What Is the Difference Between a Public Blockchain and a Private Blockchain?

Understanding the fundamental differences between public and private blockchains is essential for anyone interested in blockchain technology, whether for investment, development, or strategic planning. Both types of blockchains serve distinct purposes and are suited to different use cases based on their architecture, security features, and governance models.

Public Blockchains: Openness and Decentralization

Public blockchains are open-source networks that anyone can access and participate in without restrictions. They operate on a decentralized model where no single entity has control over the entire network. This decentralization ensures that transactions are transparent and tamper-proof because they are validated by consensus mechanisms such as Proof of Work (PoW) or Proof of Stake (PoS). Examples like Bitcoin and Ethereum exemplify this approach—allowing users worldwide to send transactions freely while maintaining high levels of security through collective validation.

One key advantage of public blockchains is their transparency; all transaction data is publicly visible on the ledger. This openness fosters trust among participants but also raises privacy concerns depending on the application. Additionally, because they leverage collective computational power across numerous nodes globally, public blockchains tend to be more resilient against attacks but may face scalability challenges due to network congestion.

However, operating openly means these networks often face regulatory scrutiny since their transparency can conflict with privacy regulations in certain jurisdictions. Despite this, public blockchains remain popular for cryptocurrencies due to their decentralization benefits—eliminating reliance on central authorities.

Private Blockchains: Control and Confidentiality

In contrast, private blockchains restrict access exclusively to authorized participants within an organization or consortium. These systems are typically used internally by companies such as Walmart or Maersk for supply chain management or inventory tracking purposes. The controlling entity maintains centralized authority over node participation and transaction validation processes.

This controlled environment allows organizations greater flexibility in customizing consensus mechanisms tailored specifically to their operational needs—such as faster transaction speeds or enhanced privacy controls—and limits exposure of sensitive data outside trusted parties. Consequently, private blockchain networks offer higher confidentiality compared to public counterparts but at some expense of decentralization.

While private chains provide increased control over data integrity within an organization’s ecosystem—a critical factor for enterprise adoption—they may also introduce risks related to central points of failure if not properly managed. Moreover, since access is restricted—and transparency limited—their use cases typically focus on internal operations rather than open financial ecosystems like cryptocurrencies.

Choosing Between Public vs Private Blockchains

The decision between deploying a public versus private blockchain hinges largely on specific project requirements:

- Use Case: For applications demanding full transparency—such as cryptocurrency transactions—a public blockchain makes sense.

- Security & Privacy: When sensitive information must be protected from external visibility—for example in supply chain management—a private blockchain offers better confidentiality.

- Control & Governance: Organizations seeking complete control over who participates prefer private chains; those favoring decentralization lean toward public options.

- Scalability & Performance: Private networks often deliver faster processing times due to fewer nodes involved but might struggle with scaling beyond organizational boundaries.

- Regulatory Environment: Public chains face more regulatory oversight; private chains can be designed with compliance considerations built-in from inception.

Recent Trends & Developments

Over recent years (2023–2025), adoption trends indicate increasing interest across industries in both types of blockchain solutions:

- Many organizations explore hybrid models combining elements from both worlds—using permissioned (private) layers atop open (public) frameworks—to balance transparency with control.

- Governments are providing clearer regulations around digital assets which influence how enterprises implement these technologies.

- The rise of enterprise-grade platforms emphasizes scalability improvements necessary for large-scale deployment while maintaining security standards expected by regulators.

- Concerns about security risks associated with centralized control have prompted investments into robust governance frameworks within private networks.

Potential Challenges Facing Both Types

Despite promising developments, several issues persist:

- Security vulnerabilities remain a concern especially if controlling entities fail adequately securing their infrastructure.

- Scalability limitations could hinder growth if network demands increase significantly without technological upgrades.

- Regulatory uncertainty continues around how different jurisdictions will treat various forms of blockchain activity—particularly regarding privacy laws like GDPR—which could impact future deployments.

Understanding these dynamics helps stakeholders make informed decisions aligned with organizational goals while navigating evolving legal landscapes effectively.

How Different Industries Use Public vs Private Blockchains

Various sectors leverage each type based on specific needs:

Financial Services: Often utilize public blockchains like Ethereum for decentralized finance applications due to transparency requirements but may adopt permissioned ledgers internally for compliance reasons.

Supply Chain Management: Companies such as Maersk deploy private blockchains that enable secure sharing among trusted partners without exposing sensitive commercial data publicly.

Healthcare: Uses hybrid approaches where patient records might be stored privately yet linked via secure protocols accessible only by authorized personnel under strict regulatory oversight.

Key Factors Influencing Blockchain Choice

When selecting between a public or private solution consider factors such as:

- Data Sensitivity

- Speed Requirements

- Regulatory Compliance4.. Degree Of Decentralization Needed5.. Cost Implications6.. Long-term Scalability Goals

Emerging Trends Shaping Future Adoption

Looking ahead into 2024–2025:

Hybrid models will become increasingly prevalent as organizations seek balanced solutions combining openness with controlled access.

Enhanced interoperability protocols will facilitate smoother integration between different types of ledgers across industries

Regulatory clarity will continue improving which encourages broader adoption beyond niche markets

By understanding these core distinctions alongside current trends—and aligning them with your strategic objectives—you can better navigate the complex landscape surrounding blockchain technology today.

Keywords:public vs private blockchain comparison,differences between decentralized vs permissioned ledger,blockchain technology applications,enterprise blockchain solutions,blockchain regulation updates

JCUSER-WVMdslBw

2025-05-22 15:22

What is the difference between a public blockchain and a private blockchain?

What Is the Difference Between a Public Blockchain and a Private Blockchain?

Understanding the fundamental differences between public and private blockchains is essential for anyone interested in blockchain technology, whether for investment, development, or strategic planning. Both types of blockchains serve distinct purposes and are suited to different use cases based on their architecture, security features, and governance models.

Public Blockchains: Openness and Decentralization

Public blockchains are open-source networks that anyone can access and participate in without restrictions. They operate on a decentralized model where no single entity has control over the entire network. This decentralization ensures that transactions are transparent and tamper-proof because they are validated by consensus mechanisms such as Proof of Work (PoW) or Proof of Stake (PoS). Examples like Bitcoin and Ethereum exemplify this approach—allowing users worldwide to send transactions freely while maintaining high levels of security through collective validation.

One key advantage of public blockchains is their transparency; all transaction data is publicly visible on the ledger. This openness fosters trust among participants but also raises privacy concerns depending on the application. Additionally, because they leverage collective computational power across numerous nodes globally, public blockchains tend to be more resilient against attacks but may face scalability challenges due to network congestion.

However, operating openly means these networks often face regulatory scrutiny since their transparency can conflict with privacy regulations in certain jurisdictions. Despite this, public blockchains remain popular for cryptocurrencies due to their decentralization benefits—eliminating reliance on central authorities.

Private Blockchains: Control and Confidentiality

In contrast, private blockchains restrict access exclusively to authorized participants within an organization or consortium. These systems are typically used internally by companies such as Walmart or Maersk for supply chain management or inventory tracking purposes. The controlling entity maintains centralized authority over node participation and transaction validation processes.

This controlled environment allows organizations greater flexibility in customizing consensus mechanisms tailored specifically to their operational needs—such as faster transaction speeds or enhanced privacy controls—and limits exposure of sensitive data outside trusted parties. Consequently, private blockchain networks offer higher confidentiality compared to public counterparts but at some expense of decentralization.

While private chains provide increased control over data integrity within an organization’s ecosystem—a critical factor for enterprise adoption—they may also introduce risks related to central points of failure if not properly managed. Moreover, since access is restricted—and transparency limited—their use cases typically focus on internal operations rather than open financial ecosystems like cryptocurrencies.

Choosing Between Public vs Private Blockchains

The decision between deploying a public versus private blockchain hinges largely on specific project requirements:

- Use Case: For applications demanding full transparency—such as cryptocurrency transactions—a public blockchain makes sense.

