies where rapid shifts can occur due to external factors such as regulatory news or technological developments.

The Role of Market Sensitivity in Investment Strategies

Market sensitivity directly influences investment decisions because it reflects how much an asset's value responds during different phases of economic cycles:

- Risk Assessment: High-beta assets tend to be more volatile but offer higher potential returns during bullish periods.

- Diversification: Combining low-beta assets with high-beta ones can help balance risk within a portfolio.

- Performance Benchmarking: Comparing an investment’s actual return against its expected movement based on its beta provides insights into managerial skill or mispricing.

Investors aiming for aggressive growth may prefer high-beta securities because they amplify gains when markets perform well but come with increased downside risks during downturns. Conversely, conservative investors might favor low-beta investments that tend not to fluctuate wildly even amid turbulent markets.

By understanding these dynamics through beta analysis, investors can tailor their strategies according to their risk tolerance levels while aligning with long-term financial goals.

Beta Beyond Traditional Markets: Focus on Cryptocurrencies

While initially developed for traditional stock markets, recent years have seen increasing application of beta analysis within cryptocurrency investing—a sector characterized by extreme volatility and rapid innovation. Cryptocurrencies like Bitcoin and Ethereum exhibit significant price swings driven by factors such as technological updates (e.g., network upgrades), regulatory developments across jurisdictions, macroeconomic trends affecting fiat currencies’ strength—and speculative trading behaviors fueled by social media hype.

In this context:

- Cryptocurrencies often display higher betas compared with traditional assets due primarily to their unpredictable nature.

- Regulatory uncertainty can cause sudden spikes or drops in prices—impacting their measured sensitivity.

- Technological advancements may either increase adoption (potentially lowering perceived risk) or introduce new vulnerabilities affecting stability metrics like beta.

As crypto markets mature further—with increased institutional participation—the relevance and accuracy of using measures like beta will improve but must be interpreted carefully given their unique characteristics compared with conventional equities or bonds.