- Security & Privacy: When sensitive information must be protected from external visibility—for example in supply chain management—a private blockchain offers better confidentiality.

- Control & Governance: Organizations seeking complete control over who participates prefer private chains; those favoring decentralization lean toward public options.

- Scalability & Performance: Private networks often deliver faster processing times due to fewer nodes involved but might struggle with scaling beyond organizational boundaries.

- Regulatory Environment: Public chains face more regulatory oversight; private chains can be designed with compliance considerations built-in from inception.

Recent Trends & Developments

Over recent years (2023–2025), adoption trends indicate increasing interest across industries in both types of blockchain solutions:

- Many organizations explore hybrid models combining elements from both worlds—using permissioned (private) layers atop open (public) frameworks—to balance transparency with control.

- Governments are providing clearer regulations around digital assets which influence how enterprises implement these technologies.

- The rise of enterprise-grade platforms emphasizes scalability improvements necessary for large-scale deployment while maintaining security standards expected by regulators.

- Concerns about security risks associated with centralized control have prompted investments into robust governance frameworks within private networks.

Potential Challenges Facing Both Types

Despite promising developments, several issues persist:

- Security vulnerabilities remain a concern especially if controlling entities fail adequately securing their infrastructure.

- Scalability limitations could hinder growth if network demands increase significantly without technological upgrades.

- Regulatory uncertainty continues around how different jurisdictions will treat various forms of blockchain activity—particularly regarding privacy laws like GDPR—which could impact future deployments.

Understanding these dynamics helps stakeholders make informed decisions aligned with organizational goals while navigating evolving legal landscapes effectively.

How Different Industries Use Public vs Private Blockchains

Various sectors leverage each type based on specific needs:

Financial Services: Often utilize public blockchains like Ethereum for decentralized finance applications due to transparency requirements but may adopt permissioned ledgers internally for compliance reasons.

Supply Chain Management: Companies such as Maersk deploy private blockchains that enable secure sharing among trusted partners without exposing sensitive commercial data publicly.

Healthcare: Uses hybrid approaches where patient records might be stored privately yet linked via secure protocols accessible only by authorized personnel under strict regulatory oversight.

Key Factors Influencing Blockchain Choice

When selecting between a public or private solution consider factors such as:

- Data Sensitivity

- Speed Requirements

- Regulatory Compliance4.. Degree Of Decentralization Needed5.. Cost Implications6.. Long-term Scalability Goals

Emerging Trends Shaping Future Adoption

Looking ahead into 2024–2025:

Hybrid models will become increasingly prevalent as organizations seek balanced solutions combining openness with controlled access.

Enhanced interoperability protocols will facilitate smoother integration between different types of ledgers across industries

Regulatory clarity will continue improving which encourages broader adoption beyond niche markets

By understanding these core distinctions alongside current trends—and aligning them with your strategic objectives—you can better navigate the complex landscape surrounding blockchain technology today.

Keywords:public vs private blockchain comparison,differences between decentralized vs permissioned ledger,blockchain technology applications,enterprise blockchain solutions,blockchain regulation updates

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Error executing ChatgptTask

kai

2025-05-22 09:54

What’s the difference between custodial and non-custodial wallets?

Error executing ChatgptTask

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

⏰ Time: 2025/8/5 21:00:00 - 2025/8/11 23:59:59(UTC)

✅ Activity 1: Register and complete the trading tasks below to receive one share of the airdrop.

✅ Activity 2: Trade ahead and get 5 USDT airdrop

✅ Activity 3: Sunshine Award, register and get 10 USDT equivalent tokens

🔸 More details:https://bit.ly/453FTc5

JuCoin Community

2025-08-05 15:25

💙Airdrop Tuesday: Register to receive airdrops and trade for 10,000 USDT 🎉

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

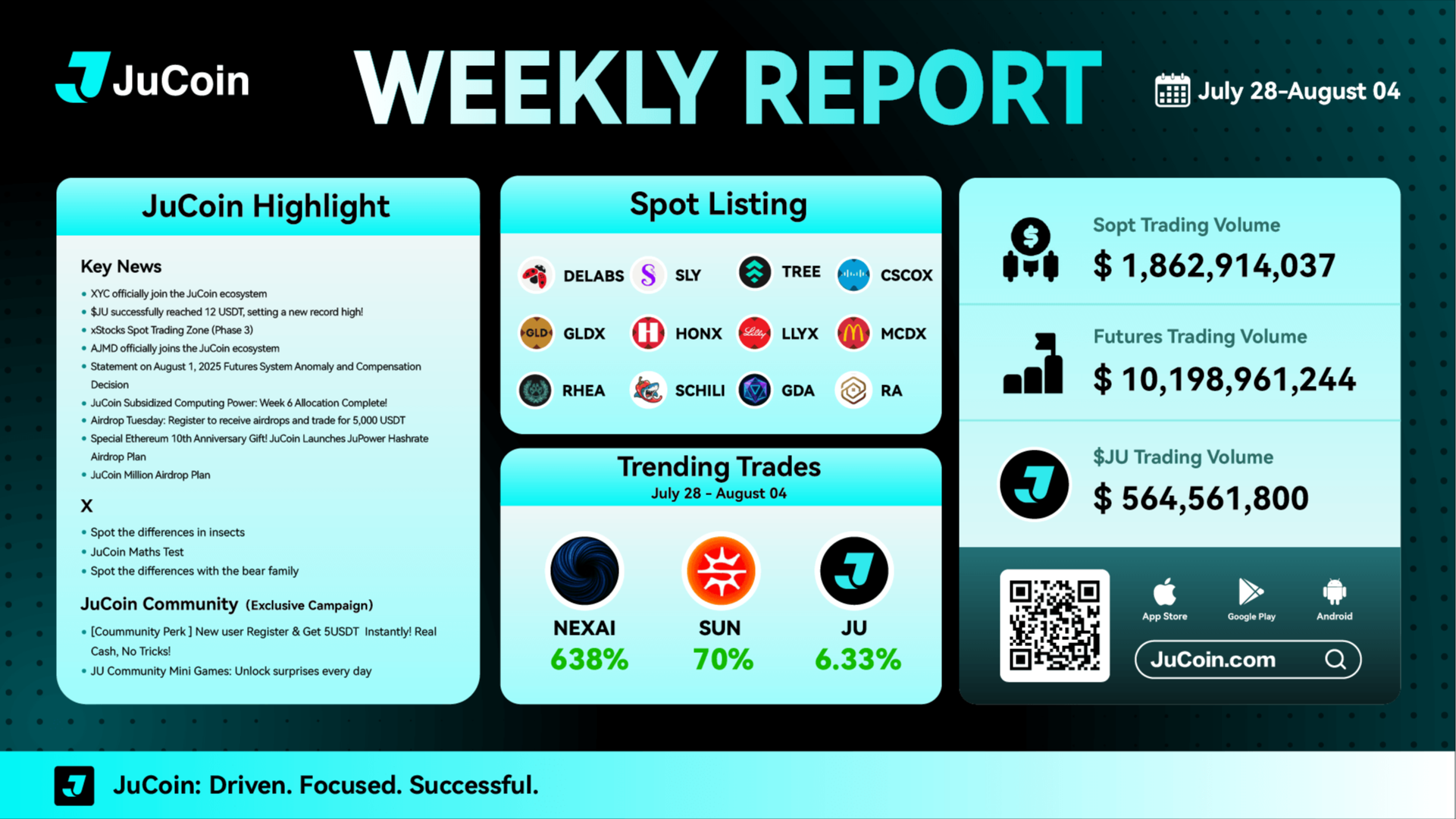

💚12 new spot listings added

💚8 campaigns launched this week

💚Platform token $JU surged over 6.33%

Stay connected with JuCoin and never miss an update!

👉 Register Now:https://www.jucoin.online/en/accounts/register?ref=MR6KTR

JuCoin Community

2025-08-04 09:41

👌JuCoin Weekly Report | July 28 – August 3 🔥

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

JuCoin is pleased to announce the launch of xStocks Spot Trading (Phase 4 on Aug. 4, 2025. We welcome all users to participate in trading. Below are the details:

🔹Trading Pairs: ABBVX/USDT、ACNX/USDT、AZNX/USDT、CMCSAX/USDT、CRWDX/USDT、HDX/USDT、KOX/USDT、NFLXX/USDT、PEPX/USDT、PGX/USDT、UNHX/USDT、VTIX/USDT

🔹Trading Time: Aug. 4, 2025 at 07:00 (UTC)

👉 More: https://bit.ly/3U8VIYP

JuCoin Community

2025-08-04 04:34

🚨 xStocks Spot Trading Zone (Phase 4)

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The DeFi sector is experiencing a remarkable resurgence in 2025, transforming from speculative arena to robust financial infrastructure. Here's what's driving this explosive growth:

💰 Key Growth Drivers:

-

Layer 2 solutions (Optimism, Arbitrum, zk-Rollups) slashing costs & boosting speeds by 20%

$153 billion TVL reached in July 2025 - a three-year high!

Major institutional investment with $1.69B+ Ethereum holdings from leading firms

Enhanced regulatory clarity through EU's MiCA framework

🎯 What's Powering the Momentum:

1️⃣ Cross-Chain Revolution: Seamless asset transfers across Ethereum, Solana, Avalanche ecosystems 2️⃣ Yield Farming Evolution: Advanced protocols offering up to 25% returns on stablecoin strategies 3️⃣ Solana DEX Dominance: 81% of all DEX transactions, $890B trading volume in 5 months 4️⃣ Real-World Asset Tokenization: Converting real estate, commodities into tradeable blockchain tokens

🏆 Innovation Highlights:

-

Jupiter Perps averaging $1B daily perpetual trading volume

AI-powered security with real-time risk alerts and scam detection

Decentralized stablecoins driving cross-chain liquidity

Enhanced composability creating "money legos" for complex financial products

💡 Market Impact:

-

Ethereum maintains 60% DeFi TVL dominance with Lido & Aave leading

Solana surpassing Ethereum in transaction volumes and daily active users

Liquid restaking protocols attracting massive institutional inflows

Multi-signature wallets & advanced auditing boosting security confidence

🔮 Future Outlook: The shift from speculation to utility-focused infrastructure signals DeFi's maturation. With improved security, regulatory clarity, and institutional adoption, the sector is positioned for mainstream financial integration.

Read the complete analysis with detailed insights and market projections: 👇

https://blog.jucoin.com/explore-the-catalysts-behind-defis-recent-surge/?utm_source=blog

#DeFi #Layer2 #Ethereum #Solana #YieldFarming #Crypto #Blockchain #TVL #Institutions #RWA #CrossChain #JuCoin #Web3 #TradFi #Stablecoins #DEX #AI #Security

JU Blog

2025-08-01 08:54

🚀 DeFi Hits $153B TVL - Exploring the Key Catalysts Behind 2025's Massive Surge!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The altcoin market is experiencing significant resurgence with institutional backing and regulatory clarity driving unprecedented growth opportunities. Here's what's shaping the current landscape:

💰 Market Dynamics:

-

Post-Bitcoin capital rotation (Bitcoin hit $118K in July 2025)

86% of institutional investors have or plan digital asset exposure

Altcoin Season Index at 50 (early-stage rotation phase)

Enhanced liquidity through potential altcoin ETPs

🎯 Leading Sectors & Narratives:

1️⃣ AI & Blockchain Integration

-

AI-powered altcoins transitioning from speculation to utility

Autonomous agents creating economic value in crypto ecosystems

2️⃣ Real-World Asset (RWA) Tokenization

-

Market surged to $25B in Q2 2025 (245x increase since 2020)

Bridging traditional finance with blockchain technology

Fractional ownership of real estate, commodities, and fine art

3️⃣ DeFi Evolution

-

Focus on Layer 2 solutions and high-performance blockchains

Innovative liquid staking and restaking protocols

More user-friendly and cost-effective transactions

4️⃣ Gaming & Metaverse

-

Sustainable play-to-earn models

Interoperable metaverse experiences

🏛️ Regulatory Catalysts:

-

EU's MiCA regulation providing comprehensive framework

U.S. stablecoin bills (GENIUS Act) enhancing stability

Spot altcoin ETP discussions (Solana, XRP gaining traction)

XRP hitting multi-year highs amid favorable regulations

💡 Key Investment Insights:

-

Diversify into altcoins with strong fundamentals in emerging sectors

Monitor regulatory developments for institutional flow opportunities

Prioritize projects with active communities and continuous innovation

Understand capital rotation patterns from Bitcoin to altcoins

Focus on utility-driven tokens over speculative assets

🔮 Market Outlook: The shift from speculative to utility-driven altcoins is accelerating, with institutional adoption providing stability and legitimacy. Projects solving real-world problems through AI integration, RWA tokenization, and advanced DeFi protocols are positioned for sustained growth.

Read the complete market analysis with detailed sector breakdowns and investment strategies: 👇 https://blog.jucoin.com/explore-the-current-altcoin-market-in-2025/

#Altcoin #Crypto #Blockchain #AI #RWA #DeFi #Institutional #Regulation #Bitcoin #Ethereum #Solana #XRP #JuCoin #Tokenization #Web3 #Investment #2025 #DigitalAssets #MiCA #ETP

JU Blog

2025-07-31 13:37

🚀 Altcoin Market in 2025: Institutional-Driven Growth & Innovation Surge!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Are There Specific Tools for Trading Credit Spreads?

Trading credit spreads requires a combination of analytical tools, market data, and trading platforms to effectively assess risk and identify profitable opportunities. These tools help traders interpret market signals, compare bond yields, and execute trades with confidence. Understanding the available resources is essential for both novice and experienced traders aiming to navigate the complexities of credit spread trading.

Key Market Indices and Benchmarks

One of the foundational tools in credit spreads trading is the use of indices that serve as benchmarks for assessing market performance. The Barclays Capital U.S. Corporate High Yield Index tracks the performance of high-yield bonds (junk bonds), while the Barclays Capital U.S. Credit Index measures investment-grade corporate bonds. These indices provide a broad view of how different segments are performing relative to each other, enabling traders to gauge whether credit spreads are widening or narrowing in response to economic conditions.

By comparing current bond yields against these benchmarks, traders can identify potential entry or exit points based on perceived over- or under-valued spreads. For example, an unusually wide spread might signal increased default risk or market stress, presenting a buying opportunity if fundamentals support it.

Bond Yield Curves as Analytical Tools

Yield curves are vital for visualizing how bond yields vary across different maturities within similar credit categories. They illustrate expectations about future interest rates and inflation trends—factors that influence credit spreads significantly.

A normal upward-sloping yield curve suggests healthy economic growth with manageable risk premiums; conversely, an inverted curve may indicate recession fears and wider spreads on risky assets like high-yield bonds. Traders analyze shifts in these curves over time to anticipate changes in credit risk sentiment before they fully materialize in spread movements.

Role of Credit Rating Agencies

Credit rating agencies such as Moody’s, S&P Global Ratings, and Fitch Ratings play a crucial role by providing independent assessments of issuer creditworthiness. Their ratings influence investor perceptions—and consequently—yield differences between various bonds.

When an agency downgrades a company's rating from investment grade to junk status—or vice versa—the associated bond's yield typically adjusts accordingly due to changing perceived risks. Traders monitor these ratings closely since sudden downgrades can cause rapid widening in credit spreads; thus making them key indicators when planning trades.

Financial News Platforms & Market Data Providers

Real-time information is indispensable when trading credit spreads because markets can shift quickly amid macroeconomic news or geopolitical events. Platforms like Bloomberg Terminal and Reuters Eikon offer comprehensive data feeds—including live bond prices, yield movements, news alerts—and analytical tools tailored specifically for fixed-income markets.

These platforms also provide access to historical data trends which help traders analyze patterns over time—crucial for developing effective strategies around spread movements during volatile periods or economic cycles.

Advanced Trading Software & Platforms

Modern trading software enhances decision-making by integrating multiple data sources into user-friendly interfaces that facilitate trade execution directly from analysis screens:

- Bloomberg Terminal: Offers extensive analytics on bond markets alongside customizable dashboards.

- Reuters Eikon: Provides real-time quotes combined with news updates relevant for fixed-income securities.

- Proprietary Trading Platforms: Many financial institutions develop their own systems optimized for specific strategies such as pair trades involving different segments within the debt market.

These platforms often include features like scenario analysis (stress testing), automated alerts based on preset criteria (e.g., spread thresholds), and order execution capabilities—all critical components when managing complex options around credit spread fluctuations efficiently.

Emerging Technologies Impacting Credit Spread Trading

Recent technological advancements have further empowered traders through machine learning algorithms capable of analyzing vast datasets faster than traditional methods—identifying subtle patterns indicating potential shifts in spread dynamics before they become apparent publicly.

Artificial intelligence-driven models now assist with predictive analytics regarding default probabilities or macroeconomic impacts influencing sector-specific risks—a significant advantage given how swiftly sentiment can change during periods of heightened volatility such as during global crises or regulatory shifts.

Summary: Essential Tools Every Trader Should Know

To succeed at trading credit spreads effectively:

- Use benchmark indices like Barclays High Yield Index & Investment Grade Index

- Analyze yield curves regularly

- Monitor updates from reputable rating agencies

- Leverage real-time financial news platforms

- Utilize advanced software solutions tailored for fixed-income analysis

- Keep abreast with emerging AI-driven analytics technologies

Combining these resources allows traders not only to interpret current market conditions but also anticipate future movements—an essential skill given how sensitive this segment is to macroeconomic factors ranging from central bank policies to geopolitical tensions.

Final Thoughts on Building Expertise in Credit Spread Trading Tools

Developing proficiency with these tools enhances your ability to make informed decisions rooted in sound analysis rather than speculation alone. As markets evolve—with increasing automation and sophisticated data modeling—the importance lies not just in having access but understanding how best leverage each resource within your overall strategy framework.

By integrating index benchmarks, yield curve insights, ratings assessments, real-time news feeds—and embracing innovative tech solutions—you position yourself better equipped against unpredictable swings inherent within fixed-income markets’ complex landscape.

Stay informed. Stay prepared. Trade smarter.

JCUSER-F1IIaxXA

2025-06-09 22:35

Are there specific tools for trading credit spreads?

Are There Specific Tools for Trading Credit Spreads?

Trading credit spreads requires a combination of analytical tools, market data, and trading platforms to effectively assess risk and identify profitable opportunities. These tools help traders interpret market signals, compare bond yields, and execute trades with confidence. Understanding the available resources is essential for both novice and experienced traders aiming to navigate the complexities of credit spread trading.

Key Market Indices and Benchmarks

One of the foundational tools in credit spreads trading is the use of indices that serve as benchmarks for assessing market performance. The Barclays Capital U.S. Corporate High Yield Index tracks the performance of high-yield bonds (junk bonds), while the Barclays Capital U.S. Credit Index measures investment-grade corporate bonds. These indices provide a broad view of how different segments are performing relative to each other, enabling traders to gauge whether credit spreads are widening or narrowing in response to economic conditions.

By comparing current bond yields against these benchmarks, traders can identify potential entry or exit points based on perceived over- or under-valued spreads. For example, an unusually wide spread might signal increased default risk or market stress, presenting a buying opportunity if fundamentals support it.

Bond Yield Curves as Analytical Tools

Yield curves are vital for visualizing how bond yields vary across different maturities within similar credit categories. They illustrate expectations about future interest rates and inflation trends—factors that influence credit spreads significantly.

A normal upward-sloping yield curve suggests healthy economic growth with manageable risk premiums; conversely, an inverted curve may indicate recession fears and wider spreads on risky assets like high-yield bonds. Traders analyze shifts in these curves over time to anticipate changes in credit risk sentiment before they fully materialize in spread movements.

Role of Credit Rating Agencies

Credit rating agencies such as Moody’s, S&P Global Ratings, and Fitch Ratings play a crucial role by providing independent assessments of issuer creditworthiness. Their ratings influence investor perceptions—and consequently—yield differences between various bonds.

When an agency downgrades a company's rating from investment grade to junk status—or vice versa—the associated bond's yield typically adjusts accordingly due to changing perceived risks. Traders monitor these ratings closely since sudden downgrades can cause rapid widening in credit spreads; thus making them key indicators when planning trades.

Financial News Platforms & Market Data Providers

Real-time information is indispensable when trading credit spreads because markets can shift quickly amid macroeconomic news or geopolitical events. Platforms like Bloomberg Terminal and Reuters Eikon offer comprehensive data feeds—including live bond prices, yield movements, news alerts—and analytical tools tailored specifically for fixed-income markets.

These platforms also provide access to historical data trends which help traders analyze patterns over time—crucial for developing effective strategies around spread movements during volatile periods or economic cycles.

Advanced Trading Software & Platforms

Modern trading software enhances decision-making by integrating multiple data sources into user-friendly interfaces that facilitate trade execution directly from analysis screens:

- Bloomberg Terminal: Offers extensive analytics on bond markets alongside customizable dashboards.

- Reuters Eikon: Provides real-time quotes combined with news updates relevant for fixed-income securities.

- Proprietary Trading Platforms: Many financial institutions develop their own systems optimized for specific strategies such as pair trades involving different segments within the debt market.

These platforms often include features like scenario analysis (stress testing), automated alerts based on preset criteria (e.g., spread thresholds), and order execution capabilities—all critical components when managing complex options around credit spread fluctuations efficiently.

Emerging Technologies Impacting Credit Spread Trading

Recent technological advancements have further empowered traders through machine learning algorithms capable of analyzing vast datasets faster than traditional methods—identifying subtle patterns indicating potential shifts in spread dynamics before they become apparent publicly.

Artificial intelligence-driven models now assist with predictive analytics regarding default probabilities or macroeconomic impacts influencing sector-specific risks—a significant advantage given how swiftly sentiment can change during periods of heightened volatility such as during global crises or regulatory shifts.

Summary: Essential Tools Every Trader Should Know

To succeed at trading credit spreads effectively:

- Use benchmark indices like Barclays High Yield Index & Investment Grade Index

- Analyze yield curves regularly

- Monitor updates from reputable rating agencies

- Leverage real-time financial news platforms

- Utilize advanced software solutions tailored for fixed-income analysis

- Keep abreast with emerging AI-driven analytics technologies

Combining these resources allows traders not only to interpret current market conditions but also anticipate future movements—an essential skill given how sensitive this segment is to macroeconomic factors ranging from central bank policies to geopolitical tensions.

Final Thoughts on Building Expertise in Credit Spread Trading Tools

Developing proficiency with these tools enhances your ability to make informed decisions rooted in sound analysis rather than speculation alone. As markets evolve—with increasing automation and sophisticated data modeling—the importance lies not just in having access but understanding how best leverage each resource within your overall strategy framework.

By integrating index benchmarks, yield curve insights, ratings assessments, real-time news feeds—and embracing innovative tech solutions—you position yourself better equipped against unpredictable swings inherent within fixed-income markets’ complex landscape.

Stay informed. Stay prepared. Trade smarter.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How to Earn CYBER Tokens: A Complete Guide

Understanding how to earn CYBER tokens is essential for users interested in participating actively within the CyberConnect ecosystem. As a decentralized social platform leveraging blockchain technology, CyberConnect offers multiple avenues for users to earn and utilize CYBER tokens. This guide provides a clear overview of the steps involved, ensuring you can maximize your engagement and potential rewards.

What Are CYBER Tokens and Why Are They Valuable?

CYBER tokens are the native cryptocurrency of the CyberConnect platform, serving as a fundamental component of its decentralized social network. These tokens facilitate various activities such as paying transaction fees, staking for governance participation, and unlocking exclusive features. Their value is driven by their utility within the ecosystem and broader market dynamics influenced by DeFi trends.

Holding CYBER tokens not only grants access to special features but also empowers users to participate in decision-making processes through governance voting. This dual role enhances user engagement while aligning incentives across the community.

How Can You Earn CYBER Tokens Through Staking?

Staking is one of the most straightforward methods to earn additional CYBER tokens. It involves locking up a certain amount of your existing tokens in designated smart contracts on the platform for a specified period—ranging from days to months. In return, stakers receive rewards proportional to their staked amount.

To get started with staking:

- Acquire CYBER Tokens: First, purchase or transfer existing CYBER tokens into your compatible wallet.

- Choose a Staking Pool: Navigate through available staking pools on official platforms or partner sites that support CyberConnect.

- Lock Your Tokens: Follow instructions provided by these pools or platforms to lock your tokens securely.

- Earn Rewards: Over time, you'll accrue rewards based on your stake size and duration; these can often be compounded or reinvested.

Staking not only generates passive income but also contributes toward network security and decentralization efforts.

Participating in Governance for Additional Rewards

Another way to earn CYBER involves active participation in governance decisions within CyberConnect. Token holders typically have voting rights that influence proposals related to platform upgrades, feature development, or policy changes.

Engaging in governance usually requires:

- Holding Sufficient Tokens: Ensure you possess enough CYBER tokens required for voting eligibility.

- Reviewing Proposals: Stay informed about ongoing discussions or proposals posted on official channels.

- Casting Votes: Use your holdings during voting periods via supported interfaces—often integrated into wallets or dedicated dashboards.

Active voters may sometimes receive incentives such as bonus tokens or recognition within the community—adding an extra layer of earning potential beyond mere token appreciation.

Creating Content and Engaging with Community Activities

CyberConnect emphasizes community-driven content creation as part of its social ecosystem. Users who produce high-quality posts, comments, videos, or other forms of content may be rewarded with CYBER tokens either directly from platform incentives or through engagement metrics like likes and shares.

To leverage this:

- Develop engaging content aligned with community interests.

- Participate regularly by commenting on others’ posts.

- Share valuable insights that foster discussion.

- Keep an eye out for specific campaigns offering token rewards for particular activities (e.g., contests).

This approach not only helps grow your presence but can also lead directly—or indirectly—to earning more cybertokens over time due to increased activity levels recognized by reward mechanisms.

Utilizing Referral Programs

Referral programs are common across blockchain projects aiming at expanding their user base organically. By inviting friends or colleagues into CyberConnect using unique referral links:

- You can earn small amounts of CYBER when new users sign up using your link.

- Some programs offer tiered rewards based on referral activity levels.

Ensure you understand each program’s terms before participating; effective referrals require genuine engagement rather than spammy tactics which could violate policies leading to penalties.

Tips To Maximize Your Earnings

While engaging with these methods individually is beneficial, combining them strategically will optimize earnings:

- Regularly stake available funds during high-reward periods

- Stay updated about governance proposals requiring votes

- Consistently create quality content that resonates with communities

- Promote platform growth via referrals responsibly

Additionally,

Stay Informed: Follow official channels like blogs, social media accounts (Twitter/Discord), and newsletters related to CyberConnect for updates about new earning opportunities or changes in protocols affecting reward structures.

Security First: Always use secure wallets supported by reputable providers when handling cryptocurrencies; avoid sharing private keys under any circumstances.

Final Thoughts

Earning CYBER tokens involves active participation across multiple facets—staking assets securely online; engaging thoughtfully in governance decisions; contributing valuable content; leveraging referral programs—all aligned towards fostering growth within this decentralized social ecosystem. By understanding each pathway thoroughly—and staying vigilant regarding security practices—you position yourself well both as an active contributor and potential beneficiary within this innovative blockchain-based community space.

Additional Resources:

- Official CyberConnect Documentation – [Link]

- Community Forums & Social Media – [Links]

- Guides on Cryptocurrency Security Best Practices – [Links]

By following these steps diligently while keeping abreast of industry developments—including regulatory shifts—you can effectively navigate earning opportunities around CYBER coins today—and prepare yourself better amid future innovations emerging from DeFi ecosystems worldwide

Lo

2025-06-09 21:45

What steps do I need to take to earn CYBER tokens?

How to Earn CYBER Tokens: A Complete Guide

Understanding how to earn CYBER tokens is essential for users interested in participating actively within the CyberConnect ecosystem. As a decentralized social platform leveraging blockchain technology, CyberConnect offers multiple avenues for users to earn and utilize CYBER tokens. This guide provides a clear overview of the steps involved, ensuring you can maximize your engagement and potential rewards.

What Are CYBER Tokens and Why Are They Valuable?

CYBER tokens are the native cryptocurrency of the CyberConnect platform, serving as a fundamental component of its decentralized social network. These tokens facilitate various activities such as paying transaction fees, staking for governance participation, and unlocking exclusive features. Their value is driven by their utility within the ecosystem and broader market dynamics influenced by DeFi trends.

Holding CYBER tokens not only grants access to special features but also empowers users to participate in decision-making processes through governance voting. This dual role enhances user engagement while aligning incentives across the community.

How Can You Earn CYBER Tokens Through Staking?

Staking is one of the most straightforward methods to earn additional CYBER tokens. It involves locking up a certain amount of your existing tokens in designated smart contracts on the platform for a specified period—ranging from days to months. In return, stakers receive rewards proportional to their staked amount.

To get started with staking:

- Acquire CYBER Tokens: First, purchase or transfer existing CYBER tokens into your compatible wallet.

- Choose a Staking Pool: Navigate through available staking pools on official platforms or partner sites that support CyberConnect.

- Lock Your Tokens: Follow instructions provided by these pools or platforms to lock your tokens securely.

- Earn Rewards: Over time, you'll accrue rewards based on your stake size and duration; these can often be compounded or reinvested.

Staking not only generates passive income but also contributes toward network security and decentralization efforts.

Participating in Governance for Additional Rewards

Another way to earn CYBER involves active participation in governance decisions within CyberConnect. Token holders typically have voting rights that influence proposals related to platform upgrades, feature development, or policy changes.

Engaging in governance usually requires:

- Holding Sufficient Tokens: Ensure you possess enough CYBER tokens required for voting eligibility.

- Reviewing Proposals: Stay informed about ongoing discussions or proposals posted on official channels.

- Casting Votes: Use your holdings during voting periods via supported interfaces—often integrated into wallets or dedicated dashboards.

Active voters may sometimes receive incentives such as bonus tokens or recognition within the community—adding an extra layer of earning potential beyond mere token appreciation.

Creating Content and Engaging with Community Activities

CyberConnect emphasizes community-driven content creation as part of its social ecosystem. Users who produce high-quality posts, comments, videos, or other forms of content may be rewarded with CYBER tokens either directly from platform incentives or through engagement metrics like likes and shares.

To leverage this:

- Develop engaging content aligned with community interests.

- Participate regularly by commenting on others’ posts.

- Share valuable insights that foster discussion.

- Keep an eye out for specific campaigns offering token rewards for particular activities (e.g., contests).

This approach not only helps grow your presence but can also lead directly—or indirectly—to earning more cybertokens over time due to increased activity levels recognized by reward mechanisms.

Utilizing Referral Programs

Referral programs are common across blockchain projects aiming at expanding their user base organically. By inviting friends or colleagues into CyberConnect using unique referral links:

- You can earn small amounts of CYBER when new users sign up using your link.

- Some programs offer tiered rewards based on referral activity levels.

Ensure you understand each program’s terms before participating; effective referrals require genuine engagement rather than spammy tactics which could violate policies leading to penalties.

Tips To Maximize Your Earnings

While engaging with these methods individually is beneficial, combining them strategically will optimize earnings:

- Regularly stake available funds during high-reward periods

- Stay updated about governance proposals requiring votes

- Consistently create quality content that resonates with communities

- Promote platform growth via referrals responsibly

Additionally,

Stay Informed: Follow official channels like blogs, social media accounts (Twitter/Discord), and newsletters related to CyberConnect for updates about new earning opportunities or changes in protocols affecting reward structures.

Security First: Always use secure wallets supported by reputable providers when handling cryptocurrencies; avoid sharing private keys under any circumstances.

Final Thoughts

Earning CYBER tokens involves active participation across multiple facets—staking assets securely online; engaging thoughtfully in governance decisions; contributing valuable content; leveraging referral programs—all aligned towards fostering growth within this decentralized social ecosystem. By understanding each pathway thoroughly—and staying vigilant regarding security practices—you position yourself well both as an active contributor and potential beneficiary within this innovative blockchain-based community space.

Additional Resources:

- Official CyberConnect Documentation – [Link]

- Community Forums & Social Media – [Links]

- Guides on Cryptocurrency Security Best Practices – [Links]

By following these steps diligently while keeping abreast of industry developments—including regulatory shifts—you can effectively navigate earning opportunities around CYBER coins today—and prepare yourself better amid future innovations emerging from DeFi ecosystems worldwide

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How to Earn Free OBOL Tokens: A Complete Guide

Understanding OBOL Tokens and Their Value

OBOL is a decentralized cryptocurrency built on a blockchain network that emphasizes transparency, security, and community participation. It is designed to facilitate peer-to-peer transactions while offering various incentives for users through its ecosystem. The OBOL token serves multiple functions, including paying transaction fees, earning staking rewards, and participating in governance decisions that influence the platform’s future development.

As with many emerging cryptocurrencies, one of the most attractive aspects for new users is the opportunity to earn free OBOL tokens. These tokens can be obtained through several methods that do not require an initial investment but instead rely on active engagement within the OBOL community or participation in specific campaigns.

Key Methods to Earn Free OBOL Tokens

1. Participating in Airdrops

Airdrops are one of the most common ways for new users to receive free tokens from blockchain projects like OBOL. Typically announced via official channels such as the project’s website or social media pages (Twitter, Telegram), airdrops involve distributing free tokens directly into eligible wallets. To participate:

- Follow official OBOL social media accounts.

- Register your wallet address on their platform if required.

- Complete any specified tasks such as verifying your identity or joining their community groups.

Airdrops serve both as promotional tools and ways to distribute tokens broadly among potential users who might later become active participants in the ecosystem.

2. Referral Programs

Referral programs incentivize existing users to invite others into the platform by offering rewards—often in the form of free tokens—for each successful referral. For example:

- Share your unique referral link with friends interested in cryptocurrency.

- When they sign up and meet certain criteria (like completing KYC or making a transaction), you earn additional OBOL tokens.

This method leverages network effects and helps expand user adoption while rewarding loyal members of the community.

3. Bounty Campaigns and Community Tasks

Bounty campaigns are another effective way to earn free OBOL tokens by contributing value back to the project:

- Translating whitepapers or marketing materials into different languages.

- Creating content such as articles, videos, or social media posts about OBOL.

- Participating actively in online forums or discussion groups related to blockchain technology.

These activities help increase awareness about OBOL while rewarding contributors with tokens proportional to their effort.

4. Staking for Rewards

Staking involves locking up a certain amount of existing coins within a designated wallet or platform interface for a set period—earning additional rewards over time as compensation for supporting network security and stability. If available with OBOL:

- Stake your current holdings through official platforms.

- Receive periodic staking rewards which may include additional free ORBIL tokens depending on campaign rules.

Staking not only provides passive income opportunities but also aligns user interests with long-term project success.

5. Engaging With Community Platforms

Active involvement within communities—such as forums like Reddit, Telegram groups, Discord servers—can sometimes lead to exclusive opportunities like early access features or special giveaways involving free token distributions. Staying informed about updates from official sources ensures you don’t miss out on these chances.

Why These Methods Matter: Building Trust & Long-Term Value

Participating actively across these avenues demonstrates genuine interest rather than speculative behavior alone—a key factor aligning with principles of transparency and decentralization central to blockchain projects like OBOL . Such engagement fosters trustworthiness (E-A-T) essential when considering investments; it also helps you stay updated on regulatory changes that could impact token distribution policies.

Risks & Considerations When Earning Free Tokens

While earning free OBSL can be appealing, it’s important not just focus solely on immediate gains but also consider potential risks involved:

- Regulatory Environment: Changes in laws governing cryptocurrencies could restrict some distribution methods such as airdrops or bounty campaigns.

- Market Volatility: Cryptocurrency prices fluctuate rapidly; even earned tokens might lose significant value if market conditions turn unfavorable.

- Security Concerns: Always verify sources before sharing personal information; beware of scams promising “free” coins requiring sensitive data.

Final Thoughts: Maximize Your Opportunities Responsibly

Earning free OPBL involves engaging actively through multiple channels—from participating in official airdrops and referral programs to contributing content via bounty campaigns—and staying informed about ongoing developments within its ecosystem . By doing so responsibly—with attention toward security practices—you can build both your holdings and understanding of decentralized finance platforms effectively.

Keywords: earn free ObolTokens | ObolToken distribution | crypto giveaways | staking rewards | DeFi incentives | blockchain community engagement

JCUSER-WVMdslBw

2025-06-09 20:34

What are the steps to earn free OBOL tokens?

How to Earn Free OBOL Tokens: A Complete Guide

Understanding OBOL Tokens and Their Value

OBOL is a decentralized cryptocurrency built on a blockchain network that emphasizes transparency, security, and community participation. It is designed to facilitate peer-to-peer transactions while offering various incentives for users through its ecosystem. The OBOL token serves multiple functions, including paying transaction fees, earning staking rewards, and participating in governance decisions that influence the platform’s future development.

As with many emerging cryptocurrencies, one of the most attractive aspects for new users is the opportunity to earn free OBOL tokens. These tokens can be obtained through several methods that do not require an initial investment but instead rely on active engagement within the OBOL community or participation in specific campaigns.

Key Methods to Earn Free OBOL Tokens

1. Participating in Airdrops

Airdrops are one of the most common ways for new users to receive free tokens from blockchain projects like OBOL. Typically announced via official channels such as the project’s website or social media pages (Twitter, Telegram), airdrops involve distributing free tokens directly into eligible wallets. To participate:

- Follow official OBOL social media accounts.

- Register your wallet address on their platform if required.

- Complete any specified tasks such as verifying your identity or joining their community groups.

Airdrops serve both as promotional tools and ways to distribute tokens broadly among potential users who might later become active participants in the ecosystem.

2. Referral Programs

Referral programs incentivize existing users to invite others into the platform by offering rewards—often in the form of free tokens—for each successful referral. For example:

- Share your unique referral link with friends interested in cryptocurrency.

- When they sign up and meet certain criteria (like completing KYC or making a transaction), you earn additional OBOL tokens.

This method leverages network effects and helps expand user adoption while rewarding loyal members of the community.

3. Bounty Campaigns and Community Tasks

Bounty campaigns are another effective way to earn free OBOL tokens by contributing value back to the project:

- Translating whitepapers or marketing materials into different languages.

- Creating content such as articles, videos, or social media posts about OBOL.

- Participating actively in online forums or discussion groups related to blockchain technology.

These activities help increase awareness about OBOL while rewarding contributors with tokens proportional to their effort.

4. Staking for Rewards

Staking involves locking up a certain amount of existing coins within a designated wallet or platform interface for a set period—earning additional rewards over time as compensation for supporting network security and stability. If available with OBOL:

- Stake your current holdings through official platforms.

- Receive periodic staking rewards which may include additional free ORBIL tokens depending on campaign rules.

Staking not only provides passive income opportunities but also aligns user interests with long-term project success.

5. Engaging With Community Platforms

Active involvement within communities—such as forums like Reddit, Telegram groups, Discord servers—can sometimes lead to exclusive opportunities like early access features or special giveaways involving free token distributions. Staying informed about updates from official sources ensures you don’t miss out on these chances.

Why These Methods Matter: Building Trust & Long-Term Value

Participating actively across these avenues demonstrates genuine interest rather than speculative behavior alone—a key factor aligning with principles of transparency and decentralization central to blockchain projects like OBOL . Such engagement fosters trustworthiness (E-A-T) essential when considering investments; it also helps you stay updated on regulatory changes that could impact token distribution policies.

Risks & Considerations When Earning Free Tokens

While earning free OBSL can be appealing, it’s important not just focus solely on immediate gains but also consider potential risks involved:

- Regulatory Environment: Changes in laws governing cryptocurrencies could restrict some distribution methods such as airdrops or bounty campaigns.

- Market Volatility: Cryptocurrency prices fluctuate rapidly; even earned tokens might lose significant value if market conditions turn unfavorable.

- Security Concerns: Always verify sources before sharing personal information; beware of scams promising “free” coins requiring sensitive data.

Final Thoughts: Maximize Your Opportunities Responsibly

Earning free OPBL involves engaging actively through multiple channels—from participating in official airdrops and referral programs to contributing content via bounty campaigns—and staying informed about ongoing developments within its ecosystem . By doing so responsibly—with attention toward security practices—you can build both your holdings and understanding of decentralized finance platforms effectively.

Keywords: earn free ObolTokens | ObolToken distribution | crypto giveaways | staking rewards | DeFi incentives | blockchain community engagement

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Benefits of Trading in the XT Carnival

Understanding the XT Carnival Platform

The XT Carnival is a decentralized trading platform that has gained attention within the cryptocurrency community for its innovative approach to digital asset trading. Built on blockchain technology, it aims to provide a secure, transparent, and user-friendly environment for both novice and experienced traders. Unlike traditional centralized exchanges, the XT Carnival emphasizes decentralization, which enhances security and reduces reliance on third-party intermediaries. Its infrastructure supports a wide array of cryptocurrencies and tokens, enabling users to diversify their investment portfolios efficiently.

Security and Transparency in Cryptocurrency Trading

One of the primary advantages of trading through the XT Carnival is its robust security framework rooted in blockchain technology. Transactions are recorded on a public ledger—an immutable record that ensures transparency and accountability. This transparency allows traders to verify transactions independently, fostering trust within the platform’s community. Additionally, decentralization minimizes risks associated with hacking or fraud common in centralized exchanges because there is no single point of failure.

Furthermore, recent security enhancements such as multi-factor authentication (MFA) and advanced encryption algorithms have strengthened user account protection. Regular security audits further ensure that vulnerabilities are identified and addressed promptly—an essential feature given the increasing sophistication of cyber threats targeting crypto assets.

User Experience: Accessibility for All Levels

Ease of use is another significant benefit offered by the XT Carnival platform. Its intuitive interface caters to both beginners who are just starting their crypto journey and seasoned traders seeking efficient tools for complex strategies. The platform’s design simplifies navigation across various features like order placement, portfolio management, or accessing DeFi integrations.

For new users especially, having an accessible yet powerful trading environment reduces barriers often associated with cryptocurrency markets’ complexity. Clear menus, straightforward processes for deposits/withdrawals, real-time asset tracking—all contribute toward making trading less intimidating while maintaining professional-grade functionality.

Asset Diversity: Broadening Investment Opportunities

Supporting multiple cryptocurrencies—including popular tokens like Bitcoin (BTC), Ethereum (ETH), along with numerous altcoins—the XT Carnival enables diversification across different digital assets easily within one platform. This flexibility helps mitigate risks tied to market volatility since investors can spread exposure rather than relying solely on one asset class.

Moreover, support for various tokens facilitates participation in emerging trends such as DeFi projects or yield farming opportunities directly through integrated protocols—expanding potential earning avenues beyond simple buy-and-sell trades.

Cost-Effective Trading: Lower Fees Compared to Traditional Platforms

Trading costs significantly influence profitability; hence lower transaction fees are highly valued by traders worldwide. The XT Carnival offers competitive fee structures compared to traditional financial markets or centralized exchanges—which often impose higher charges due to middlemen or legacy systems.

Reduced fees mean smaller spreads between buy/sell prices and less overhead during frequent trades—a crucial advantage especially for active day traders or those executing high-volume transactions regularly seeking maximum returns from their investments.

Community Engagement & Support Networks

A vibrant community can enhance user experience by providing support channels such as social media groups or forums where members share insights about market trends or platform updates. The XT Carnival actively fosters this sense of community engagement through regular updates about new features—like DeFi protocol integrations—and educational content aimed at empowering users with knowledge about secure trading practices.

This participatory approach not only builds trust but also encourages active involvement from users who feel part of an evolving ecosystem rather than just passive participants in a transactional process.

Recent Developments Enhancing Platform Capabilities

Since its launch early 2023, the XT Carnival has rapidly evolved by integrating additional functionalities aligned with industry trends:

DeFi Protocol Integration: Mid-2023 saw partnerships enabling access to decentralized finance services such as lending platforms or yield farming directly via the exchange interface.

Security Upgrades: Late 2023 brought multi-layered security measures including MFA options alongside regular audits ensuring ongoing safety against cyber threats.

Strategic Collaborations: Partnerships with other blockchain entities aim at expanding liquidity pools and offering more comprehensive financial products—further enriching user options.

These developments demonstrate how continuous innovation positions it favorably amidst growing competition.

Risks & Challenges Facing Traders on Xt Carnival

While benefits abound when engaging with this emerging platform — including low fees and diversified assets — potential risks should be acknowledged:

Regulatory Environment: As governments scrutinize cryptocurrencies more intensely worldwide—with some imposing bans—the regulatory landscape remains uncertain which could impact operations.

Security Concerns: Despite improvements; no system is entirely immune from cyber-attacks; thus vigilance remains essential when managing private keys or sensitive data.

Market Volatility: Cryptocurrency prices fluctuate wildly; sudden downturns may affect trader confidence leading possibly to decreased activity if not managed carefully.

Why Choose Trading Through Xt Carnival?

For individuals interested in exploring digital asset markets securely while benefiting from low-cost transactions coupled with broad asset support—the XT Carnival presents an attractive option rooted in transparency thanks to blockchain technology's inherent qualities. Its focus on community engagement combined with ongoing development efforts signals long-term potential despite existing challenges posed by regulation or market volatility.

By understanding these core benefits—from enhanced security measures over traditional platforms—to diversified investment options supported by an active ecosystem—users can make informed decisions suited toward their risk appetite and growth objectives within today’s dynamic crypto landscape.

Keywords: cryptocurrency trading benefits | decentralized exchange advantages | blockchain-based platforms | low transaction fees crypto | DeFi integration platforms | secure crypto trading environments

JCUSER-WVMdslBw

2025-06-09 01:39

What are the benefits of trading in the XT Carnival?

Benefits of Trading in the XT Carnival

Understanding the XT Carnival Platform

The XT Carnival is a decentralized trading platform that has gained attention within the cryptocurrency community for its innovative approach to digital asset trading. Built on blockchain technology, it aims to provide a secure, transparent, and user-friendly environment for both novice and experienced traders. Unlike traditional centralized exchanges, the XT Carnival emphasizes decentralization, which enhances security and reduces reliance on third-party intermediaries. Its infrastructure supports a wide array of cryptocurrencies and tokens, enabling users to diversify their investment portfolios efficiently.

Security and Transparency in Cryptocurrency Trading

One of the primary advantages of trading through the XT Carnival is its robust security framework rooted in blockchain technology. Transactions are recorded on a public ledger—an immutable record that ensures transparency and accountability. This transparency allows traders to verify transactions independently, fostering trust within the platform’s community. Additionally, decentralization minimizes risks associated with hacking or fraud common in centralized exchanges because there is no single point of failure.

Furthermore, recent security enhancements such as multi-factor authentication (MFA) and advanced encryption algorithms have strengthened user account protection. Regular security audits further ensure that vulnerabilities are identified and addressed promptly—an essential feature given the increasing sophistication of cyber threats targeting crypto assets.

User Experience: Accessibility for All Levels

Ease of use is another significant benefit offered by the XT Carnival platform. Its intuitive interface caters to both beginners who are just starting their crypto journey and seasoned traders seeking efficient tools for complex strategies. The platform’s design simplifies navigation across various features like order placement, portfolio management, or accessing DeFi integrations.

For new users especially, having an accessible yet powerful trading environment reduces barriers often associated with cryptocurrency markets’ complexity. Clear menus, straightforward processes for deposits/withdrawals, real-time asset tracking—all contribute toward making trading less intimidating while maintaining professional-grade functionality.

Asset Diversity: Broadening Investment Opportunities

Supporting multiple cryptocurrencies—including popular tokens like Bitcoin (BTC), Ethereum (ETH), along with numerous altcoins—the XT Carnival enables diversification across different digital assets easily within one platform. This flexibility helps mitigate risks tied to market volatility since investors can spread exposure rather than relying solely on one asset class.

Moreover, support for various tokens facilitates participation in emerging trends such as DeFi projects or yield farming opportunities directly through integrated protocols—expanding potential earning avenues beyond simple buy-and-sell trades.

Cost-Effective Trading: Lower Fees Compared to Traditional Platforms

Trading costs significantly influence profitability; hence lower transaction fees are highly valued by traders worldwide. The XT Carnival offers competitive fee structures compared to traditional financial markets or centralized exchanges—which often impose higher charges due to middlemen or legacy systems.

Reduced fees mean smaller spreads between buy/sell prices and less overhead during frequent trades—a crucial advantage especially for active day traders or those executing high-volume transactions regularly seeking maximum returns from their investments.

Community Engagement & Support Networks

A vibrant community can enhance user experience by providing support channels such as social media groups or forums where members share insights about market trends or platform updates. The XT Carnival actively fosters this sense of community engagement through regular updates about new features—like DeFi protocol integrations—and educational content aimed at empowering users with knowledge about secure trading practices.

This participatory approach not only builds trust but also encourages active involvement from users who feel part of an evolving ecosystem rather than just passive participants in a transactional process.

Recent Developments Enhancing Platform Capabilities

Since its launch early 2023, the XT Carnival has rapidly evolved by integrating additional functionalities aligned with industry trends:

DeFi Protocol Integration: Mid-2023 saw partnerships enabling access to decentralized finance services such as lending platforms or yield farming directly via the exchange interface.

Security Upgrades: Late 2023 brought multi-layered security measures including MFA options alongside regular audits ensuring ongoing safety against cyber threats.

Strategic Collaborations: Partnerships with other blockchain entities aim at expanding liquidity pools and offering more comprehensive financial products—further enriching user options.

These developments demonstrate how continuous innovation positions it favorably amidst growing competition.

Risks & Challenges Facing Traders on Xt Carnival

While benefits abound when engaging with this emerging platform — including low fees and diversified assets — potential risks should be acknowledged:

Regulatory Environment: As governments scrutinize cryptocurrencies more intensely worldwide—with some imposing bans—the regulatory landscape remains uncertain which could impact operations.

Security Concerns: Despite improvements; no system is entirely immune from cyber-attacks; thus vigilance remains essential when managing private keys or sensitive data.

Market Volatility: Cryptocurrency prices fluctuate wildly; sudden downturns may affect trader confidence leading possibly to decreased activity if not managed carefully.

Why Choose Trading Through Xt Carnival?

For individuals interested in exploring digital asset markets securely while benefiting from low-cost transactions coupled with broad asset support—the XT Carnival presents an attractive option rooted in transparency thanks to blockchain technology's inherent qualities. Its focus on community engagement combined with ongoing development efforts signals long-term potential despite existing challenges posed by regulation or market volatility.

By understanding these core benefits—from enhanced security measures over traditional platforms—to diversified investment options supported by an active ecosystem—users can make informed decisions suited toward their risk appetite and growth objectives within today’s dynamic crypto landscape.

Keywords: cryptocurrency trading benefits | decentralized exchange advantages | blockchain-based platforms | low transaction fees crypto | DeFi integration platforms | secure crypto trading environments

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are the Advantages of Using a Market Order?

When engaging in financial trading, understanding different order types is essential for executing strategies effectively. Among these, the market order stands out as one of the most straightforward and widely used tools. Its simplicity and immediacy make it particularly appealing to traders who prioritize quick execution over price precision. This article explores the key advantages of using a market order, providing insights into why traders across various markets—stocks, cryptocurrencies, commodities—prefer this type of instruction.

Immediate Execution Ensures Quick Entry and Exit

One of the primary benefits of a market order is its ability to execute immediately upon placement. When a trader submits a market order, it is sent directly to the exchange or broker for instant processing. This feature is especially valuable in fast-moving markets where prices can fluctuate rapidly within seconds. For traders aiming to capitalize on short-term movements or needing to exit positions swiftly to limit losses, immediate execution can be critical.

In volatile environments like cryptocurrency markets or during significant news events affecting stock prices, delays in execution could mean missing out on optimal entry or exit points. Market orders eliminate this concern by prioritizing speed over price specificity.

Flexibility Across Asset Classes

Market orders are versatile and applicable across various asset classes including stocks, bonds, commodities, ETFs (Exchange-Traded Funds), and cryptocurrencies. Whether an investor wants to buy shares in a company during an IPO or sell Bitcoin quickly during sudden price swings—market orders facilitate these transactions seamlessly.

This flexibility simplifies trading strategies because traders do not need to specify complex parameters such as limit prices unless they wish to do so later with other types of orders like limit or stop-loss orders. The ease of use makes market orders suitable for both novice investors learning about trading mechanics and experienced professionals executing rapid trades.

Simplicity Makes Trading More Accessible

Placing a market order requires minimal input: typically just specifying what security you want to buy or sell and how much you want involved. Unlike more complex instructions that involve setting specific target prices (limit orders) or conditional triggers (stop-loss), market orders are straightforward commands that anyone can understand easily.

This simplicity reduces potential errors during trade placement—a crucial factor for beginners who may find detailed instructions intimidating at first glance—and speeds up decision-making processes when quick action is needed.

Risk Management Through Speed

While some might assume that placing an immediate buy or sell exposes traders solely to risks related to unfavorable prices due to volatility; many see it as part of effective risk management when used appropriately. By executing trades instantly at current market conditions, traders avoid situations where their intended transaction gets delayed due to network issues or hesitation that could lead them into worse pricing scenarios later on.

Furthermore, combining market orders with other risk mitigation tools such as stop-losses allows traders not only for swift entry/exit but also controlled risk exposure based on predefined thresholds rather than waiting indefinitely for ideal conditions which may never materialize amid turbulent markets.

Cost Efficiency Compared To Limit Orders

In some cases—particularly in highly liquid markets—market orders can be more cost-effective than limit orders because they guarantee execution without additional fees associated with setting specific price points that might not be reached promptly—or at all—in volatile conditions.

Since limit orders require patience until your specified price level is hit—which might never happen if the asset's price moves away quickly—a market order ensures your trade goes through immediately without waiting for favorable pricing conditions that may no longer exist by then.

However, it's important for traders aware of potential slippage—the difference between expected transaction prices and actual executed prices—to weigh whether immediate execution outweighs possible costs from less favorable fill rates during periods of high volatility.

Contexts Where Market Orders Are Particularly Useful

Market orders are especially advantageous under certain circumstances:

- High Volatility Markets: During rapid price changes—as seen frequently in cryptocurrency exchanges—they allow quick entry/exit before significant shifts occur.

- Time-Sensitive Trades: When timing matters most—for example: reacting swiftly after earnings reports—they enable prompt action.

- Liquidity-Rich Environments: In highly traded assets like major stocks listed on prominent exchanges where bid-ask spreads are narrow.